RBI & monitoring of Banks (GS Paper 3, Economy)

Why in news?

- The Reserve Bank of India (RBI) has placed Dhanlaxmi Bank under tight monitoring with the Thrissur-based private bank’s financial position coming under greater public scrutiny.

- The RBI’s move comes in the wake of the intense court battle waged by a group of minority shareholders against the bank’s management team over inadequate financial disclosures, rising expenses, and general mismanagement of the business.

How did it get to this situation?

- Dhanlaxmi Bank’s capital to risk weighted assets ratio (CRAR) dropped to around 13% at the end of March 2022 from 14.5% a year ago, prompting the RBI to take stock of the financial health of the bank.

- Under Basel-III norms, which were adopted by financial regulators across the globe in the aftermath of the financial crisis of 2007-08 that involved major failures in the banking system, banks are supposed to maintain their CRAR at 9% or above. The RBI’s move to increase its oversight on Dhanlaxmi Bank is seen as a response to the deterioration in the bank’s capital adequacy.

Prompt Corrective Action (PCA):

- Dhanlaxmi Bank’s capital adequacy has dropped below the stipulated standards in the past and it has even been placed under the prompt corrective action framework (PCA) by the RBI to deal with serious deteriorations in its financial position.

- Under the PCA, the RBI places restrictions on lending by troubled banks and keeps a close eye on them until their financial position improves sufficiently.

- Dhanlaxmi Bank has been accused by its minority shareholders of mismanagement in the wake of the decision of the management to expand the bank to new geographies amid an unexpected rise in expenses. The management has also been accused of inadequate disclosure of information to explain the rise in costs.

Why is capital adequacy important for a bank?

- Capital adequacy ratio is an indicator of the ability of a bank to survive as a going business entity in case it suffers significant losses on its loan book. A bank cannot continue to operate if the total value of its assets drops below the total value of its liabilities as it would wipe out its capital (or net worth) and render the bank insolvent.

- So, banking regulations such as the Basel-III norms try to closely monitor changes in the capital adequacy of banks in order to prevent major bank failures which could have a severe impact on the wider economy.

- The capital position of a bank should not be confused with cash held by a bank in its vaults to make good on its commitment to depositors.

CRAR:

- The CRAR, which is a ratio that compares the value of a bank’s capital (or net worth) against the value of its various assets weighted according to how risky each asset is, is used to gauge the risk of insolvency faced by a bank.

- The riskier a type of asset held in a bank’s balance sheet, the higher the weightage given to the value of the asset while calculating the bank’s capital adequacy ratio. This causes the capital adequacy ratio of the bank to drop, thus signalling a higher risk of insolvency during crises.

- In other words, the CRAR tries to gauge the risk posed to the solvency of the bank by the quality or riskiness of the assets on the bank’s balance sheet.

- In the case of Dhanlaxmi Bank, the write-down and reclassification of tier-2 bonds, which are considered effectively to be equivalent to equity capital since they are unsecured, in the next few months is expected to adversely affect the bank’s capital adequacy ratio.

Efforts to raise capital:

- Dhanlaxmi Bank has been trying to issue additional shares in the open market through a rights issue in order to deal with its capital adequacy woes. Through a rights issue, the bank will be able to raise more equity capital from existing shareholders. This is in contrast to an initial public offering where shares are issued to new shareholders.

- The additional capital could help in raising the bank’s capital adequacy ratio which is necessary to comply with regulations and serve as a buffer that absorbs any losses incurred by the bank on its loan book in the case of any crisis in the future.

- The rights issue, however, has been delayed by the ongoing court battle with minority shareholders and the bank’s non-compliance with rules regarding the composition and strength of the management board. This delay could compromise the bank’s ability to meet the RBI’s stipulated norms on capital adequacy anytime soon.

What happens next?

- The RBI is likely to keep a close eye on Dhanlaxmi Bank over the next few months as the bank’s ability to meet capital adequacy norms comes under greater strain.

- The central bank may even decide to intervene in case the delay of the rights issue threatens the bank’s ability to comfortably meet the capital adequacy norms recommended under Basel-III regulations.

- In fact, Dhanlaxmi Bank could even become an acquisition target in case its management is unable to raise the required capital. In such a case, an investor with the capital required to immediately boost the bank’s capital adequacy may well find favour with the RBI.

Lockdown increased exposure to indoor air pollution

(GS Paper 3, Environment)

Context:

- During COVID-19 lockdowns, many countries observed historic improvements in ambient air quality. A new study shows that despite the historic improvements in ambient air quality, PM2.5 exposures increased for 65% of Indians and a third of the global population during the lockdown, largely attributed to biomass cooking activity.

- Nearly 65% of Indians use biomass as an exclusive or secondary cooking fuel, and they were exposed to higher PM2.5 levels during the lockdown.

Indoor pollution in rural households:

- Another element of study was presenting India’s most comprehensive PM2.5 exposure disparity and environmental justice analysis, this allowed to assess which demographic groups have the highest PM2.5 exposures.

- Rural women have the highest levels of air pollution exposure, however, during the lockdown working-age men and school-going children observed the largest exposure increases.

- Given the prevalence of biomass-fueled cookstoves and that people were now confined to stay indoors, it reasons that air pollution exposure must have increased for any biomass using household.

- Even though the penetration of cleaner cooking fuel such as LPG has increased during the last few years due to interventions (Ujjwala Yojna), a significant proportion of Indian households still use biomass as primary cooking or secondary cooking fuel.

How women are more vulnerable?

- The researchers introduced and utilised a novel exposure framework that incorporated nationwide time-use data (i.e., how much time people spend doing various activities) with representative microenvironment (e.g., kitchen area, living area, work/school, ambient) PM2.5 concentrations to quantify exposure increases and estimated that 65% of Indians had increased exposures during the lockdown, with average nationwide exposures increasing by 13%, from 116 µg m-3 to 131 µg m-3.

- On average Indian women spend 87-89% of their time indoors, whereas men spend 71-73%. The indoor PM2.5 concentration for biomass-user households is 2-20 times higher than their respective outdoor concentration in different Indian states.

- Before the lockdown, the time-weighted average exposure was comparatively lower as people were spending some of their time in outdoor environments. The shifting of outdoor time to indoor during the lockdown resulted in increased exposures to biomass-fuel emissions.

- During baseline conditions, working-age rural women have the highest PM2.5 exposures of any demographic, with average exposures of 175 µg m-3, due mainly to exposure to biomass cooking-related emissions.

- The other demographic groups that had the highest exposure were working-age men and school-age children, whose average modeled exposures increased by 24% (from 88 µg m-3 to 108 µg m-3) and 18% (from 98 µg m-3 to 115 µg m-3), respectively.

Global scenario:

- Given that households globally who use biomass cookstoves will have observed increased exposures during lockdown, they extended the framework globally and conservatively estimated that 35% of the global population will have observed increased exposures during the lockdown.

- This occurred largely in developing economies (Africa, South East Asia) where biomass use is prevalent.

Way Forward:

- There have been a number of cleaner-cooking initiatives introduced to replace biomass cookstoves.

- But the finding that PM2.5 exposures increased for the 65% of Indians and a third of the global population during a period of historically clean ambient air quality, re-emphasises the urgent need to further address clean cooking interventions to reduce PM2.5 exposures and in turn improve health outcomes.

Delayed 5G implementation in India

(GS Paper 3, Science and Tech)

Context:

- Prime Minister announced the launch of next generation 5G services in India on October 1.

- However, the majority of mobile phone users may need to wait till December to enjoy the high speed internet.

Which operators have launched 5G, and in which cities?

- Currently, two operators, Bharti Airtel and Reliance Jio, are offering 5G services in limited cities.

- While Bharti Airtel has announced commercial rollout of these services in Delhi, Mumbai, Chennai, Bengaluru, Hyderabad, Siliguri, Nagpur and Varanasi, rival Reliance Jio has started beta trials of these services in Mumbai, Delhi, Kolkata and Varanasi.

- However, even in these cities, the network is not uniformly available. For example, in Delhi and Chennai, Bharti Airtel 5G services are currently available only in select areas.

- While Bharti Airtel has committed to introduce 5G services in the entire country by March 2024, Reliance Jio has promised to “deliver 5G to every town, every taluka, and every tehsil of our country” by December 2023.

- The third private operator Vodafone Idea is expected to begin the rollout of 5G services soon.

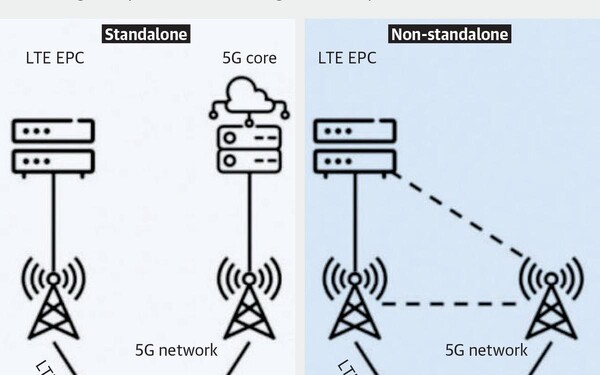

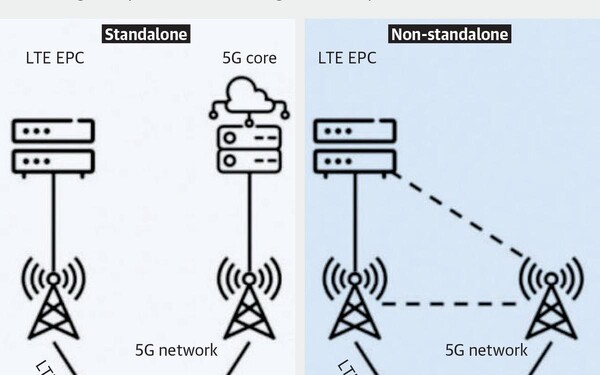

- A network rollout is undertaken in phases and will require significant investments by operators. For example, Reliance Jio has announced plans to invest ₹2 lakh crore in the rollout of a nationwide standalone 5G network by December 2023.

Will all smartphone owners be able to use 5G?

- Only users of 5G capable smartphones will be able to experience these services. Currently, of the total smartphone base of about 600 million, only about 50-60 million handsets are estimated to be 5G smartphones, even though the first 5G smartphone was unveiled in the country two years ago in 2020.

- However, even users of these 50-60 million phones have been having trouble latching on to 5G services in the area where it is available.

- For the phones to start latching on to 5G networks in India, the first thing needed is support for 5G bands such as n1, n12, n78, n28, n58 (these are some of the bands that are expected to work in India).

What are the manufacturers saying?

- Most manufacturers have said that they are working with the operators to roll out an over the air (OTA) update that will enable users to access 5G services.

- Apple has said that it is working with “carrier partners in India to bring the best 5G experience to iPhone users as soon as network validation and testing for quality and performance is completed. 5G will be enabled via a software update and will start rolling out to iPhone users in December.”

- For Samsung and Xiaomi, some devices already offer support for the 5G network. For others, Samsung has committed to rolling out the OTA updates by middle of November 2022, and Xiaomi has said it will begin rollout of OTA Diwali onwards.