Nuclear energy: fixing the finance (GS Paper 2, Science and Technology)

Urgent Need for Reassessment of Nuclear Financing Policies

- Multilateral Development Banks (MDBs) need to reassess their financing policies to accommodate private capital or blended financing models for nuclear energy generation.

- Despite the indispensable role of nuclear energy in meeting climate goals, MDBs and private investors have not significantly contributed to the industry’s financing.

- The lack of financial support from institutions like the World Bank reflects outdated financing policies that hinder the growth of nuclear energy.

Successful Financial Models and Cooperative Funding Practices:

- Countries like France, South Korea, Russia, and the U.K. have implemented successful cooperative funding models for nuclear projects.

- Cooperative finance models such as ‘Mankala’ in Finland, where multiple private companies jointly own and fund energy producers, offer a replicable example of successful financing.

- Financial creativity, coupled with market support and low interest rates, can unlock the potential of nuclear energy at scale.

Discrepancy Between Nuclear Infrastructure Development and Financing:

- Despite the increasing number of nuclear reactors worldwide, the state of nuclear infrastructure development and finance mobilization is not proportional.

- Examples like NuScale Power’s terminated project in Utah and bankruptcy filings of nuclear powerhouses Westinghouse and Areva highlight the challenges faced in nuclear project financing and implementation.

- China’s ambitious targets for nuclear energy production underscore the urgency to address the gap between infrastructure development and financing.

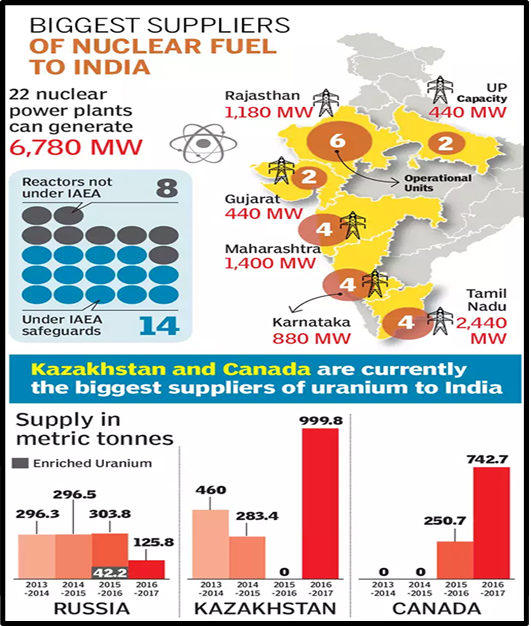

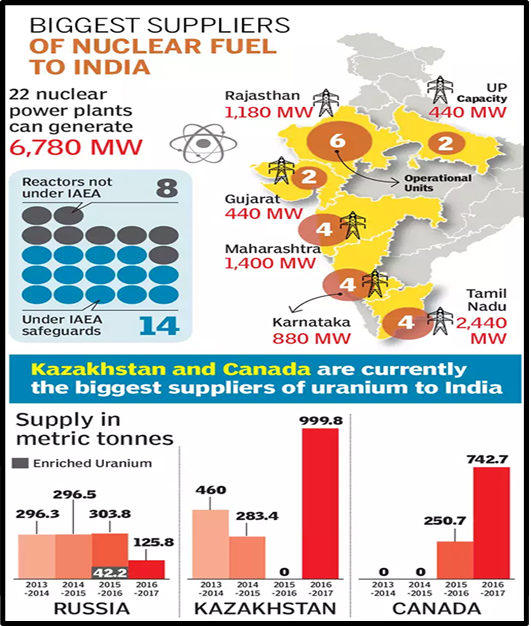

India’s Position and Efforts in Nuclear Energy:

- India’s nuclear industry faces challenges such as stigma, weaponization risk, and regulatory hurdles, limiting its adoption rate despite offering reliable and cost-effective energy.

- Recent initiatives in India, including inviting private investments, tripling nuclear capacity, and advancements like the Prototype Fast Breeder Reactor (PFBR), indicate a positive trajectory for the industry.

- The PFBR’s innovative capabilities signify India’s commitment to advancing its nuclear industry and achieving self-reliance in nuclear energy production.

Conclusion:

- Urgent reassessment of nuclear financing needed due to disproportionate infrastructure development and financing. Successful models like cooperative funding exist. India’s nuclear industry is evolving despite challenges, signalling positive growth prospects.