The genomic revolution promises to transform cancer care (GS Paper 3, Science and Technology)

Context:

- Cancer has emerged as a major public health concern worldwide with about 20 million new patients being added every year. The World Health Organization has estimated the cancer burden will increase by almost 60% over the next decade, potentially rendering it the second major cause of death.

- India alone adds approximately 1.4 million new cancer cases every year, with almost 1 in 1,000 Indians being diagnosed annually, per the National Cancer Registry.

Causes of cancer:

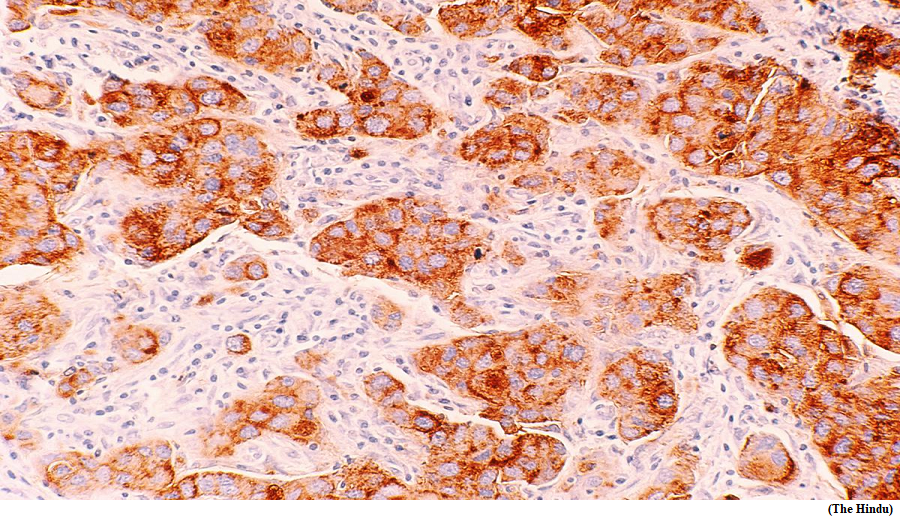

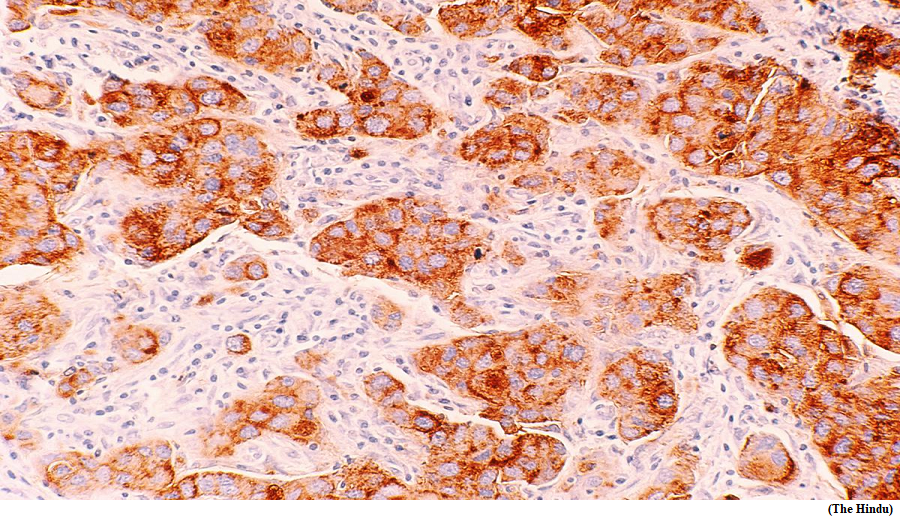

- Cancer is a disease of the genome. It is caused by changes in genes that cause some cells to divide in an uncontrolled way. These changes can be inherited or acquired.

- Inherited genetic variants form the basis of many hereditary cancers, including breast and ovarian cancer.

Precision oncology:

- Advancements in genomic technologies in the past couple of decades, including global initiatives such as the Cancer Genome Atlas, have provided a shot in the arm to understand the molecular underpinnings of cancer, which, in turn, have yielded a new generation of therapies that target molecular defects. Such therapies are called precision oncology therapies.

- Their eligibility in a given setting is determined by molecular tests. Of the 200-odd therapies the U.S. Food and Drug Administration has approved, almost a third have a DNA-based test as biomarker.

- While scientists are discovering new biomarkers for cancers, the focus of late has been shifting to understand how genomic tests could become the mainstay of cancer treatment in clinical settings.

‘100,000 Genome Program’:

- As part of the U.K.’s ongoing ‘100,000 Genome Program’, a study of over 13,800 cancer patients suggested cancer genomics could indeed transform cancer care.

- The programme reportedly demonstrated that genome sequencing integrated with routine clinical data could render cancer treatments more customisable. The implications of this study extend far beyond the boundaries of current practice of medicine, and mark a leap forward in the era of precision oncology.

- According to the study, a higher fraction of individuals diagnosed with brain tumours as well as those dealing with bowel or lung cancers had distinct DNA changes that could become new targets for therapy. The study also provided novel insights that could reshape even our understanding of challenging conditions such as ovarian cancers and sarcomas.

- For example, approximately 10% of sarcomas (rare cancers of the bone and soft tissue) exhibited genetic changes that could impact treatment decisions. The researchers also identified a corresponding proportion of ovarian cancers as being potentially inherited.

Consequences of genomic medicine:

- The National Health Service (NHS) in England has been keen on understanding how genomic medicine can be harnessed to enhance cancer care.

- The study also signifies the realisation of the promise of precision medicine, envisioned almost a decade ago with the launch of the population-scale ‘100,000 Genomes Project’, in which patients were recruited as part of a larger genomics initiative whose focus was as much cancer as rare genetic diseases.

Caution:

- The lessons learned from this large study are already finding real-world application in some parts of the U.K. Hospital trusts in East Midlands are incorporating insights from preemptive genome-sequencing and referring individuals with certain genetic mutations to clinical trials for certain therapies or steering clear of treatments or modifying the dosages of therapies that might potentially result in adverse side-effects.

- But one crucial consideration is the use of information gleaned from whole-genome sequencing in practice, especially in a scenario where, say, a particularly harmful genetic change has been identified in an individual but for which there are no treatments available.

- Fortunately, advances in precision oncology therapies are rapidly closing this gap.

Way Forward:

- Research is moving towards a more comprehensive understanding of tumours, one that integrates genomics, along with studies on proteins and metabolites in the body – also known as ‘multi-omics’.

- At the same time, it is gaining wider application in identifying newer molecular subtypes of cancer with implications for cancer progression and treatment. However, integrating these new insights into clinical care will require a paradigm shift in clinical testing as it exists.

- Research from such studies will lay the foundation for a future where genomics insights and evidence can seamlessly inform clinical decision-making on the population-scale.

What are the RBI guidelines on State guarantees?

(GS Paper 3, Economy)

Why in news?

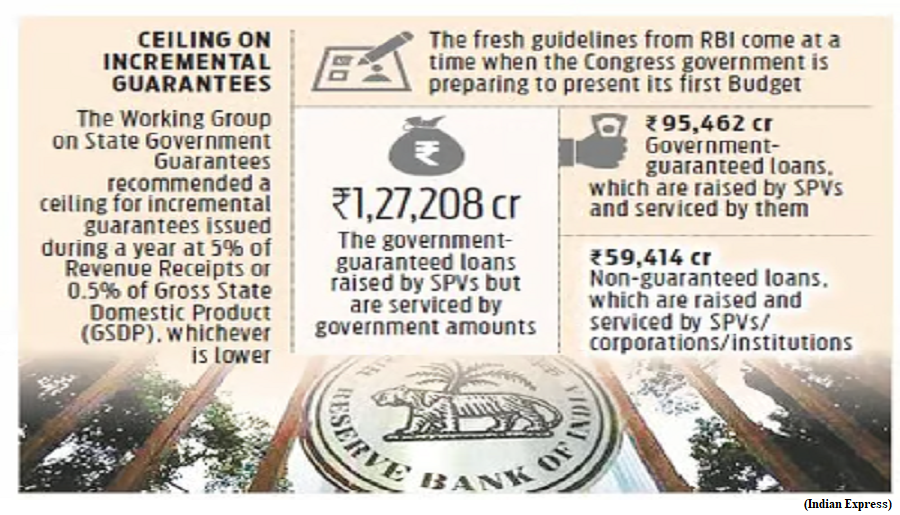

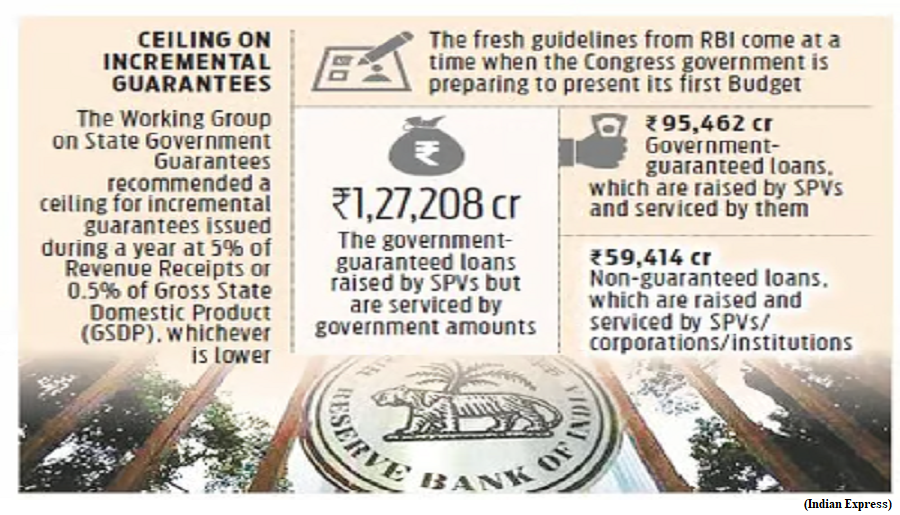

- Recently, a working group constituted by the Reserve Bank of India (RBI) made certain recommendations to address issues relating to guarantees extended by State governments.

- Among other things, the Working Group prescribed a uniform reporting framework for the guarantees extended, besides expanding the definition of what constitutes a ‘guarantee.’

What constitutes a ‘guarantee’?

- A ‘guarantee’ is contingent liability of a State, processed by an accessory contract, that protects the lender/investor from the risk of borrower defaulting. They promise to be answerable for the debt, default or miscarriage of the latter.

- The entity to whom the guarantee is given is the ‘creditor’, the defaulting entity on whose behalf the guarantee is given is called the ‘principal debtor’ and the entity giving the guarantee (State governments in this context) is called the ‘surety’.

- If A delivers certain goods or services to B and B does not make the agreed-upon payment, B is defaulting and at the risk of being sued for the debt. C steps in and promises that s/he would pay for the default of B. This is a guarantee.

- The RBI working group’s report notes that while guarantees are innocuous in good times, it may lead to significant fiscal risks and burden the State at other times.

- This may result in unanticipated cash outflows and increased debt. State governments are often required to sanction, and issue guarantees, on behalf of State-owned enterprises, cooperative institutions, urban local bodies and/or other State-governed entities, to respective lenders.

- The latter could be commercial banks or other financial institutions. In return, the entities are required to pay a guarantee fee to the governments.

What about definition of guarantee?

- The Working Group has suggested that the term ‘guarantee’ should be used in a broader sense and include all instruments, by whatever name they may be called, if they create obligation on the guarantor (State) to make a payment on behalf of the borrower at a future date.

- Further, it must not make any distinction between conditional or unconditional, or financial or performance guarantees in order to assess the fiscal risk.

What about according guarantees?

- The Working Group has recommended that government guarantees should not be used to obtain finance through State-owned entities, which substitute budgetary resources of the State Government. Additionally, they should not be allowed to create direct liability/de-facto liability on the State.

- It further recommends adherence to the Government of India guidelines that stipulate that guarantees be given only for the principal amount and normal interest component of the underlying loan.

- Furthermore, they must not be extended for external commercial borrowings, must not be extended for more than 80% of the project loan and must not be provided to private sector companies/ institutions.

What about risk determination?

- The Group suggested that States assign appropriate risk weights (indicative of the holding the lender should ideally have to adjust the associated risk) before extending guarantees. The categorisation could be high, medium or low risk. These must also consider past record of defaults.

- Additionally, it deemed a ceiling on issuance of guarantees as “desirable.” The report argues that should a guarantee be required to be invoked, it could lead to significant fiscal stress on the State government.

- To manage the potential stress, for incremental guarantees (additional guarantees) issued during a year, it proposes a ceiling at 5% of Revenue Receipts or 0.5% of GSDP — whichever is less.

What about disclosures?

- The Working Group has recommended that the apex banking regulator may consider advising banks/NBFCs to disclose the credit extended to State-owned entities, backed by State-government guarantees.

- Availability of data, both from issuer and the lender, the report states, may improve the credibility of the data reported by the State government. It has also sought a proper database capturing all extended guarantees.