Economic Survey 2022 23 Highlights (GS Paper 3, Economy)

Why in news?

- Recently, the Union Minister for Finance and Corporate Affairs, Nirmala Sitharaman, presented the Economic Survey 2022-23 in the Union Parliament. The highlights of the Survey are as follows:

State of the Economy 2022-23:

- Recovering from pandemic-induced contraction, Russian-Ukraine conflict and inflation, Indian economy is staging a broad based recovery across sectors, positioning to ascend to the pre-pandemic growth path in FY23.

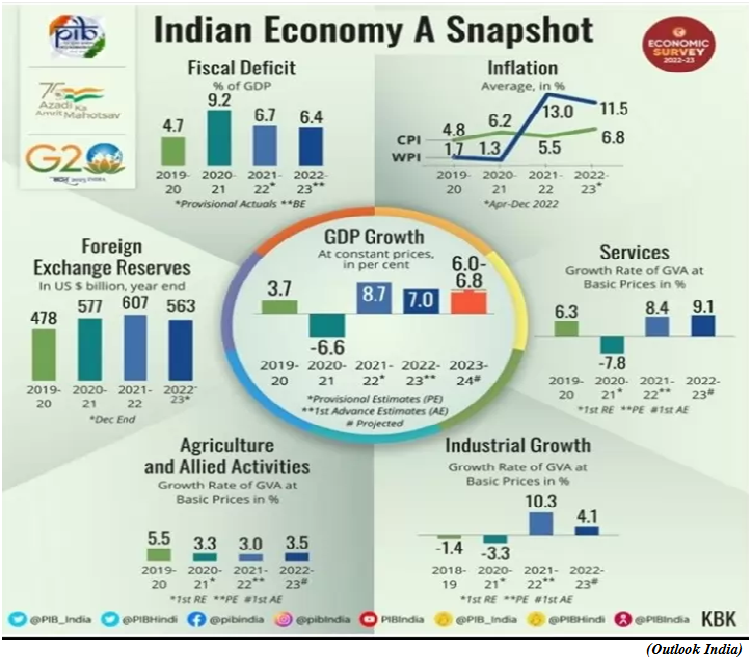

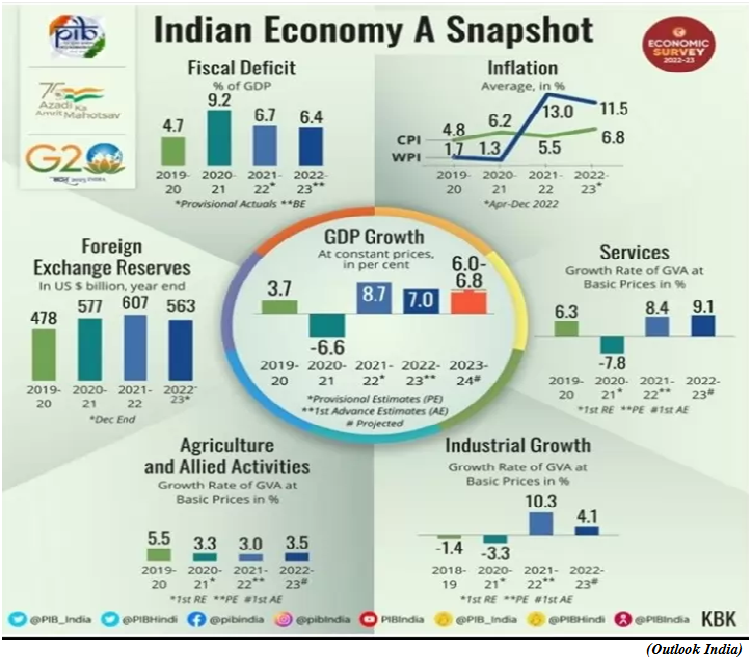

- India's GDP growth is expected to remain robust in FY24. GDP forecast for FY24 to be in the range of 6-6.8 %.

- Private consumption in H1 is highest since FY15 and this has led to a boost to production activity resulting in enhanced capacity utilisation across sectors.

- The Capital Expenditure of Central Government and crowding in the private Capex led by strengthening of the balance sheets of the Corporates is one of the growth driver of the Indian economy in the current year.

- The credit growth to the MSME sector was over 30.6 per cent on average during Jan-Nov 2022.

- Retail inflation is back within RBI's target range in November 2022.

- Direct Tax collections for the period April-November 2022 remain buoyant.

India’s Medium Term Growth Outlook:

- Indian economy underwent wide-ranging structural and governance reforms that strengthened the economy's fundamentals by enhancing its overall efficiency during 2014-2022.

- With an underlying emphasis on improving the ease of living and doing business, the reforms after 2014 were based on the broad principles of creating public goods, adopting trust-based governance, co-partnering with the private sector for development, and improving agricultural productivity.

- The period of 2014-2022 also witnessed balance sheet stress caused by the credit boom in the previous years and one-off global shocks, that adversely impacted the key macroeconomic variables such as credit growth, capital formation, and hence economic growth during this period.

- This situation is analogous to the period 1998-2002 when transformative reforms undertaken by the government had lagged growth returns due to temporary shocks in the economy. Once these shocks faded, the structural reforms paid growth dividends from 2003.

- Similarly, the Indian economy is well placed to grow faster in the coming decade once the global shocks of the pandemic and the spike in commodity prices in 2022 fade away.

- Indian economy has also started benefiting from the efficiency gains resulting from greater formalisation, higher financial inclusion, and economic opportunities created by digital technology-based economic reforms.

Fiscal Developments:

- The Union Government finances have shown a resilient performance during the year FY23, facilitated by the recovery in economic activity, buoyancy in revenues from direct taxes and GST, and realistic assumptions in the Budget.

- The Gross Tax Revenue registered a YoY growth of 15.5 per cent from April to November 2022, driven by robust growth in the direct taxes and Goods and Services Tax (GST).

- Growth in direct taxes during the first eight months of the year was much higher than their corresponding longer-term averages.

- GST has stabilised as a vital revenue source for central and state governments, with the gross GST collections increasing at 24.8 per cent on YoY basis from April to December 2022.

- Union Government's emphasis on capital expenditure (Capex) has continued despite higher revenue expenditure requirements during the year. The Centre's Capex has steadily increased from a long-term average of 1.7 per cent of GDP (FY09 to FY20) to 2.5 per cent of GDP in FY22 PA.

- The Centre has also incentivised the State Governments through interest-free loans and enhanced borrowing ceilings to prioritise their spending on Capex.

- With an emphasis on infrastructure-intensive sectors like roads and highways, railways, and housing and urban affairs, the increase in Capex has large-scale positive implications for medium-term growth.

Monetary Management and Financial Intermediation:

- The RBI initiated its monetary tightening cycle in April 2022 and has since raised the repo rate by 225 bps, leading to moderation of surplus liquidity conditions.

- Cleaner balance sheets led to enhanced lending by financial institutions.

- The growth in credit offtake is expected to sustain, and combined with a pick-up in private capex, will usher in a virtuous investment cycle.

- Non-food credit offtake by scheduled Commercial Banks (SCBs) has been growing in double digits since April 2022.

- Credit disbursed by Non-Banking Financial Companies (NBFCs) has also been on the rise.

- The Gross Non-Performing Assets (GNPA) ratio of SCBs has fallen to a seven-year low of 5.0.

- The Capital-to-Risk Weighted Assets Ratio (CRAR) remains healthy at 16.0.

- The recovery rate for the SCBs through Insolvency and Bankruptcy (IBC) was highest in FY22 compared to other channels.

Prices and Inflation:

- While the year 2022 witnessed a return of high inflation in the advanced world after three to four decades, India caps the rise in prices.

- While India’s retail inflation rate peaked at 7.8 per cent in April 2022, above the RBI’s upper tolerance limit of 6 per cent, the overshoot of inflation above the upper end of the target range in India was however one of the lowest in the world.

- The government adopted a multi-pronged approach to tame the increase in price levels

- Phase wise reduction in export duty of petrol and diesel

- Import duty on major inputs were brought to zero while tax on export of iron ores and concentrates increased from 30 to 50 per cent

- Waived customs duty on cotton imports w.e.f 14 April 2022, until 30 September 2022

- Prohibition on the export of wheat products under HS Code 1101 and imposition of export duty on rice

- Timely policy intervention by the government in housing sector, coupled with low home loan interest rates propped up demand and attracted buyers more readily in the affordable segment in FY23.

- An overall increase in composite Housing Price Indices (HPI) assessment and Housing Price Indices market prices indicates a revival in the housing finance sector. A stable to moderate increase in HPI also offers confidence to homeowners and home loan financiers in terms of the retained value of the asset.

Social Infrastructure and Employment:

- Social Sector witnessed significant increase in government spending.

- Central and State Government’s budgeted expenditure on health sector touched 2.1% of GDP in FY23 (BE) and 2.2% in FY22 (RE) against 1.6% in FY21.

- Social sector expenditure increases to Rs. 21.3 lakh crore in FY23 (BE) from Rs. 9.1 lakh crore in FY16.

- Survey highlights the findings of the 2022 report of the UNDP on Multidimensional Poverty Index which says that 41.5 crore people exit poverty in India between 2005-06 and 2019-20.

- The Aspirational Districts Programme has emerged as a template for good governance, especially in remote and difficult areas.

- Labour markets have recovered beyond pre-Covid levels, in both urban and rural areas, with unemployment rates falling from 5.8 per cent in 2018-19 to 4.2 per cent in 2020-21.

- The year FY22 saw improvement in Gross Enrolment Ratios (GER) in schools and improvement in gender parity. GER in the primary-enrolment in class I to V as a percentage of the population in age 6 to 10 years - for girls as well as boys have improved in FY22.

- Due to several steps taken by the government on health, out-of-pocket expenditure as a percentage of total health expenditure declined from 64.2% in FY14 to 48.2% in FY19.

Climate Change and Environment:

- India declared the Net Zero Pledge to achieve net zero emissions goal by 2070.

- India achieved its target of 40 per cent installed electric capacity from non-fossil fuels ahead of 2030.

- The likely installed capacity from non-fossil fuels to be more than 500 GW by 2030 resulting in decline of average emission rate by around 29% by 2029-30, compared to 2014-15.

- India to reduce emissions intensity of its GDP by 45% by 2030 from 2005 levels.

- About 50% cumulative electric power installed capacity to come from non-fossil fuel-based energy resources by 2030.

- A mass movement LIFE– Life style for Environment launched.

- Sovereign Green Bond Framework (SGrBs) issued in November 2022.

- RBI auctions two tranches of ₹4,000 crore Sovereign Green Bonds (SGrB).

- National Green Hydrogen Mission to enable India to be energy independent by 2047.

- Green hydrogen production capacity of at least 5 MMT (Million Metric Tonne) per annum to be developed by 2030. Cumulative reduction in fossil fuel imports over ₹1 lakh crore and creation of over 6 lakh jobs by 2030 under the National green Hydrogen Mission. Renewable energy capacity addition of about 125 GW and abatement of nearly 50 MMT of annual GHG emissions by 2030.

- Solar power capacity installed, a key metric under the National Solar Mission stood at 61.6 GW as on October 2022.

Agriculture and Food Management:

- Private investment in agriculture increases to 9.3% in 2020-21.

- MSP for all mandated crops fixed at 1.5 times of all India weighted average cost of production since 2018.

- Institutional Credit to the Agricultural Sector continued to grow to 18.6 lakh crore in 2021-22

- Foodgrains production in India saw sustained increase and stood at 315.7 million tonnes in 2021-22.

- Free foodgrains to about 81.4 crore beneficiaries under the National Food Security Act for one year from January 1, 2023.

- About 11.3 crore farmers were covered under the Scheme in its April-July 2022-23 payment cycle.

- Rs 13,681 crores sanctioned for Post-Harvest Support and Community Farms under the Agriculture Infrastructure Fund.

- Online, Competitive, Transparent Bidding System with 1.74 crore farmers and 2.39 lakh traders put in place under the National Agriculture Market (e-NAM) Scheme.

- Organic Farming being promoted through Farmer Producer Organisations (FPO) under the Paramparagat Krishi Vikas Yojana (PKVY).

- India stands at the forefront to promote millets through the International Year of Millets initiative.

Industry:

- Overall Gross Value Added (GVA) by the Industrial Sector (for the first half of FY 22-23) rose 3.7 per cent, which is higher than the average growth of 2.8 per cent achieved in the first half of the last decade.

- PMI manufacturing has remained in the expansion zone for 18 months since July 2021, and Index of Industrial Production (IIP) grows at a healthy pace.

- Credit to Micro, Small and Medium Enterprises (MSMEs) has grown by an average of around 30% since January 2022 and credit to large industry has been showing double-digit growth since October 2022.

- Electronics exports rise nearly threefold, from US $4.4 billion in FY19 to US $11.6 Billion in FY22.

- India has become the second-largest mobile phone manufacturer globally, with the production of handsets going up from 6 crore units in FY15 to 29 crore units in FY21.

- Foreign Direct Investment (FDI) flows into the Pharma Industry has risen four times, from US $180 million in FY19 to US $699 million in FY22.

- The Production Linked Incentive (PLI) schemes introduced across 14 categories, with an estimated capex of ₹4 lakh crore over the next five years, to plug India into global supply chains. Investment of ₹47,500 crores has been seen under the PLI schemes in the FY22, which is 106% of the designated target for the year.

- Over 39,000 compliances have been reduced and more than 3500 provisions decriminalized as of January 2023.

Services:

- The services sector is expected to grow at 9.1% in FY23, as against 8.4% (YoY) in FY22.

- Robust expansion in PMI services, indicative of service sector activity, observed since July 2022.

- India was among the top ten services exporting countries in 2021, with its share in world commercial services exports increasing from 3 per cent in 2015 to 4 per cent in 2021.

- Credit to services sector has grown by over 16% since July 2022.

- US$ 7.1 billion FDI equity inflows in services sector in FY22.

- Contact-intensive services are set to reclaim pre-pandemic level growth rates in FY23.

- Sustained growth in the real estate sector is taking housing sales to pre-pandemic levels, with a 50% rise between 2021 and 2022.

- Hotel occupancy rate has improved from 30-32% in April 2021 to 68-70% in November 2022.

- Tourism sector is showing signs of revival, with foreign tourist arrivals in India in FY23 growing month-on-month with resumption of scheduled international flights and easing of Covid-19 regulations.

- Digital platforms are transforming India’s financial services.

- India’s e-commerce market is projected to grow at 18 per cent annually through 2025.

External Sector:

- Merchandise exports were US$ 332.8 billion for April-December 2022.

- India diversified its markets and increased its exports to Brazil, South Africa and Saudi Arabia.

- To increase its market size and ensure better penetration, in 2022, CEPA with UAE and ECTA with Australia come into force.

- India is the largest recipient of remittances in the world receiving US$ 100 bn in 2022. Remittances are the second largest major source of external financing after service export

- As of December 2022, Forex Reserves stood at US$ 563 bn covering 9.3 months of imports.

- As of end-November 2022, India is the sixth largest foreign exchange reserves holder in the world.

- The current stock of external debt is well shielded by the comfortable level of foreign exchange reserves.

- India has relatively low levels of total debt as a percentage of Gross National Income and short-term debt as a percentage of total debt.

Government on Track to achieve Fiscal Deficit Target Of 6.4%

(GS Paper 3, Economy)

Why in news?

- According to the Economic survey 2022-23, fiscal deficit is expected to be at 6.4% of GDP in FY 23. The Survey highlighted that conservative budget assumptions provided a buffer during global uncertainties.

- The resilience in the fiscal performance was due to a recovery in economic activity and buoyancy in revenues.

Gross Tax Revenue:

- Gross Tax Revenue registered a Year on year (YoY) growth of 15.5 % from April to November 2022, and the Net Tax Revenue to the Centre after the assignment to states grew by 7.9 % on a YoY basis.

- Structural reforms like the introduction of GST and the digitalisation of economic transactions have led to the greater formalisation of the economy and hence expanded the tax net and enhanced tax compliance. Thus revenues have grown at a pace much higher than the growth in GDP.

- The Direct taxes grew at 26 % Year On Year basis due to corporate and personal income tax growth in FY22. The growth rates observed in the major direct taxes during the first eight months of FY23 were much higher than their corresponding longer-term averages.

- The high imports have led to a 12.4 % YoY growth in the customs collection from April to November 2022. The excise duty collection has declined by 20.9 % from April to November 2022 on a YoY basis.

Buoyant GST Collection:

- The GST Tax payers doubled to 1.4 crore from 70 lakhs in 2022. The gross GST collections were ₹13.40 lakh crore from April to December 2022.

- Thus, implying a YoY growth of 24.8 % with an average monthly collection of ₹1.5 lakh crore.

- The improvement in GST collections has been due to the nationwide drive against GST evaders and fake bills and systemic changes introduced such as rate rationalisation correcting inverted duty structure.

Disinvestment:

- Out of the budgeted amount of ₹65,000 crore for FY23, 48 % has been collected as of 18 January 2023 as the pandemic-induced uncertainty, the geopolitical conflict, and the associated risks have posed challenges before the plans and prospects of the government's disinvestment targets over the last three years.

- The government has reaffirmed its commitment towards privatisation and strategic disinvestment of Public Sector Enterprises by implementing the New Public Sector Enterprise Policy and Asset Monetisation Strategy.

Capital expenditure:

- The capital expenditure by the Central Government has steadily increased from a long-term average 2.5% of GDP in FY22 PA. It is further budgeted to increase to 2.9% of GDP in FY23 highlighting an improvement in the quality of Government expenditure over the years.

- The Survey informed that ₹7.5 lakh crore of Capital Expenditure is budgeted for FY23, of which more than 59.6 % has been spent from April to November 2022.

- During this period, capital expenditure registered a YoY growth of over 60 %, much higher than the long-term average growth of 13.5 % recorded in the corresponding period from FY16 to FY20. Rs.1.5 lakh core were allocated to road transport and highways, Rs.1.20 lakh crore to railways, 0.7 lakh crore to defence and 0.3 lakh crore to telecommunications in FY22.

- It is considered as a counter-cyclical fiscal tool strengthening aggregate demand, generates employment and boosts other sectors.

Revenue Expenditure:

- The revenue expenditure of the Union government was brought down from 15.6% of GDP in FY21 to 13.5% of GDP in FY22 Provisional Actual (PA).

- This contraction was led by a reduction of the subsidy expenditure which was brought down from 3.6% of GDP in FY21 to 1.9% of GDP in FY22 PA.

- It was further budgeted to reduce to 1.2% of GDP in FY23. However, around 94.7% of the budgeted expenditure on subsidies has been utilised from April to November 2022 due to the sudden outbreak of geopolitical conflict resulting in higher international prices for food, fertiliser and fuel.

- Thus, the revenue expenditure from April to November 2022 has grown by over 10% on a YoY basis, higher than the growth noted in the corresponding period last year.

Overview of State Government Finances:

- The combined Gross Fiscal Deficit (GFD) of the States, which increased to 4.1% of GDP in FY21, was brought down to 2.8% in FY22 PA. Given the geopolitical uncertainties, the consolidated GFD-GDP ratio for States has been budgeted at 3.4% in FY23.

- However, from April- November 2022, the combined borrowings of the 27 major states have just reached 33.5% of their total budgeted borrowings for the year. The data from last three years shows that states had unutilised borrowing limits.

- The capital outlay of States grew by 31.7% in FY22 PA. This increase is attributable to strong revenue buoyancy and the support provided by the Centre in terms of advance releases of payments to the states, GST compensation payments, and interest-free loans.

Debt Profile of the Government:

- IMF projects the global government debt at 91% of GDP in 2022, about 7.5% points above the pre-pandemic levels. In this global backdrop, the total liabilities of the Union Government moderated from 59.2% of GDP in FY21 to 56.7% in FY22 (P).

- India's public debt profile is relatively stable and is characterised by low currency and interest rate risks. Of the Union Government's total net liabilities in end-March 2021, 95.1% were denominated in domestic currency, while sovereign external debt constituted 4.9%, implying low currency risk.

- Further, sovereign external debt is entirely from official sources, which insulates it from volatility in the international capital markets, highlights the Economic Survey.

- Furthermore, Public debt in India is primarily contracted at fixed interest rates, with floating internal debt constituting only 1.7% of GDP in end-March 2021. The debt portfolio is, therefore, insulated from interest rate volatility.

India ranks third in Net Gain in Average Annual Forest area in last Decade: Economic Survey 2022-23

(GS Paper 3, Economy)

Why in news?

- The Economic Survey 2022-23 highlights India’s climate vision which is integrally linked to its vision of development that foregrounds the goals of poverty eradication and guaranteeing basic well-being to all its citizens.

Progress on India’s Climate Action

- India has made significant progress in promoting the sustainable development by integrating its development goals with the ambitious climate action goals.

India’s Forest Cover:

Preservation of Ecosystems:

Transition to Renewable Energy

- India is progressively becoming a favored destination for investment in renewables. During the period 2014 -2021, total investment in renewables stood at US$ 78.1 billion in India.

- The likely installed capacity by the end of 2029-30 is expected to be more than 800 GW, of which non-fossil fuel would contribute more than 500 GW, resulting in the decline of average emission rate of around 29 per cent by 2029-30, compared to 2014-15.

- The National Green Hydrogen Mission, approved by the government with an outlay of ₹19,744 crore is to make India an energy-independent nation, and to de-carbonize the critical sectors, thereby resulting in 3.6 Giga tonnes of cumulative CO2 emission reduction by 2050.

Finance for Sustainable Development

Green Bonds:

- The issuance of Sovereign Green Bonds will help the government to tap the requisite finance from potential investors for deployment in public sector projects aimed at reducing the carbon intensity of economy.

- A framework in this regard has been issued in compliance with International Capital Market Association (ICMA) Green Bond Principles (2021).

- A Green Finance working committee has also been set up to oversee and validate key decisions on the issuance of Sovereign green bonds.

- The Reserve Bank of India has notified the indicative calendar for the issuance of Sovereign Green Bonds for the fiscal year 2022-23, totaling ₹16,000 crore.

Business Responsibility and Sustainability Report (BRSR):

- SEBI has issued new sustainability reporting requirements under the Business Responsibility and Sustainability Report (BRSR), which are more granular with quantifiable metrics in line with the principles ensconced in the ‘National Guidelines on Responsible Business Conduct’.

- The Survey mentions that BRSR was made mandatory for the top 1000 listed entities (by market capitalisation) from 2022-23.

India at COP 27

- India has updated its Nationally Determined Contributions (NDCs) by advancing its target of installed electric capacity from non-fossil fuels ahead of 2030, to 50%.

- The Survey mentions India’s Long-Term Low Carbon Development Strategy (LT-LEDS) which focuses on the rational utilisation of national resources with due regard to energy security.

- This strategy is in line with the vision of LiFE, Lifestyle for the Environment, calling for a worldwide paradigm shift from mindless and destructive consumption to mindful and deliberate utilisation.

Initiatives related to other environmental issues

- India and Nepal have signed a Memorandum of Understanding (MoU) in August 2022 on biodiversity conservation to strengthen and enhance the coordination and cooperation in the field of forests and wildlife.

- The survey highlights the achievement of India in doubling the tiger numbers in 2018, four years before the targeted year 2022.

- The population of Asiatic Lions has also shown a steady increase, with a population of 674 individuals in 2020, higher than the 523 lions in 2015.

- New Battery Waste Management Rules, 2022, & E-Waste (Management) Rules, 2022, have also been notified to promote the circular economy.