Rare clouded leopard (GS Paper 3, Environment)

Why in news?

- Recently, the Buxa Tiger Reserve in West Bengal posted a picture of a clouded leopard, one of the most ancient and mysterious of the cat species.

- It was sighted the International Clouded Leopard Day observed on 4 August.

Vulnerable Species:

- The clouded leopard was officially recorded in 1821 but little is known about it more than two centuries later.

- The International Union for Conservation of Nature (IUCN), which works in the field of nature conservation and sustainable use of natural resources, has listed this uncommon cat as vulnerable.

- Its population had a sharp decline in the second half of the 20th century because of poaching and deforestation. Less than 10,000 clouded leopards are believed to be living in the wild.

What’s the clouded leopard?

- The clouded leopard (Neofelis nebulosa) is named after the distinctive “clouds” on its coat – ellipses partially edged in black, with the insides a darker colour than the background colour of the pelt.

- The base of the fur is a pale yellow to rich brown, making the darker cloud-like markings look even more distinctive.

- The limbs and underbelly are marked with large black ovals, and the back of its neck is conspicuously marked with two thick black bars.

- It’s a medium-sized cat, about two to three feet long with an exceptionally long tail and the longest canine teeth of any living feline. It is smaller than the regular leopard which is 4.25 to 6.25 feet long.

- The clouded leopard is mostly related to the snow leopards and is in the same taxonomic subfamily, Pantherinae, as tigers, lions, jaguars, and true leopards. However, it does not roar and unlike smaller cats, it doesn’t purr.

Habitat:

- “Cloudeds” are rarely seen in the wild and their habitat remains mysterious. They roam the hunting grounds of Asia from the rain forests of Indonesia to the foothills of the Nepali Himalayas, says The National Geographic.

- They are found in Bhutan, Nepal, northeast India, Burma, Thailand, Vietnam, Malaysia, Cambodia, Laos, Bangladesh, and Borneo. They are believed to be extinct in Taiwan and China.

- Although population numbers are thought to be lower outside protected areas, their populations are probably healthiest in Borneo because of the absence of tigers and leopards.

- In India, these cats inhabit the forests of the northeast and now one has been seen in West Bengal. However, the clouded leopard is not as easily spotted as the other leopards.

Is the ‘clouded’ in Buxa the first on record in India?

- No. in 2021, a team of researchers recorded photographic evidence of clouded leopards in a community-owned forest in Nagaland along the Indo-Myanmar border.

- Clouded leopards are known to inhabit low-elevation evergreen rainforests. Found at a height of 3,700 metres – one of the highest reported altitudes where the animal has been sighted in the world so far – made the discovery even more significant.

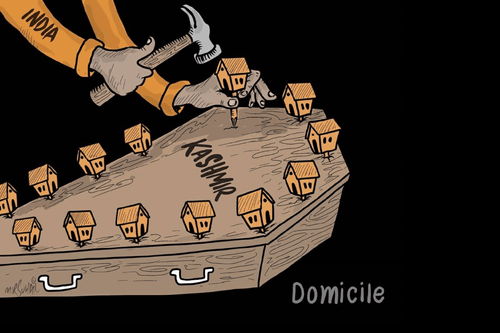

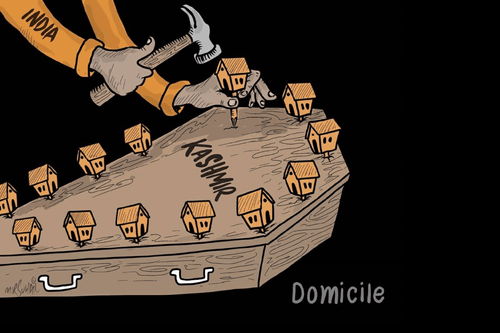

The rise of Kashmir

(GS Paper 2, Polity and GOvernance)

Context:

- August 5 marks the third anniversary of the abrogation of Articles 370 and 35A, which seemed impossible till it was done on 5 Augusts 2019.

Jammu and Kashmir, since then has travelled quite a distance to re-arrange priorities of development, initiate deep reforms in governance, curb corruption, neutralise a well-fed terror ecosystem and realise the dreams of youth.

Developmental projects:

- A series of targeted efforts to tide over governance bottlenecks, financial indiscipline and lack of monitoring has yielded results in the form of developmental projects. In 2018-19, only 9,229 projects were completed in a year. This has increased to 50,627 in the financial year 2021-22.

- The effort is to ensure that Jammu and Kashmir is at par with the other states and UTs in most of the indicators.

- Rs 1 lakh crore is being spent to improve road connectivity and build tunnels, and to fill the resource gap in the creation of new infrastructure. Social sector spending has increased by 43.83 per cent and the economic sector by 45.60 per cent in the last three years. It shows the importance the Centre has attached to the overall development of Jammu and Kashmir.

Measures for improving the delivery of public services and prudent financial management:

- Implementation of the Janbhagidari Empowerment portal demonstrates the administration’s will to empower people through an initiative that enables them to oversee the works being executed and money spent in their area. It encourages them to become a partner in the development process.

- The Government have harnessed the power of information technology to eliminate red tape and enhance transparency.

- J&K was ranked first amongst the UTs in the recently released National e-Governance Service Delivery Assessment Report. More than 200 public services have been made available online to receive real-time feedback from citizens.

- Providing houses to people in rural areas, developing roads, putting in place primary health facilities and safe drinking water services, creating more avenues for education, employment, and agriculture, attracting private investment and bridging gaps between government delivery mechanisms and people’s expectations were some of the tasks completed by building trust between the administration and the people.

Structural and institutional changes:

- Structural and institutional changes like ending the 150-year-old Darbar Move brought in another layer of transparency and improvement in governance. It also saved about Rs 400 crore annual expenditure that used to be incurred in shifting logistics from Srinagar to Jammu and back.

- It has also prevented the loss of at least one working month every year. The Government have adopted zero tolerance for corruption and more than 639 cases were registered against UT employees in the last two years.

- The intelligentsia and PRIs were called upon to collectively rise to the task ahead in terms of strengthening agriculture, horticulture, planning projects for rural Jammu and Kashmir, unemployment and getting rid of inertia in governance. The thrust of the initiatives was to strengthen grass roots institutions and make villages the growth engine of the UT.

Visible outcomes:

- The security situation in the UT has undergone a sea change for the better. Stone pelting and strikes have become a thing of the past. Strict action is being taken against troublemakers, instigators and agent provocateurs through legal measures.

- No civilian casualty occurred while managing the law and order situation in the last three years. The net result is the record footfall of tourists, one crore tourists visited the UT during the last seven months (January to July).

Upcoming projects:

- Jammu and Kashmir is trying to scale up infrastructure. Projects worth Rs 58,477 crore under the Prime Minister’s Development Package have picked up pace and direction after impediments and bottlenecks that hindered growth; land acquisition, forest clearances, utility shifting and court cases were removed.

Education Sector:

- Fifty new degree colleges have been established increasing the number of seats by 25,000.

- Big ticket infrastructure projects have come in the healthcare sector. Two new AIIMS, seven new medical colleges, two cancer institutes and 15 nursing colleges have been added and 140 health institutions are being upgraded.

- An additional 41,141 km of roads have been constructed. J&K is placed 4th in the ranking of states and UTs based on their performance in the Pradhan Mantri Gram Sadak Yojana.

Hydropower:

- Despite having a hydropower potential of 20,000 MW, J&K could tap only 3,500 MW in 70 years.

- In the last two years, projects for about 3,000 MW were revived.

Agriculture & allied sectors:

- Earlier, J&K had shied away from agrarian change. With sustained interventions, the UT has achieved the third rank in the monthly income of agriculture households and was ranked the fifth best performing state/UT in agriculture and allied sectors.

Employment:

- Thirty thousand jobs were generated in the government, 5.2 lakh youth were provided with the opportunity to become entrepreneurs under central and UT schemes, and more than five lakh women were associated with self-help groups.

- The Government is determined to utilise technology to train our youth for Industry 4.0. In the last 70 years, only Rs15,000 crore private investment was realised in J&K whereas in the last two years, the UT attracted proposals worth Rs 56,000 crore.

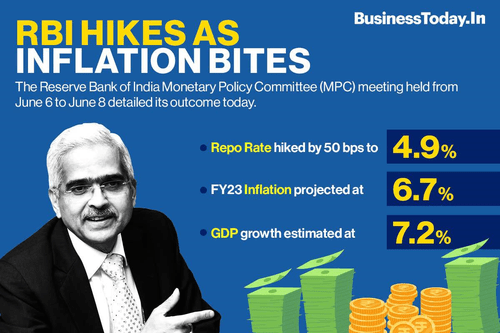

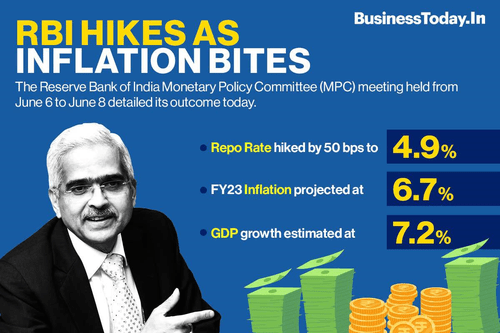

The RBI’s latest hike in Repo Rate

(GS Paper 3, Economy)

Why in news?

With an eye on inflation amid the prevailing global uncertainties, the Reserve Bank of India (RBI) announced a 50 basis point hike in the repo rates, the rate at which RBI lends to commercial banks thereby taking the cumulative rate hike over the last three months to 140 basis points.

Why the 50 basis point hike?

- As it decided to go for a second 50 basis point hike within two months, elevated levels of inflation remained the key concern for RBI’s monetary policy committee (MPC).

- With inflation expected to remain above the upper threshold in Q2 and Q3, the MPC stressed that sustained high inflation could destabilise inflation expectations and harm growth in the medium term.

- The MPC, therefore, judged that further calibrated withdrawal of monetary accommodation is warranted to keep inflation expectations anchored and contain the second-round effects.

- Accordingly, the MPC decided to increase the policy repo rate by 50 basis points to 5.4 per cent.

- Even as the consumer price inflation has eased from its surge in April, the MPC noted that it remains uncomfortably high and above the upper threshold of the target

Why is RBI not drawing comfort from softening inflation?

- Even as RBI Governor stated that CPI inflation has peaked and RBI has projected inflation to soften and come down to 5 per cent in Q1 FY23, RBI went ahead with a 50-basis point hike as it said that currently inflation remains at unacceptable levels and global uncertainties prevail.

- The MPC feels that there are global challenges on the front of inflationary surges, tightening of financial conditions, sharp appreciation of the US dollar, and lower growth across geographies, and hence, monetary policy has to act.

- The MPC’s actions are in line with the current global inflation scenario and has leaned in favour of anchoring inflationary expectations to work out solutions to free the growth potential of the economy.

How will it impact borrowers and depositors?

- This is set to further hit existing home loan customers and prospective borrowers, as it will result in a hike in lending rates.

- At the same time, conservative investors who like to park their funds in bank fixed deposits, will benefit as banks are expected to raise their deposit rates following the rate hike. The deposit rate hike, however, will also be dependent upon the credit demand in the economy and the need for banks to raise additional funds.

- Banks and housing finance companies have already raised their lending rates between 70 to 90 basis points following the 90 basis point hike in repo rate by RBI in May and June. Now banks and HFCs are expected to raise the rates again.

- Following the 140 basis point hike in the repo rate over the last three months, if the lending rates were to rise by 150 basis points, it will have a significant impact on EMIs.

Will there be more rate hikes?

- RBI has projected an inflation of 6.7 per cent for the year 2022-23 and has said that the inflation will come down to 5 per cent in Q1FY23.

- It has, however, said that its future actions would depend upon the evolving situation. Given its enhanced concerns around inflation, market participants feel that the central bank may go for additional rate hikes of 50-60 basis points over the remaining part of the year.

- The MPC also decided to remain focused on withdrawal of accommodation to ensure that inflation remains within the target going forward, while supporting growth.

What is the view on growth?

- Even as there are concerns over global growth and risks of recession in some developed economies, the RBI retained its GDP growth forecast of 7.2 per cent for the current financial year and has projected it to grow by 6.7 per cent for Q1FY23.

- While indicators such as production of consumer durables, domestic air passenger traffic and sale of passenger vehicles suggest improvement in urban demand, the RBI said that urban consumption will benefit from the demand for contact-intensive services, better performance of corporates, and improving consumer optimism.

- As high frequency indicators of the services sector like railway freight traffic, port freight traffic, e-way bills, toll collections and commercial vehicle sales remained robust in June and July, RBI said that investment activity has been picking up.

- While PMI manufacturing rose to an 8-month high in July, PMI services indicated continued expansion in July.

What is the view on liquidity?

- As a result of the repo rate hike of 50bps, the standing deposit facility rate now stands at 5.15 per cent and cumulatively, it has been raised by 180 basis points in FY23.

- While the hikes in SDF rate has led to a gradual decline in systemic liquidity, the deposit rates have also firmed up and that will improve the availability of funds with banks, amidst a pickup in credit.

- To maintain adequate liquidity in the system, RBI will conduct two-way fine tuning operations in the form of Variable Rate Repo (VRR) and Variable Rate Reverse Repo (VRRR) operations of different maturities.

Amendment to Energy Conservation Act

(GS Paper 3, Environment)

Why in news?

- In order to facilitate the achievement of more ambitious climate change targets and ensure a faster transition to a low-carbon economy, the government is seeking to strengthen a 20-year law, called the Energy Conservation Act of 2001, which has powered the first phase of India’s shift to a more energy-efficient future.

Objectives:

- The Bill to amend the Energy Conservation Act, 2001, which was introduced in Parliament, has two main objectives.

- First, it seeks to make it compulsory for a select group of industrial, commercial and even residential consumers to use green energy. A prescribed minimum proportion of the energy they use must come from renewable or non-fossil fuel sources.

- And second, it seeks to establish a domestic carbon market and facilitate trade in carbon credits.

- Importantly, the amendment Bill seeks to widen the scope of energy conservation to include large residential buildings as well. Till now, the energy conservation rules applied mainly on industrial and commercial complexes.

Energy Conservation:

- The 2001 law defined standards for energy conservation and efficiency to be followed by a select group of industries and commercial complexes. Efficiency standards were also prescribed for equipment and appliances like air conditioners or refrigerators.

- This law set up the Bureau of Energy Efficiency (BEE) to promote the use of more efficient processes and equipment in order to save energy. The star ratings on various household appliances and the largescale shift to LED bulbs were some of the successful initiatives of BEE that have resulted in massive energy savings over a period of time.

- The overall objective has been to improve energy efficiency across sectors, so that much more productivity can be obtained from the same amount of energy. Over the years, India’s energy intensity, or the amount of energy consumption per unit of GDP, has declined significantly.

New provisions:

- The amendment Bill seeks to build upon the progress made so far. For example, just like the standards for appliances and equipment, energy consumption standards would be specified for motor vehicles, ships and other water vessels, industrial units, and buildings.

- In the case of vehicles and water vessels, fuel consumption norms would be defined.

- New sustainable building codes are to be defined which every building with a certain threshold of energy consumption, whether industrial, commercial or residential, would have to adhere to.

- Every such building would have to ensure that at least a part of its total energy consumption comes from renewable or non-fossil fuel sources. This would help in reducing the proportion of fossil-fuel based energy being used in the economy and push the demand for renewable or other non-fossil fuels.

What are carbon markets?

- The creation of a domestic carbon market is one of the most significant provisions of the proposed amendment Bill. Carbon markets allow the trade of carbon credits with the overall objective of bringing down emissions. These markets create incentives to reduce emissions or improve energy efficiency.

- For example, an industrial unit which outperforms the emission standards stands to gain credits. Another unit which is struggling to attain the prescribed standards can buy these credits and show compliance to these standards. The unit that did better on the standards earns money by selling credits, while the buying unit is able to fulfill its operating obligations.

- Under the Kyoto Protocol, the predecessor to the Paris Agreement, carbon markets have worked at the international level as well. The Kyoto Protocol had prescribed emission reduction targets for a group of developed countries.

- Other countries did not have such targets, but if they did reduce their emissions, they could earn carbon credits. These carbon credits could then be sold off to those developed countries which had an obligation to reduce emissions but were unable to.

- This system functioned well for a few years. But the market collapsed because of the lack of demand for carbon credits. As the world negotiated a new climate treaty in place of the Kyoto Protocol, the developed countries no longer felt the need to adhere to their targets under the Kyoto Protocol. A similar carbon market is envisaged to work under the successor Paris Agreement, but its details are still being worked out.

Domestic carbon markets:

- Domestic or regional carbon markets are already functioning in several places, most notably in Europe, where an emission trading scheme (ETS) works on similar principles.

- Industrial units in Europe have prescribed emission standards to adhere to, and they buy and sell credits based on their performance. China, too, has a domestic carbon market.

- A similar scheme for incentivising energy efficiency has been running in India for over a decade now.

- This BEE scheme, called PAT, (or perform, achieve and trade) allows units to earn efficiency certificates if they outperform the prescribed efficiency standards. The laggards can buy these certificates to continue operating.

- However, the new carbon market that is proposed to be created through this amendment to the Energy Conservation Act would be much wider in scope.