COP15 Summit adopts historic biodiversity deal (GS Paper 3, Environment)

Why in news?

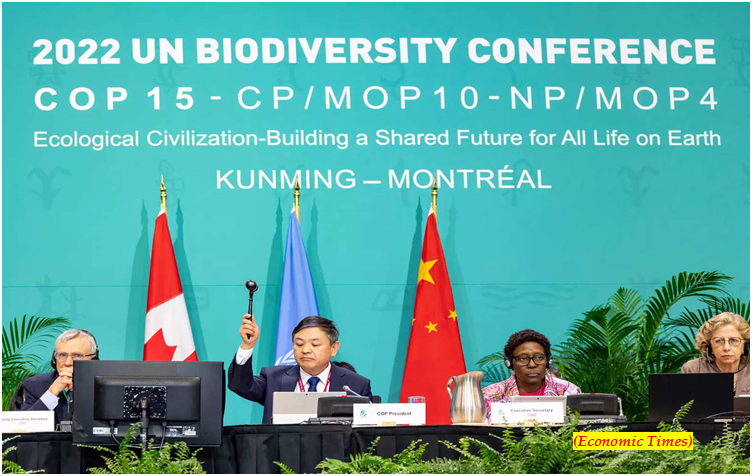

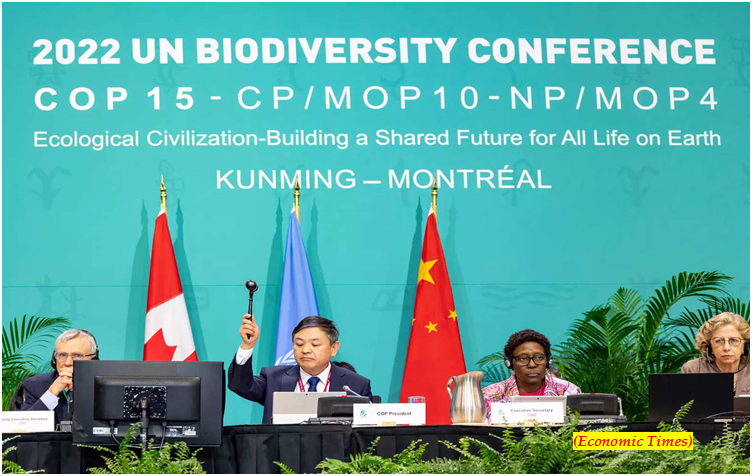

- Nearly 200 nations of the world recently agreed on a historic package of measures deemed critical to addressing the dangerous loss of biodiversity and restoring natural ecosystems.

- Convened under UN auspices, chaired by China, and hosted by Canada, the 15th Conference of Parties to the UN Convention on Biological Diversity adopted the "Kunming-Montreal Global Biodiversity Framework" (GBF), including four goals and 23 targets for achievement by 2030.

Global targets:

- Among the global targets for 2030 are: Effective conservation and management of at least 30 per cent of the world's lands, inland waters, coastal areas and oceans, with emphasis on areas of particular importance for biodiversity and ecosystem functioning and services.

- The GBF prioritizes ecologically-representative, well-connected and equitably-governed systems of protected areas and other effective area-based conservation, recognizing indigenous and traditional territories and practices.

- Currently 17 per cent and 10 per cent of the world's terrestrial and marine areas respectively are under protection.

The framework's four overarching global goals:

Goal A:

- The integrity, connectivity and resilience of all ecosystems are maintained, enhanced, or restored, substantially increasing the area of natural ecosystems by 2050;

- Human induced extinction of known threatened species is halted, and, by 2050, extinction rate and risk of all species are reduced tenfold, and the abundance of native wild species is increased to healthy and resilient levels;

- The genetic diversity within populations of wild and domesticated species, is maintained, safeguarding their adaptive potential.

Goal B:

- Biodiversity is sustainably used and managed and nature's contributions to people, including ecosystem functions and services, are valued, maintained and enhanced, with those currently in decline being restored, supporting the achievement of sustainable development, for the benefit of present and future generations by 2050

Goal C:

- The monetary and non-monetary benefits from the utilization of genetic resources, and digital sequence information on genetic resources, and of traditional knowledge associated with genetic resources, as applicable, are shared fairly and equitably, including, as appropriate with indigenous peoples and local communities, and substantially increased by 2050, while ensuring traditional knowledge associated with genetic resources is appropriately protected, thereby contributing to the conservation and sustainable use of biodiversity, in accordance with internationally agreed access and benefit-sharing instruments.

Goal D:

- Adequate means of implementation, including financial resources, capacity-building, technical and scientific cooperation, and access to and transfer of technology to fully implement the Kunmin-Montreal global biodiversity framework are secured and equitably accessible to all Parties, especially developing countries, in particular the least developed countries and small island developing States, as well as countries with economies in transition, progressively closing the biodiversity finance gap of $700 billion per year, and aligning financial flows with the Kunming-Montreal Global Biodiversity Framework and the 2050 Vision for Biodiversity.

15th Conference of Parties to the UN CBD:

- Held at Montreal's Palais des Congres from December 7-19, representatives of 188 governments on site (95 per cent of all 196 Parties to the UN CBD, as well as two non-Parties; the US and The Vatican), finalised and approved measures to arrest the ongoing loss of terrestrial and marine biodiversity and set humanity in the direction of a sustainable relationship with nature, with clear indicators to measure progress.

- In addition to the GBF, the meeting approved a series of related agreements on its implementation, including planning, monitoring, reporting and review; resource mobilization; helping nations to build their capacity to meet the obligations; and digital sequence information on genetic resources.

Way Forward:

- COP15 delegates agreed to establish within the GBF a multilateral fund for the equitable sharing of benefits between providers and users of DSI, to be finalized at COP16 in Turkey in 2024.

Centre to set up appellate panels to redress grievances of social media users

(GS Paper 2, Govewrnance)

Why in news?

- The Union government will set up appellate panels to redress the grievances the users may have against social media platforms like Twitter and Facebook on hosting contentious content following amendments to the new IT rules, the Delhi High Court was informed.

Details:

- The submission was made before Justice Yashwant Varma who was hearing a batch of petitions concerning the suspension and deletion of accounts of several social media users, including Twitter users.

- Additional Solicitor, representing the Centre, placed before the court a notification of October 28 in terms of which certain amended rules have come to be introduced in the Information Technology (Intermediary Guidelines and Digital Media Ethics Code) Rules, 2021.

Grievance Appellate Committee:

- As per the newly inserted rule, the Central government shall, by notification, establish one or more Grievance Appellate Committees within three months from the date of commencement of the IT Amendment Rules, 2022.

- Each Grievance Appellate Committee shall consist of a chairperson and two whole time members appointed by the Central Government, of which one shall be a member ex-officio and two shall be independent members.

- Any person aggrieved by a decision of the Grievance Officer may prefer an appeal to the Grievance Appellate Committee within a period of thirty days from the date of receipt of communication from the Grievance Officer.

- The Grievance Appellate Committee shall adopt an online dispute resolution mechanism wherein the entire appeal process, from filing of appeal to the decision thereof, shall be conducted through digital mode.

- Every order passed by the Grievance Appellate Committee shall be complied with by the intermediary concerned and a report to that effect shall be uploaded on its website.

Background:

- The High Court had on August 17 granted time to the Centre to inform if it was drafting any regulations to govern the issue of de-platforming of users from social media.

The minimum tax on big businesses

(GS Paper 3, Economy)

Why in news?

- Recently, the members of the European Union last week agreed in principle to implement a minimum tax of 15% on big businesses.

- In 2021, 136 countries had agreed on a plan to redistribute tax rights across jurisdictions and enforce a minimum tax rate of 15% on large multinational corporations. It is estimated that the minimum tax rate would boost global tax revenues by $150 billion annually.

What is minimum tax rate?

- EU members have agreed to implement a minimum tax rate of 15% on big businesses in accordance with Pillar 2 of the global tax agreement framed by the Organisation for Economic Cooperation and Development (OECD) last year.

- Under the OECD’s plan, governments will be equipped to impose additional taxes in case companies are found to be paying taxes that are considered too low. This is to ensure that big businesses with global operations do not benefit by domiciling themselves in tax havens in order to save on taxes.

- Pillar 1 of the OECD’s tax plan, on the other hand, tries to address the question of taxing rights. Large multinational companies have traditionally paid taxes in their home countries even though they did most of their business in foreign countries.

- The OECD plan tries to give more taxing rights to the governments of countries where large businesses conduct a substantial amount of their business. As a result, large U.S. tech companies may have to pay more taxes to governments of developing countries.

What is the need for a global minimum tax?

- Corporate tax rates across the world have been dropping over the last few decades as a result of competition between governments to spur economic growth through greater private investments.

- Global corporate tax rates have fallen from over 40% in the 1980s to under 25% in 2020, due to global tax competition that was kick-started by former U.S. President Ronald Reagan and former British Prime Minister Margaret Thatcher in the 1980s.

- The OECD’s tax plan tries to put an end to this “race to the bottom” which has made it harder for governments to shore up the revenues required to fund their rising spending budgets.

- The minimum tax proposal is particularly relevant at a time when the fiscal state of governments across the world has deteriorated as seen in the worsening of public debt metrics.

What lies ahead?

- Some governments, particularly those of traditional tax havens, are likely to disagree and stall the implementation of the OECD’s tax plan. High tax jurisdictions like the EU are more likely to fully adopt the minimum tax plan as it saves them from having to compete against low tax jurisdictions.

- Low tax jurisdictions, on the other hand, are likely to resist the OECD’s plan unless they are compensated sufficiently in other ways. Even within the EU, countries such as Poland have already tried to stall the adoption of the global minimum tax proposal citing various non-economic reasons.

- Since the OECD’s plan essentially tries to form a global tax cartel, it will always face the risk of losing out to low-tax jurisdictions outside the cartel and cheating by members within the cartel.

What good will the OECD’s tax plan do to the global economy?

- Supporters of the OECD’s tax plan believe that it will end the global “race to the bottom” and help governments collect the revenues required for social spending.

- Many believe that the plan will also help counter rising global inequality by making it tougher for large businesses to pay low taxes by availing the services of tax havens.

- Critics of the OECD’s proposal, however, see the global minimum tax as a threat. They argue that without tax competition between governments, the world would be taxed a lot more than it is today, thus adversely affecting global economic growth.