Telangana Government Releases Funds Towards Crop Loan Waiver (GS Paper 2, Polity & Governance)

Context

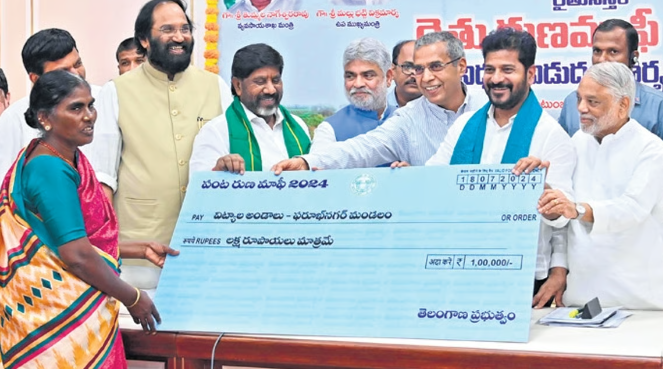

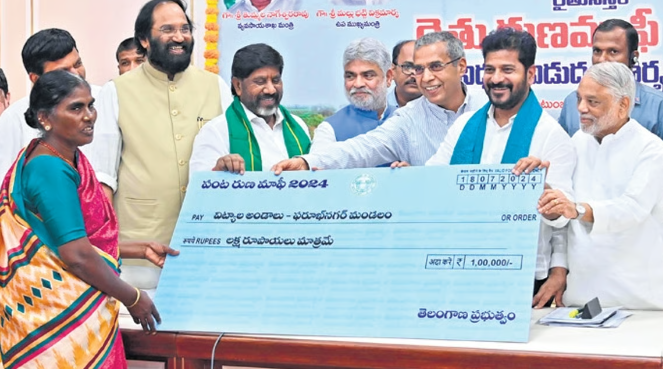

- The Telangana government has initiated the first phase of its farm loan waiver scheme, crediting Rs 6,098 crore into the accounts of over 11 lakh farmers.

- This move aims to alleviate the financial burden on farmers, ensuring economic stability and social welfare in rural areas.

Understanding Loan Waivers

Farm Loan Waivers:

- Definition: Financial relief measures where the government forgives certain agricultural loans, freeing farmers from the obligation to repay.

- Mechanism: The government allocates funds to banks and financial institutions to cover the farmers’ outstanding debt.

- Challenges Addressed: Farmers often struggle with issues like disputed land ownership, diminishing groundwater reserves, poor soil quality, rising input costs, and low crop productivity.

Arguments in Favor of Loan Waivers

- Debt Relief:

- Provides immediate financial relief to farmers facing severe hardships due to crop failure, natural disasters, or low market prices.

- Prevents farmers from falling into a deeper debt spiral.

- Improved Investment Capacity:

- Alleviates the debt burden, allowing farmers to invest in better inputs (seeds, fertilizers), irrigation, and technology.

- Potentially leads to increased productivity in the long run.

- Social and Political Stability:

- Addresses widespread farmer distress, preventing social unrest in rural areas.

- Helps maintain social stability by mitigating economic pressures on farming communities.

- Stimulating Rural Economy:

- Increased disposable income for farmers can boost demand for essential goods and services in rural areas.

- Enhances overall economic activity and prosperity in the countryside.

Arguments Against Loan Waivers

- Moral Hazard:

- Creates a moral hazard problem, where farmers might become less cautious about taking loans, expecting future government bailouts.

- Can lead to a cycle of debt and reliance on government interventions.

- Fiscal Burden:

- Puts significant financial strain on the government, diverting funds from potential long-term solutions for the agricultural sector.

- Example: Maharashtra’s decision to waive off crop loans cost about Rs 45,000 crore in 2020.

- Limited Long-Term Impact:

- Provides only temporary relief without addressing the root causes of farm distress, such as low crop prices, volatile markets, and high input costs.

- Persistent issues like lack of irrigation or proper storage facilities remain unaddressed.

- Distortion of Credit Market:

- Discourages banks and financial institutions from lending to farmers, fearing potential future bailouts.

- Makes it harder for farmers to access credit, hindering long-term investments in their farms.

- Inefficiency and Corruption:

- Implementation can be inefficient and prone to corruption.

- Risk of intended beneficiaries not receiving full benefits due to bureaucratic hurdles or mismanagement.

Way Ahead

- Investment in Infrastructure:

- Develop better storage facilities, improved transportation networks, and efficient marketing channels.

- Ensure farmers get fair prices for their produce.

- Crop Diversification:

- Encourage farmers to diversify their crops to reduce dependence on a few vulnerable crops.

- Mitigate risks associated with price fluctuations and crop failures.

- Sustainable Agricultural Practices:

- Promote sustainable farming methods to improve soil health and water management.

- Invest in research and development for improved crop varieties and resilient farming techniques.

- Financial Literacy and Risk Management:

- Educate farmers on financial literacy and risk management practices.

- Provide access to crop insurance and other financial tools to manage uncertainties.

- Long-term Policy Reforms:

- Implement long-term policy reforms focusing on the overall improvement of the agricultural sector.

- Address systemic issues such as market access, input costs, and farmer incomes to create a sustainable agricultural economy.

Conclusion

- While farm loan waivers can provide immediate relief to distressed farmers, they are not a sustainable solution to the deep-rooted challenges in the agricultural sector.

- A balanced approach, combining immediate relief measures with long-term structural reforms, is essential to ensure the economic well-being and sustainability of the farming community in India.

- By investing in infrastructure, promoting crop diversification, and implementing sustainable agricultural practices, the government can create a more resilient and prosperous agricultural sector.