Cabinet approves extension of Animal Husbandry Infrastructure Development Fund (GS Paper 3, Economy)

Why in news?

- The Union Cabinet recently approved the continuation of Animal Husbandry Infrastructure Development Fund (AHIDF) to be implemented under Infrastructure Development Fund (IDF) with an outlay of Rs.29,610.25 crore for another three years up to 2025-26.

Key Highlights:

- The scheme will incentivize investments for Dairy processing and product diversification, Meat processing and product diversification, Animal Feed Plant, Breed multiplication farm, Animal Waste to Wealth Management (Agri-waste management) and Veterinary vaccine and drug production facilities.

- Government of India will provide 3% interest subvention for 8 years including two years of moratorium for loan up to 90% from the scheduled bank and National Cooperative Development Corporation (NCDC), NABARD and NDDB.

- The eligible entities are individuals, Private Companies, FPO, MSME, Section 8 companies. Now the Dairy Cooperatives will also avail benefits for modernization, strengthening of the dairy plants.

- Government of India will also provide credit guarantee to the MSME and Dairy Cooperatives up to the 25% of the credit borrowed from the Credit Guarantee Fund of Rs.750 crore.

Outcome:

- The AHIDF has so far created an impact by adding 141.04 LLPD (Lakh Ltr. Per Day) of milk processing capacity, 79.24 lakh metric ton of feed processing capacity and 9.06 Lakh metric ton of meat processing capacity by adding to the supply chain since the inception of the scheme.

- The scheme has been able to increase processing capacity by 2-4% in dairy, meat and animal feed sector.

Upgradation of infrastructure:

- Animal Husbandry sector presents an opportunity for the investors to invest in the Livestock sector making this sector a lucrative one ranging from value addition, cold chain and integrated units of Dairy, Meat, Animal Feed units to technologically assisted Livestock and Poultry farms, Animal Waste to wealth Management and Setting up of Veterinary Drugs/ Vaccine units.

- After inclusion of new activities like technologically assisted breed multiplication farms, strengthening of veterinary drugs and vaccine units, Animal waste to wealth management, the scheme will exhibit a huge potential for the upgradation of infrastructure in Livestock sector.

Economic aspect:

- The scheme will be a channel towards employment generation directly and indirectly to 35 lakh people through entrepreneurship development and aims for wealth creation in the livestock sector. So far, the AHIDF has benefitted directly /indirectly approximately to 15 lakh farmers.

- Thus investment by incentivisation in AHIDF would not only leverage private investment 7 times but would also motivate farmers to invest more on inputs thereby driving higher productivity leading to increase in farmers income.

RBI curbs to render Paytm wallet and FASTag inoperative

(GS Paper 3, Economy)

Why in news?

- The Reserve Bank of India (RBI) imposed additional curbs on Paytm Payments Bank Ltd (PPBL) recently prohibiting it from operating its mobile wallet after February 29.

Details:

- It has also been barred from taking further deposits or undertaking credit transactions or top-ups in any customer accounts, prepaid instruments, wallets, FASTags, or National Common Mobility Cards, after February 29.

- However, it will be allowed to credit any interest, cashbacks, or refunds into these accounts at any time, and customers are also free to withdraw or use their balances in these accounts without restrictions. According to sources, the RBI’s action will not impact the usage of the UPI channel used through the Paytm app, as this is owned by the parent company and not by PPBL.

Why RBI took this action?

- The RBI has initiated action against Paytm following a comprehensive system audit report and subsequent compliance validation report by external auditors, which revealed “persistent non-compliances and continued material supervisory concerns in the bank, warranting further supervisory action”.

- The RBI had, on March 11, 2022, directed PPBL to stop onboarding new customers with immediate effect. However, it was found that the bank was continuing to onboard customers through an offline mode in violation of the RBI directive, necessitating further action.

- As per the RBI’s fresh directive, the bank’s customers can withdraw or use the available balance amounts in their accounts without any restrictions, including their savings bank accounts, current accounts, prepaid instruments, FASTags, and National Common Mobility Cards.

What has Paytm said in response to the RBI action?

- As Paytm shares fell 20 per cent on the exchanges, One97 Communications Ltd said it was “taking immediate steps to comply with RBI directions”, including working with the regulator to address their concerns as quickly as possible.

- Depending on the nature of the resolution, the company expects the RBI action to have a worst-case impact of Rs 300-500 crore on its annual EBITDA (earnings before interest, tax, depreciation and amortisation) going forward.

- Also, going forward, One97 Communications will be working only with other banks, and not with Paytm Payments Bank.

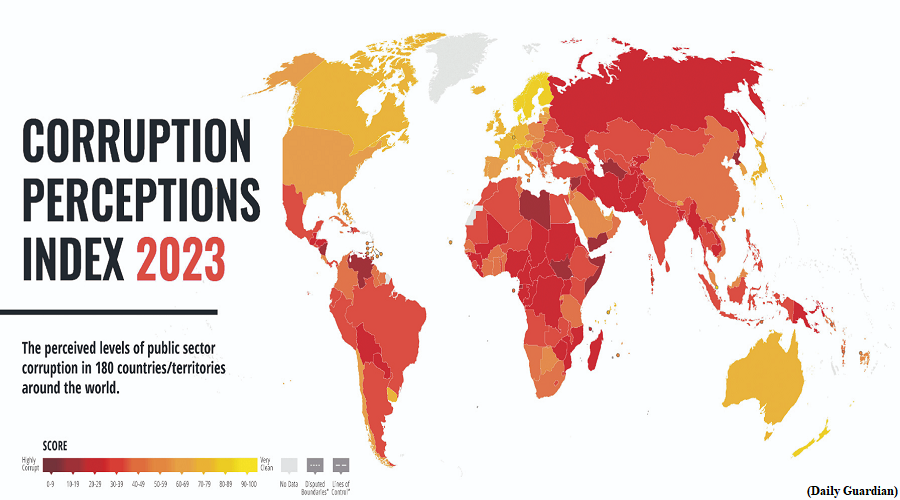

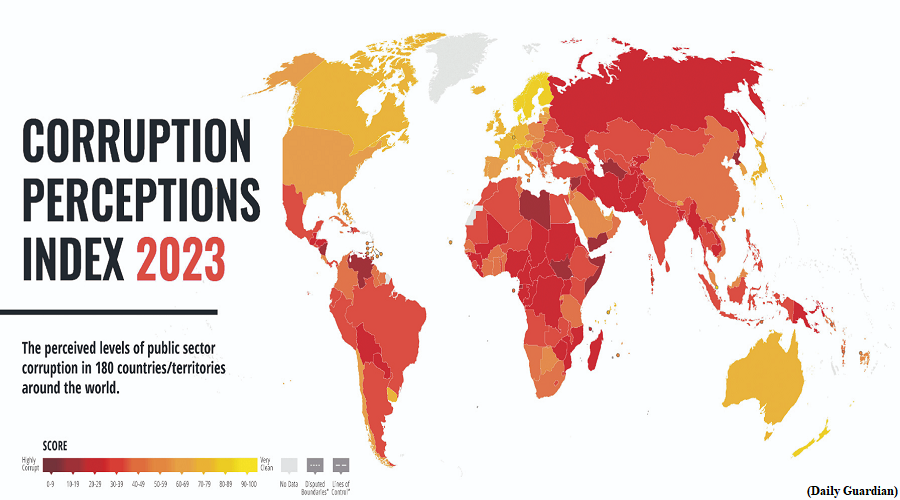

India ranks 93 among 180 countries in Global Corruption Index, Report

(GS Paper 3, Economy)

Why in news?

- Transparency International released its 2023 Corruption Perceptions Index (CPI) recently, revealing a list of the world's most corrupt countries.

Details:

- The report highlighted minimal progress in addressing public sector corruption, as the global average for CPI remained stagnant at 43 for the twelfth consecutive year.

- More than two-thirds of the 180 listed countries received a score below 50 on the scale, indicating a prevalence of corruption.

- The CPI ranks countries based on their perceived levels of public sector corruption, which range from zero (extremely corrupt) to 100 (very clean).

Key Findings:

- Denmark tops the index for the sixth year in a row, with a score of 90, owing to its "well-functioning justice systems".

- Finland and New Zealand are in second and third place, with scores of 87 and 85 respectively.

- This year's top ten countries are Norway (84), Singapore (83), Sweden (82), Switzerland (82), the Netherlands (79), Germany (78), and Luxembourg (78).

Most corrupt countries in the world:

- Taking the bottom spots in the CPI are Somalia (11), Venezuela (13), Syria (13), South Sudan (13), and Yemen (16). These countries are all affected by protracted crises, primarily armed conflicts.

- Nicaragua (17), North Korea (17), Haiti (17), Equatorial Guinea (17), Turkmenistan (18), and Libya (18) are the subsequent lowest performers on the index.

Where does India stand?

- In the CPI, India secured the 93rd position with a score of 39, according to the Transparency International report. India's overall score remained relatively stable, as it was 40 in 2022, securing the 85th position.

- Meanwhile, Pakistan, with a score of 29, and Sri Lanka (34) grappled with their respective debt burdens and ensuing political instability, the report said.

- Among India's neighbours, Afghanistan and Myanmar scored 20, China scored 42, Japan scored 73, and Bangladesh scored 24.