Audit Diwas and the Role of the Comptroller & Auditor General (CAG) (GS Paper 2, Polity)

Context:

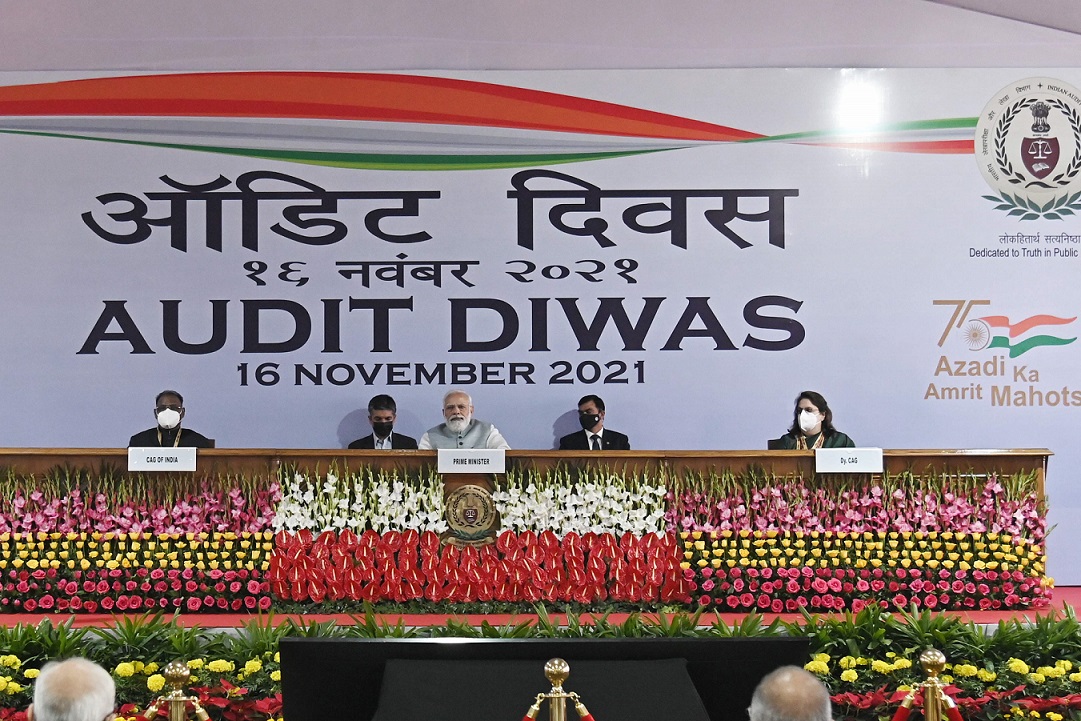

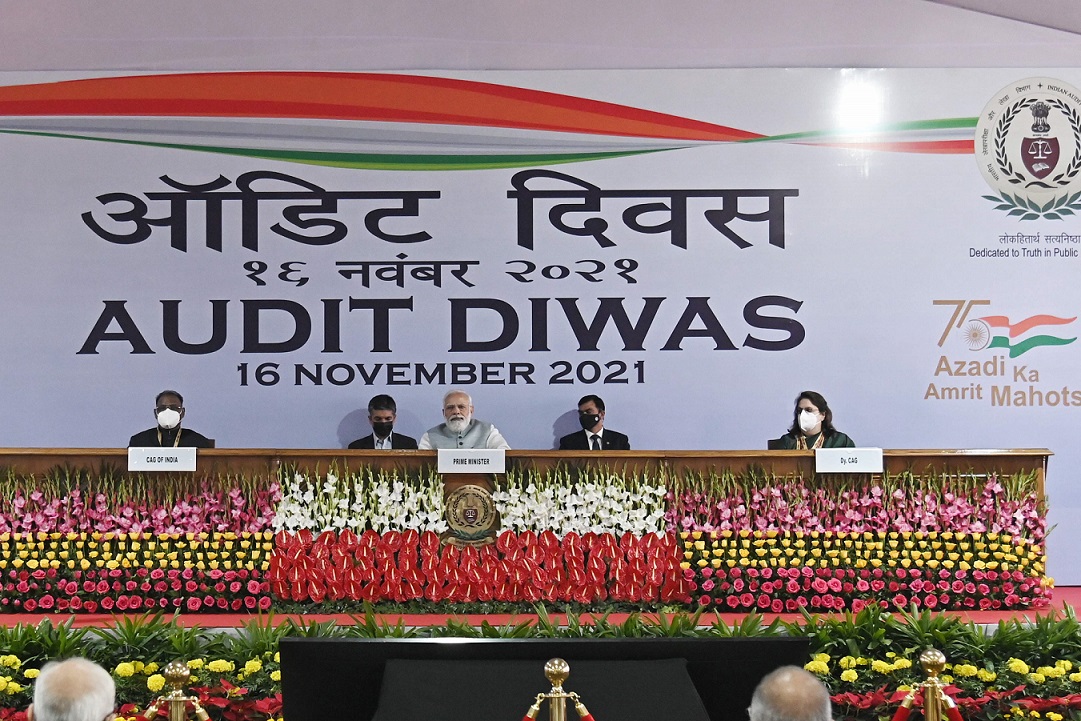

- On Audit Diwas (November 16), the Lok Sabha Speaker highlighted the key role played by the Comptroller & Auditor General (CAG) in ensuring accountability, transparency, and good governance within India.

- The day serves as a reminder of the critical importance of audits in fostering financial discipline in public administration.

About the Comptroller & Auditor General (CAG):

The CAG is a constitutional body responsible for auditing the accounts of the Central and State governments, as well as public sector organizations. Its primary duty is to ensure that public funds are used effectively and in accordance with the law.

- Appointment: The CAG is appointed by the President of India through a warrant under the President's hand and seal.

- Tenure: The CAG holds office for a term of 6 years or until the age of 65 years, whichever is earlier.

- Removal: The CAG can only be removed by the President, following the same process as a Supreme Court judge, ensuring its independence.

Constitutional Mandate:

The office of the CAG is established by Article 148 of the Indian Constitution, and its duties and powers are detailed in Article 149. It is tasked with auditing the accounts of the Union, State, and public corporations, as defined by Parliament.

Key constitutional provisions include:

- Article 150: Prescribes the format for Union and State accounts, which is designed with the CAG’s advice.

- Article 151: Requires that the CAG’s audit reports be presented to the Parliament or State Legislatures through the President or Governors.

Functions and Responsibilities of the CAG:

The CAG's primary functions include:

- Audit of Government Accounts: The CAG audits financial statements of the Union and State governments and public sector enterprises. This audit includes:

- Financial Audits: Assessing the correctness of financial statements.

- Compliance Audits: Ensuring that financial regulations are followed.

- Performance Audits: Evaluating the effectiveness and efficiency of public spending.

- Reporting to the Legislature: Audit findings are submitted in reports to the President or Governor, who presents them to Parliament or State Legislatures. These reports highlight discrepancies, inefficiencies, and possible misuse of funds.

- Advisory Role: The CAG provides advice on financial management, helping to shape policies that enhance financial accountability.

Ensuring Transparency and Accountability:

The CAG’s reports have been instrumental in identifying irregularities, mismanagement, and inefficiencies in the government’s financial operations, ensuring greater accountability. Some key examples include:

- Irregularities in Infrastructure Projects: The CAG’s audits uncovered massive cost escalations in projects like the Dwarka Expressway, where the cost rose from ₹18 crore to ₹250 crore per kilometre, questioning the financial prudence of the management.

- Misallocation of Funds: Reports have revealed the diversion of funds from welfare schemes, such as National Social Assistance Programme (NSAP), leading to inefficiencies in the implementation of these crucial initiatives.

- Healthcare Scheme Irregularities: The audit of Ayushman Bharat revealed that ₹6.97 crore was allocated for the treatment of patients who were recorded as deceased, indicating serious lapses in the oversight of healthcare schemes.

Challenges Faced by the CAG:

As public administration and financial management become more complex, the CAG faces several challenges:

- Increasing Complexity of Audits: With public-private partnerships (PPPs) and evolving financial structures, the CAG must adapt to newer forms of corruption and financial mismanagement. Auditing these innovative structures requires specialized skills.

- Technological Advancements: The rise of new technologies like artificial intelligence (AI) and data analytics can enhance audits, but it also demands continuous upgradation of the CAG's technological infrastructure and skills.

- Maintaining Independence: The independence of the CAG is fundamental for it to function impartially. Concerns have been raised regarding potential efforts to limit the CAG’s powers, which could hinder its ability to conduct independent audits.

- Capacity Building: The CAG needs to build and maintain a skilled workforce. This includes both technical training and promoting a culture of integrity and professionalism among auditors.

- Public Perception and Trust: The effectiveness of the CAG depends on public trust. Any perception of inefficiency or bias could undermine the credibility of the institution.

Way Ahead: Strengthening the CAG

To ensure the CAG continues to serve as a pillar of accountability and transparency, several steps can be taken:

- Adoption of Emerging Technologies: The CAG has already embraced technologies like AI to improve the audit process. Further adoption of advanced analytics will enable more accurate and efficient audits.

- International Collaboration: The CAG has strengthened its global presence by securing re-election as the external auditor for several international organizations, such as the World Health Organization (WHO) and the International Labour Organization (ILO). Its role in international auditing underscores its commitment to maintaining high standards.

- Institutional Support: Strengthening the CAG’s institutional framework will empower it to conduct thorough and independent audits. Providing adequate resources, training, and autonomy will ensure the CAG can fulfill its constitutional role effectively.

Conclusion:

- The CAG plays a crucial role in ensuring financial discipline, transparency, and accountability in the functioning of the government.

- By constantly adapting to new challenges and technologies, and by maintaining its independence, the CAG helps safeguard public trust and supports good governance.

- On Audit Diwas, it is important to recognize and support the continued strengthening of this constitutional institution, which is vital for India’s progress toward transparency and responsible governance.