Windfall tax & Energy Sector (GS Paper 3, Economy)

Why in news?

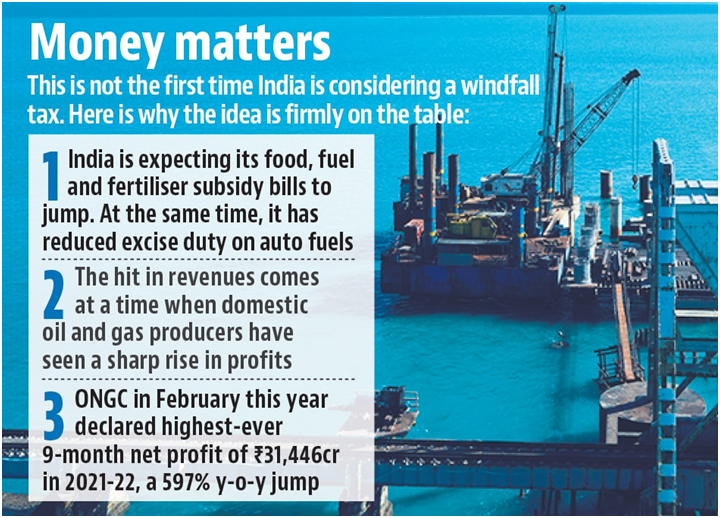

- Recently, Finance Minister defended the windfall tax imposed by the Centre on domestic crude oil producers, saying that it was not an ad hoc move but was done after full consultation with the industry.

- The Central government on July 1, introduced a windfall profit tax of ₹23,250 per tonne on domestic crude oil production, which was subsequently revised fortnightly four times so far.

- Besides India, a wave of countries including the United Kingdom, Italy, and Germany have either already imposed a windfall profit tax on super normal profits of energy companies or are contemplating doing so.

What is a windfall tax?

- Windfall taxes are designed to tax the profits a company derives from an external, sometimes unprecedented event— for instance, the energy price-rise as a result of the Russia-Ukraine conflict.

- The United States Congressional Research Service (CRS) defines a windfall as an “unearned, unanticipated gain in income through no additional effort or expense”.

- Governments typically levy a one-off tax retrospectively over and above the normal rates of tax on such profits, called windfall tax. One area where such taxes have routinely been discussed is oil markets, where price fluctuation leads to volatile or erratic profits for the industry.

- There have been varying rationales for governments worldwide to introduce windfall taxes, from redistribution of unexpected gains when high prices benefit producers at the expense of consumers, to funding social welfare schemes, and as a supplementary revenue stream for the government.

Why are countries levying windfall taxes now?

- Prices of oil, gas, and coal have seen sharp increases since late last year and in the first two quarters of the current year, although having reduced recently.

- The increase stems from a combination of factors, including a mismatch between energy demand and supply during the economic recovery from COVID-19, further amplified by the Russian war in Ukraine. Pandemic recovery and supply issues resulting from the Russia-Ukraine conflict shore up energy demands, in turn driving up global prices.

- The rising prices meant huge and record profits for energy companies while resulting in hefty gas and electricity bills for household bills in major and smaller economies. Since the gains stemmed partly from external change, multiple analysts have called them windfall profits.

Suggestion by UN, IMF & OECD:

- In early August, the United Nations sharply criticised the “grotesque greed” of big oil and gas companies for making record profits from the global energy crisis on the back of the world's poorest people. The largest energy companies in the first quarter of the year made combined profits of close to $100 billion.

- The U.N. chief urged all governments to tax these excessive profits “and use the funds to support the most vulnerable people through these difficult times.

- The calls to introduce windfall taxes also found support in organisations like the IMF, which released an advice note as to how such a tax should be levied.

- The chief of the Organisation for Economic Co-operation and Development (OECD), also recommended in March that given the windfall gains, European governments levy windfall taxes on the energy company profits to help fund support programmes for those most affected by inflation.

Imposition by India:

- In July, India announced a windfall tax on domestic crude oil producers who it believed were reaping the benefits of the high oil prices. It also imposed an additional excise levy on diesel, petrol and air turbine fuel (ATF) exports.

- India’s case was different from Europe's, as it was still importing discounted Russian oil. The windfall tax was targeted mainly at Reliance Industries Ltd and Russian oil major Rosneft-backed Nayara Energy, who the government believed were making a killing on exporting large volumes of fuel made from discounted Russian oil at the cost of the domestic market.

- Analysts also saw the windfall tax as a way for the Centre to narrow the country’s widened trade deficit.

What are the issues with imposing such taxes?

- Analysts say that companies are confident in investing in a sector if there is certainty and stability in a tax regime. Since windfall taxes are imposed retrospectively and are often influenced by unexpected events, they can brew uncertainty in the market about future taxes.

- The also said that taxes in response to price surges may suffer from design problems—given their expedited and political nature. It added that “introducing a temporary windfall profit tax reduces future investment because prospective investors will internalize the likelihood of potential taxes when making investment decisions”.

- A report, argues that if rapid increases in prices lead to higher profits, in one sense it can be called true windfalls as they are unforeseeable but on the hand, companies may argue that it is the profit they earned as a reward for the industry’s risk-taking to provide the end user with the petroleum product.

- Another issue is who should be taxed- only the big companies responsible for the bulk of high-priced sales or smaller companies as well— raising the question of whether producers with revenues or profits below a certain threshold should be exempt.

- Besides, the windfall tax imposed by Italy has already met with a roadblock; many Italian power, oil, and gas companies had not paid their 40% instalment of windfall taxes by the prescribed June date, leaving the government with a revenue shortfall of nearly $9 billion.

- Even when a similar tax was introduced by the U.S in the 1980s on domestic oil companies, the revenue it generated for the government was significantly lower than what it had projected, while the tax also reduced domestic oil production and increased imports.

Adoption cases under District Magistrates (DM)

(GS Paper 2, Social Justice)

Why in news?

From September 1, District Magistrates (DM) have been empowered to give adoption orders instead of courts. All cases pending before courts have to be now transferred.

.png)

Issues:

- Hundreds of adoptive parents in the country are now concerned that the transfer process will further delay what is already a long and tedious process.

- There are questions whether an order passed by the executive will pass muster when an adopted child’s entitlements on succession and inheritance are contested before a court.

What do the amended rules say? How did they come about?

- The Parliament passed the Juvenile Justice (Care and Protection of Children) Amendment Bill, 2021 in July 2021 in order to amend the Juvenile Justice Act (JJ Act), 2015.

- The key changes include authorising District Magistrates and Additional District Magistrates to issue adoption orders under Section 61 of the JJ Act by striking out the word “court”. This was done “in order to ensure speedy disposal of cases and enhance accountability”.

- The District Magistrates have also been empowered under the Act to inspect child care institutions as well as evaluate the functioning of district child protection units, child welfare committees, juvenile justice boards, specialised juvenile police units, child care institutions etc.

- The Act and the corresponding rules came into effect from September 1.

- The amendments to the Juvenile Justice (Care and Protection of Children) Model Rules, 2016 say, “all the cases pertaining to adoption matters pending before the Court shall stand transferred to the District Magistrate from the date of commencement of these rules.”

Why is there concern over the revised rules?

- The revised rules have parents, activists, lawyers and adoption agencies worried as cases already before courts for the past several months will have to be transferred and the process will have to start afresh.

- A petition for adoption orders is filed after a parent registers for adoption, who is then assessed through a home study report, referred a child and subsequently allowed to take a child in pre-adoption foster care pending an adoption order.

- A delay in such an order can often mean that a child can't get admission into a school because parents don't yet have a birth certificate, or like in one case, parents unable to claim health insurance if a child is admitted to a hospital.

- The Central Adoption Resource Authority (CARA) says there are nearly 1,000 adoption cases pending before various courts in the country. Parents and lawyers also state that neither judges, nor DMs are aware about the change in the JJ Act leading to confusion in the system and delays.

What is the adoption procedure in India? What are the challenges?

- Adoptions in India are governed by two laws; theHindu Adoption and Maintenance Act, 1956 (HAMA) and the Juvenile Justice Act, 2015. Both laws have their separate eligibility criteria for adoptive parents.

- Those applying under the JJ Act have to register on CARA’s portal after which a specialised adoption agency carries out a home study report. After it finds the candidate eligible for adoption, a child declared legally free for adoption is referred to the applicant.

- Under HAMA, a “dattakahom” ceremony or an adoption deed or a court order is sufficient to obtain irrevocable adoption rights. But there are no rules for monitoring adoptions and verifying sourcing of children and determining whether parents are fit to adopt.

Challenges:

- There are many problems with the adoption system under CARA but at the heart of it is the fact that there are very few children in its registry.

- According to the latest figures there are only 2,188 children in the adoption pool, while there are more than 31,000 parents waiting to adopt a child which forces many to wait for upto three years to be able to give a family to a child. This allows traffickers to take advantage of loopholes in HAMA.

- These concerns were also highlighted by a Parliamentary panelin August in its report on the ‘Review of Guardianship and Adoption Law’, which recommended a district-level survey of orphaned and abandoned children.

- In 2015, the then Minister for Women and Child Development Maneka Gandhi centralised the entire adoption system by empowering CARA to maintain in various specialised adoption agencies, a registry of children, prospective adoptive parents as well as match them before adoption.

- This was aimed at checking rampant corruption and trafficking as child care institutions and NGOs could directly give children for adoption after obtaining a no-objection certificate from CARA. But the new system has failed in ensuring that more children in need of families are brought into its safety net.

Dissolution of adoption:

- The human contact, bonding and psychological preparedness has been taken away. Therefore, parents may look at other ways to adopt a child.

- One other dangerous repercussion of this is that in the past few years, there is an increasing number of disruptions and dissolutions, where children are returned after an adoption is formalised.

Over 1.1 million sea turtles poached in the last 30 years: Study

(GS Paper 3, Environment)

Why in news?

- More than 1.1 million sea turtles have been illegally killed and in some cases trafficked from 1990 to 2020, according to a new study.

- However, there has been a decline of 28 per cent in the poaching of marine creatures, with over 44,000 turtles targeted annually over the last decade.

The reptiles faced exploitationin 65 countries/territories and 44 out of the 58 marine turtle regional management units (RMU) in the world despite laws protecting the creatures.

Sea turtles:

- The sea turtle family includes the hawksbill, loggerhead, leatherback, green and olive ridley turtle.

- These five species are found worldwide, mainly in tropical and subtropical waters.

- The species that faced the most exploitation in the 30-year-period were green (56 per cent) and hawksbill sea turtles (39 per cent).

- Other than the five species, there are two more types of sea turtles that have restricted ranges.

- Kemp’s Ridley is found mainly in the Gulf of Mexico and the flatback turtle around northern Australia and southern Papua New Guinea.

- Nearly all species of sea turtles are now classified as endangered, with three of the seven existing species being critically endangered.

Turtle trafficking:

- Southeast Asia and Madagascar were major hotspots for illegal sea turtle trade, particularly for the critically endangered hawksbills. The hawksbill turtles are prized in the illicit wildlife trade for their beautiful shells.

- Vietnam was the most common country of origin for illegal sea turtle trafficking, while China and Japan served as destinations for nearly all trafficked sea turtle products.

- Vietnam-China was the most common trade route across all three decades.

Marine Turtles:

- There was a 28 per cent decrease in the reported exploitation of marine turtles from the 2000s to the 2010s.

- Over the past decade, the number of RMUs with ‘moderate’ or ‘high’ exploitation impact scores has also decreased.

- The decline over the past decade “could be due to increased protective legislation and enhanced conservation efforts, coupled with an increase in awareness of the problem or changing local norms and traditions”.

Impact on biodiversity:

- Illegal killing and trafficking of animals and plants pose a serious threat to wildlife biodiversity. The black market wildlife trade is considered to be one of the most lucrative illicit industries in the world.

- Sea turtles are slaughtered for their eggs, meat, skin, and shell and they also face habitat destruction and accidental capture or bycatch in fishing gear.

- Climate change has an impact on turtle nesting sites, it alters sand temperatures, which affects the sex of hatchlings.

Conservation Plans:

- Efforts to protect sea turtles have shown positive strides. In 2017, residents in eastern Indonesia’s Maluku Province harvested up to 75 per cent of leatherback turtle eggs laid on one turtle nesting beach.

- Education and community outreach done by organisations like non-governmental organisation World Wide Fund has helped in reducing turtle egg harvesting by 10 per cent.

- Plans are afoot to tag 30,000 Olive Ridley turtles in Odisha. This will help scientists study them and draft conservation plans.

Way Forward:

- RMU framework for marine turtles is a solution to the challenge of how to organise marine turtles into units of protection.

- The units should be above the level of nesting populations but below the level of species within regional entities that might be on independent evolutionary trajectories.

India-Bangladesh ties, a model for bilateral cooperation

(GS Paper 2, International Relation)

Context:

- The recent state visit of the Prime Minister of Bangladesh to India has amply showcased the high stakes of both polities in their bilateral ties, imbued with regional significance.

The current Prime Minister of Bangladesh underlined the importance of the special “bonding” between the two nations, where one helped in the liberation of the other, and where both have worked together closely, especially since she came to power again in 2009.

Challenges in Indo-Bangladesh relations:

Rohingyas:

- First, the continued presence of 1.1 million Rohingyas who fled from Myanmar in 2017 has created enormous pressure on the economy and social harmony.

- She has said India is a big country that should “accommodate” them. Further, she wants stronger support from India to facilitate their early return to Myanmar.

Teesta water sharing:

- Second, the absence of agreement on sharing of the Teesta’s waters, pending since 2011 due to West Bengal’s refusal to relent, and the broader issue of joint management of 54 common rivers, have been constant grievances.

China in Bangladesh:

- Third, India’s sensitivity to growing cooperation between Bangladesh and China rankles the authorities in Bangladesh.

- She has stressed the point that if there were differences between India and China, she did not wish to “put her nose to it”.

Bangladeshi Hindus:

- Four, she has conceded that despite her government’s secular policy, “incidents” against the Hindu minority have occurred, but her government has acted against miscreants.

- At the same time, she has expressed concern about the safety of minorities in India, pointing out that “it is not only (in) Bangladesh, even in India also sometimes minorities suffered”.

Recent visits between both countries:

- She last visited India in 2019. She played host to the Prime Minister and the President of India, when they visited Bangladesh in March and December 2021, respectively.

- The visits marked triple epochal celebrations: the birth anniversary of Bangabandhu Sheikh Mujibur Rahman, the Father of Nation; the golden jubilee of Independence; and 50 years of the establishment of diplomatic relations between India and Bangladesh.

- These visits were utilised to reach new agreements and add further content and momentum to the relationship.

- The latest visit resulted in seven agreements designed to increase cooperation in the diverse domains of water sharing, railways, science and technology, space, media and capacity building.

Specific outcomes of recent visit:

- First, there was the agreement “to continue close security cooperation” over counter-terrorism, border crimes, and border management.

- Second, the two sides recommitted themselves to enhancing their development partnership which is already quite extensive and multi-faceted.

- Third, they agreed “to build resilient supply chains” between the two countries and “across the region”.

- A significant decision was to launch the Comprehensive Economic Partnership Agreement (CEPA) in 2022 and to conclude negotiations by the time Bangladesh graduates from least developed country status in 2026.

- Finally, the leaders favouredexpanding connectivity through more rail, road, inland waterways, and coastal shipping linkages. They agreed to build on the impressive successes achieved in the past decade in this sphere.

- Bilateral trade has touched a high watermark of $18 billion. Logistics for power trade between Bangladesh and its neighbours; India, Nepal and Bhutanhave been put in place.

- India will assist Bangladesh by sharing its rich experience of innovation through startups.

Crisis in Bangladesh:

- In India, there are continuing worries about the cumulative and adverse impact of COVID-19 and the Ukraine war on Bangladesh’s economy.

- The country faces escalating protests on the streets that have been triggered by a sharp rise in fuel prices, an erosion of foreign currency reserves, and a deepening financial crisis.

- Besides, the rising influence of fundamentalist forces, extremism, and radicalisation poses a serious danger to political stability. Thus, the contours of combined challenges before the Sheikh Hasina government as it faces parliamentary elections in 2023 become clear.

It is for Bangladesh citizens to elect their next government, but they should know that the contribution of Sheikh Hasina and the Awami League government to building a strong relationship with their largest neighbour is enormous and widely appreciated in India.

.png)