The first International Day of Zero Waste (GS Paper 3, Environment)

Why in news?

- Recently, the world marked the first-ever International Day of Zero Waste on March 30, 2023, encouraging everyone to prevent and minimise waste and promoting a societal shift towards a circular economy.

Stakeholders:

- The United Nations Environment Programme (UNEP) and UN Human Settlements Programme (UN-Habitat) established the day in response to the worsening impacts of waste on human health, the economy and the environment.

- The day calls upon all stakeholders to engage in activities that raise awareness of zero-waste initiatives.

Background:

- The day was established through a UN General Assembly resolution that followed other resolutions on waste, including the March 2, 2022 UN Environment Assembly’s commitment to advance a global agreement to end plastic pollution.

Why it matters?

- Waste generation has increased massively around the world in recent decades, and there are no signs of it slowing down. By 2050, worldwide municipal solid waste generation is expected to have increased by roughly 70 per cent to 3.4 billion tonnes.

- Humanity generates more than 2 billion tonnes of municipal solid waste annually, of which 45 per cent is mismanaged.

- Waste comes in all forms and sizes including plastics, debris from mining and construction sites, electronics and food. It disproportionately impacts the poor, with up to 4 billion people lacking access to controlled disposal facilities.

Significance:

- The International Day of Zero Waste aims to bring these myriad impacts of waste to the world’s attention and encourage global action at all levels to reduce pollution and waste.

- Promoting zero-waste initiatives can help advance all the goals and targets in the 2030 Agenda for Sustainable Development, including Sustainable Development Goal 11 on making cities and human settlements inclusive, safe, resilient and sustainable and UN-mandated Sustainable Development Goal 12 on ensuring sustainable consumption and production patterns, the press briefing added.

What is Bhu-Aadhaar?

(GS Paper 3, Economy)

Why in news?

- By March 2024, India aims to digitise 100 per cent of its land records and the land registration process, and give a unique 14-digit alpha-numeric identity, also called Bhu-Aadhaar, to each land parcel.

ULPIN:

- The Unique Land Parcel Identification Number (ULPIN) or Bhu-Aadhaar will have longitude and latitude coordinates of the land parcel and is based on detailed surveys and geo-referenced cadastral maps. It will cover all land parcels; rural as well as urban.

- So far, ULPIN has already been rolled out in 26 states and Union territories — Andhra Pradesh, Jharkhand, Goa, Bihar, Odisha, Sikkim, Gujarat, Maharashtra, Rajasthan, Haryana, Tripura, Chhattisgarh, Jammu & Kashmir, Assam, Madhya Pradesh, Nagaland, Mizoram, Tamil Nadu, Punjab, Dadra & Nagar Haveli and Daman & Diu, Himachal Pradesh, West Bengal, Uttar Pradesh, Uttarakhand, Kerala and Ladakh.

- Except Meghalaya, which has a tradition of community ownership of land parcels, it is currently under implementation in the remaining states and Union territories.

- ULPIN is part of the Digital India Land Records Modernisation Programme (DILRMP), a 100 per cent centrally funded scheme.

- It was earlier known as the National Land Record Modernisation Programme and was approved by the cabinet in August 2008. It was later revamped as DILRMP and implemented as a central sector scheme from 1 April 2016.

Why Bhu-Aadhaar is needed?

- So far, different states were using different methods for assigning unique IDs to land parcels in computerisation of land records.

- This made extraction of important information on farmers and their land difficult and cumbersome. In many instances, the land parcel numbers were repeated in each village, making it difficult to establish farmer-land relationships.

- It was to address this that Department of Land Resources (DoLR) along with the Ministry of Electronics and Information Technology, Department of Science and Technology and the National Remote Sensing Centre came up with the Unique Land Parcel Identification Number system.

- The 14-digit alpha-numeric unique ID is assigned to each land parcel based on geo coordinates of the parcel’s vertices. It complies with the Electronic Commerce Code Management Association (ECCMA) standard and the Open Geospatial Consortium (OGC) standard.

Significance:

- A unique ID will help in sharing of land record data across departments, financial institutions and all stakeholders.

- It will also help farmers leverage their land and use it as a collateral to borrow money from banks.

Records of Rights:

- It’s not just ULPIN. The Digital India Land Records Modernisation Programme also has other components, including transliterating the Records of Rights to any of the 22 languages recognised by the Constitution.

- Currently, the Records of Rights in each state and Union territory are maintained in local languages.

- The linguistic barriers pose serious challenges for access of information and usage in understandable form.

Way Forward:

- DoLR aims to implement all components of Digital India Land Records Modernisation Programme (DILRMP) at full pace by 31 March 2026.

- Efforts are being made to complete One Nation One Registration by 2024.

India unveils Foreign Trade Policy (FTP) 2023

(GS Paper 3, Economy)

Why in news?

- Recently, the Commerce Minister unveiled Foreign Trade Policy (FTP) 2023.

2023.png)

Details:

- The policy, which aims to boost the country's exports to $2 trillion by 2030, will shift from incentives to remission and entitlement-based regime.

- However, the FTP this time has done away with 5 year period clause. The latest policy has no end date and will be updated as and when needed.

Key Highlights:

Exports:

- India is likely to end this fiscal year with total exports of USD 760-770 billion as against USD 676 billion in 2021-22.

- The FTP benefits have been extended to e-commerce exports, which are estimated to grow to $200-300 billion by 2030. The value limit for exports through courier service is being increased from Rs 5 lakh to Rs 10 lakh per consignment.

- The FTP 2023 is dynamic and responsive to the emerging trade scenario. The department of commerce is being restructured to make it "future-ready".

- In 2021-22, the country's goods and services exports touched an all-time high of $422 billion and $254 billion respectively, taking the total shipments to $676 billion.

TEE:

Global currency:

- The new FTP also seeks to make the Indian rupee a global currency and allow international trade settlement in the domestic currency.

What is a Foreign Trade Policy?

- Foreign Trade Policy is an elaborate framework aiming to increase exports of goods and services as well as generation of employment and increase value addition in the country.

- Its primary focus is to support both the manufacturing and services sectors, with a special emphasis on improving the ease of doing business.

- Established by the Directorate General of Foreign Trade (DGFT), the governing body for the promotion and facilitation of exports and imports under the Ministry of Commerce and Industry, the policy emphasises on adopting a twin strategy of promoting traditional and sunrise sectors of exports including services.

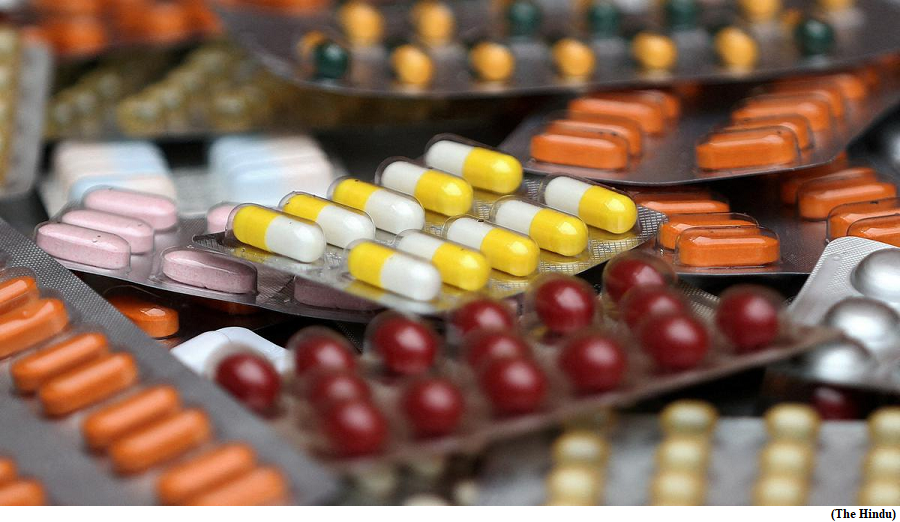

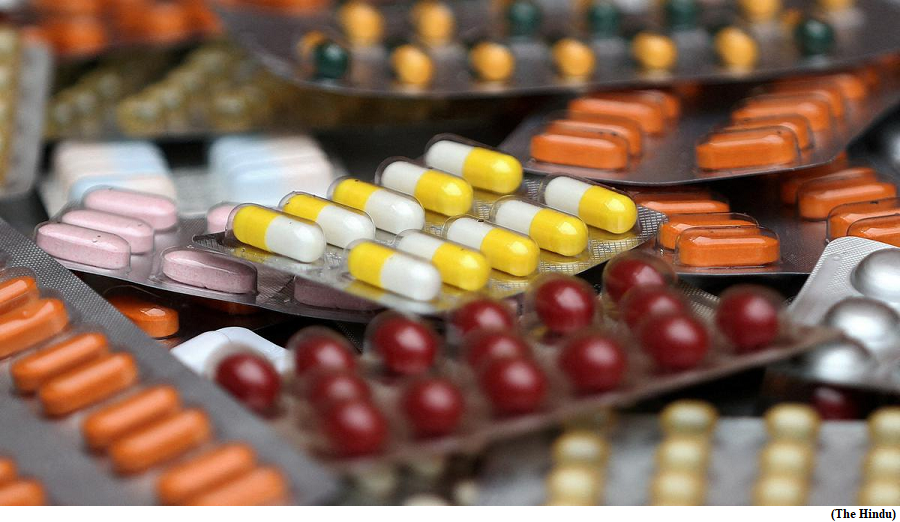

Drugs for rare diseases get customs duty relief

(GS Paper 2, Health)

Why in news?

- All drugs and food for special medical purposes imported for personal use for treatment of all rare diseases listed under the National Policy for Rare Diseases, 2021 are now fully exempted from basic customs duty, the Union government declared through a general exemption notification.

- The Centre has also fully exempted pembrolizumab (Keytruda), used in treatment of various cancers, from basic customs duty.

Criteria for exemption:

- In order to get this exemption, the individual importer has to produce a certificate from the Central or State Director of Health Services or District Medical Officer/Civil Surgeon of the district.

- Drugs/medicines generally attract basic customs duty of 10%, while some categories of life-saving drugs/vaccines attract concessional rate of 5% or nil.

What are Drugs or special foods & why it matters?

- Drugs or special foods required for the treatment of these diseases are expensive and often need to be imported.

- Food for special medical purposes is a food formulation intended to provide nutritional support to persons who suffer from a specific disease, disorder or condition.

- It is estimated that for a child weighing 10 kg, the annual cost of treatment for some rare diseases may vary from ₹10 lakh to over ₹1 crore per year, with treatment being lifelong and drug dose and cost increasing with age and weight.

- This exemption will result in substantial cost savings and provide much-needed relief to the patients.

2023.png)