Vertical Fiscal Imbalance in India’s Federal System (GS Paper 3, Economy)

Introduction

- India’s federal structure presents a unique financial dynamic between the Union and State governments, characterized by what is known as Vertical Fiscal Imbalance (VFI).

- This concept reflects a fundamental issue in fiscal federalism where the revenue-raising capacities and expenditure responsibilities between different levels of government are misaligned.

- This imbalance has significant implications for governance and public service delivery across the country.

Why VFI Matters

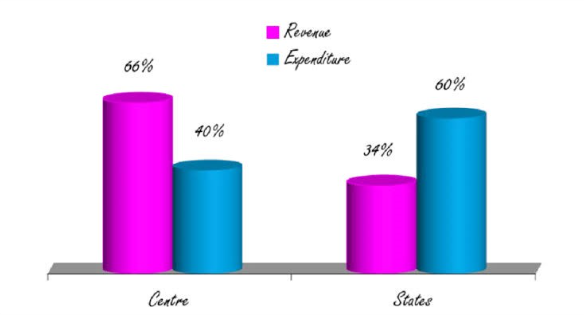

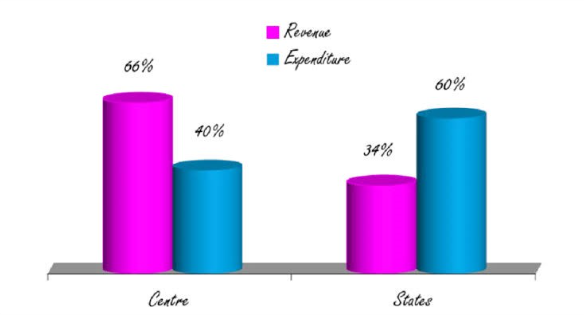

- The Vertical Fiscal Imbalance is highlighted by the fact that while State governments are responsible for a substantial portion of public expenditure (61%), they generate only a smaller share of revenue (38%).

- This disparity necessitates substantial transfers from the Union government to the States to cover the gap.

- This reliance on central transfers reflects a central feature of federal systems but also poses challenges for financial autonomy and efficiency at the State level.

Central Transfers to States

Central transfers are the primary mechanism through which the Union government supports States in addressing their fiscal needs. These transfers are categorized into two main types:

Tax Devolution

- Role of Finance Commissions: The Finance Commissions are constitutional bodies responsible for recommending the distribution of central tax revenues between the Union and State governments. Established under Article 280 of the Constitution, the Finance Commission is constituted every five years or as needed.

- Recommendations of Finance Commissions: The 14th Finance Commission significantly increased the devolution of central taxes from 32% to 42% to enhance State autonomy. The 15th Finance Commission, for the 2021-26 period, recommended a 41% share for States, adjusting for the creation of new Union territories like J&K and Ladakh. The devolution of taxes is considered untied, providing States with greater flexibility to allocate funds according to their priorities.

Grants-in-Aid

- Revenue Deficit Grants: These grants address the fiscal shortfall faced by States, particularly those with persistent revenue deficits.

- Sector-Specific Grants: Allocated for specific sectors such as health, education, and infrastructure. Some of these grants are performance-linked, meaning they depend on States meeting certain criteria or benchmarks.

- State-Specific Grants: Targeted at particular needs such as social welfare, administrative governance, and water and sanitation. These grants are intended to address specific challenges faced by individual States.

- Grants to Local Bodies: Provided to support local governance and development initiatives.

- Disaster Risk Management Grants: Allocate resources to States for managing and mitigating the impacts of natural disasters.

Distribution Criteria

The Finance Commission uses several criteria to determine the allocation of central resources to States:

- Population/Demography: States with larger populations or higher demographic needs receive more resources. This criterion ensures that expenditure needs are met in proportion to the population size.

- Demographic Performance: States that have successfully controlled population growth are rewarded. This helps in balancing the fiscal needs related to changing demographic trends.

- Income Distance: This measures the disparity between a State’s per capita income and the average per capita income across the country. States with lower per capita income receive higher allocations to promote equity.

- Area: Larger States incur additional administrative costs, and this criterion adjusts for those extra expenses.

- Forest & Ecology: States with significant forest cover are compensated for economic activities foregone due to forest conservation, reflecting the cost associated with maintaining large forest areas.

Constitutional and Financial Framework

- The Indian Constitution delineates specific fiscal responsibilities between the Union and State governments.

- The Union government is tasked with collecting major taxes such as personal income tax, corporate tax, and certain indirect taxes.

- Conversely, States are expected to manage local services and expenditure.

- However, this setup has led to an increasing VFI, exacerbated by crises such as the COVID-19 pandemic, which has further widened the gap between revenue and expenditure responsibilities.

The Role of the Finance Commission

- The Finance Commission’s primary role is to address VFI by recommending the allocation of central tax revenues to States.

- This allocation is based on the “Net Proceeds” of Union taxes, which exclude surcharges, cesses, and collection costs.

- The Commission also recommends grants under Article 275 for States facing financial difficulties.

- However, these grants are often tied to specific uses and are temporary, which limits their effectiveness in providing long-term solutions.

Unconditional Transfers: A Key Solution

- Among various forms of transfers, tax devolution remains the most flexible and unconditional.

- This allows States to utilize the funds without additional conditions, addressing their fiscal needs more effectively.

- Unconditional transfers are crucial for improving States' financial autonomy and responsiveness to local needs.

Calls for Reform

- Many States advocate for increasing the share of tax devolution to 50% to better address their fiscal challenges.

- The current level of devolution does not fully accommodate the States' needs due to significant exclusions of cesses and surcharges from the net proceeds.

- Analysts suggest that raising the devolution share to around 49% would provide States with more untied resources, enhancing their ability to manage expenditures efficiently and fostering a more cooperative fiscal federalism.

Conclusion

- Vertical Fiscal Imbalance represents a significant challenge in India’s federal financial structure.

- Addressing this imbalance requires a balanced approach involving increased tax devolution and well-targeted grants.

- By providing States with greater fiscal resources and flexibility, India can enhance governance efficiency and better meet the diverse needs of its population.