Pradhan Mantri Jan Dhan Yojana (PMJDY) completes eight years (GS Paper 2, Governance)

Why in news?

- Pradhan Mantri Jan Dhan Yojna (PMJDY), one of the biggest financial inclusion initiatives in the world recently completed 8 years of its implementation.

- PMJDY was announced by Prime Minister, Narendra Modi in his Independence Day address on 15th August 2014.

- While launching the programme on 28th August, he had described the occasion as a festival to celebrate the liberation of the poor from a vicious cycle.

What is financial inclusion?

- The Ministry of Finance, through its financial inclusion led interventions, is committed to provide financial inclusiveness and support to the marginalised and hitherto socio-economically neglected classes.

- Financial Inclusion stands for delivery of appropriate financial services at an affordable cost, on timely basis to vulnerable groups such as low-income groups and weaker sections who lack access to even the most basic banking services.

- It is important as it provides an avenue to the poor for bringing their savings into the formal financial system, an avenue to remit money to their families in villages besides taking them out of the clutches of the usurious money lenders.

Background:

- Pradhan Mantri Jan Dhan Yojana (PMJDY) is National Mission for Financial Inclusion to ensure access to financial services, namely, Banking/ Savings & Deposit Accounts, Remittance, Credit, Insurance, Pension in an affordable manner.

Objectives:

- Ensure access of financial products & services at an affordable cost

- Use of technology to lower cost & widen reach

Basic tenets of the scheme:

- Banking the unbanked - Opening of basic savings bank deposit (BSBD) account with minimal paperwork, relaxed KYC, e-KYC, account opening in camp mode, zero balance & zero charges

- Securing the unsecured - Issuance of Indigenous Debit cards for cash withdrawals & payments at merchant locations, with free accident insurance coverage of Rs. 2 lakh

- Funding the unfunded - Other financial products like micro-insurance, overdraft for consumption, micro-pension & micro-credit

Initial Features:

The scheme was launched based upon the following 6 pillars:

- Universal access to banking services – Branch and BC

- Basic savings bank accounts with overdraft facility of Rs. 10,000/- to every eligible adult

- Financial Literacy Programme– Promoting savings, use of ATMs, getting ready for credit, availing insurance and pensions, using basic mobile phones for banking

- Creation of Credit Guarantee Fund – To provide banks some guarantee against defaults

- Insurance – Accident cover up to Rs. 1,00,000 and life cover of Rs. 30,000 on account opened between 15 Aug 2014 to 31 January 2015

- Pension scheme for Unorganized sector

Important approach adopted in PMJDY based on past experience:

- Accounts opened are online accounts in core banking system of banks, in place of earlier method of offline accounts opening with technology lock-in with the vendor

- Inter-operability through RuPay debit card or Aadhaar enabled Payment System (AePS)

- Fixed-point Business Correspondents

- Simplified KYC / e-KYC in place of cumbersome KYC formalities

Extension of PMJDY with New features – The Government decided to extend the comprehensive PMJDY programme beyond 28.8.2018 with some modifications:

- Focus shift from ‘Every Household’ to Every Unbanked Adult’

- RuPay Card Insurance - Free accidental insurance cover on RuPay cards increased from Rs. 1 lakh to Rs. 2 lakh for PMJDY accounts opened after 28.8.2018.

- Enhancement in overdraft facilities -OD limit doubled from Rs 5,000/- to Rs 10,000/-; OD upto Rs 2,000/- (without conditions).Increase in upper age limit for OD from 60 to 65 years

Impact of PMJDY

- PMJDY has been the foundation stone for people-centric economic initiatives. Whether it is direct benefit transfers, COVID-19 financial assistance, PM-KISAN, increased wages under MGNREGA, life and health insurance cover, the first step of all these initiatives is to provide every adult with a bank account, which PMJDY has nearly completed.

- One in 2 accounts opened between Mar’14 to Mar’20 was a PMJDY account. Within 10 days of nationwide lockdown more than about 20 crore women PMJDY accounts were credited with ex-gratia.

- Jandhan provides an avenue to the poor for bringing their savings into the formal financial system, an avenue to remit money to their families in villages besides taking them out of the clutches of the usurious money lenders.

- PMJDY has brought the unbanked into the banking system, expanded the financial architecture of India and brought financial inclusion to almost every adult.

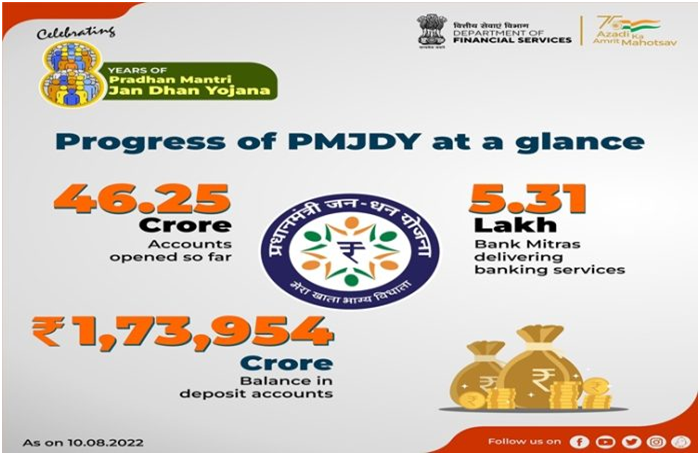

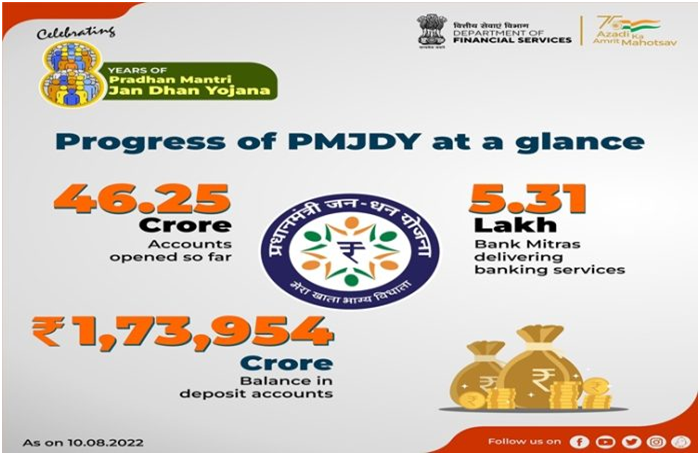

Achievements under PMJDY- As on 10th August’22:

PMJDY Accounts:

- As on 10th August ’22 number of total PMJDY Accounts: 46.25 crore; 55.59% (25.71 crore) Jan-Dhan account holders are women and 66.79% (30.89 crore) Jan Dhan accounts are in rural and semi-urban areas

- During first year of scheme 17.90 crore PMJDY accounts were opened

- Continuous increase in no of accounts under PMJDY

- PMJDY Accounts have grown three-fold from 14.72 crore in Mar’15 to 46.25 crore as on 10-08-2022. Undoubtedly a remarkable journey for the Financial Inclusion Programme.

Jan Dhan Darshak App

- A mobile application, was launched to provide a citizen centric platform for locating banking touch points such as bank branches, ATMs, Bank Mitras, Post Offices, etc. in the country.

- Over 8 lakh banking touchpoints have been mapped on the GIS App.

- This app is also being used for identifying villages which are not served by banking touchpoints within 5 km. these identified villages are then allocated to various banks by concerned SLBCs for opening of banking outlets. The efforts have resulted in significant decrease in number of such villages.

Way Forward:

- Endeavour to ensure coverage of PMJDY account holders under micro insurance schemes. Eligible PMJDY accountholders will be sought to be covered under PMJJBY and PMSBY. Banks have already been communicated about the same.

- Promotion of digital payments including RuPay debit card usage amongst PMJDY accountholders through creation of acceptance infrastructure across India

- Improving access of PMJDY account holders to Micro-credit and micro investment such as flexi-recurring deposit etc.

Concerns around Aadhaar-Voter ID linkage

(GS Paper 2, Governance)

Context:

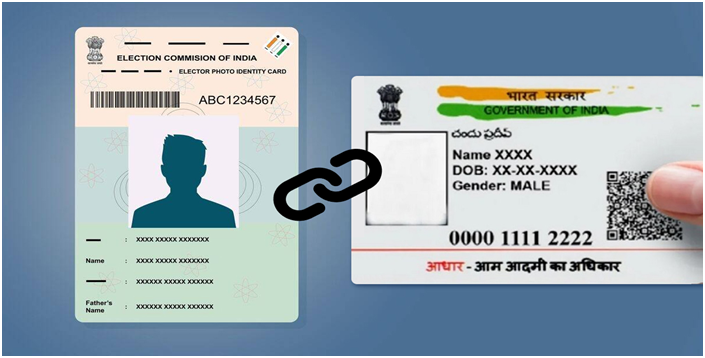

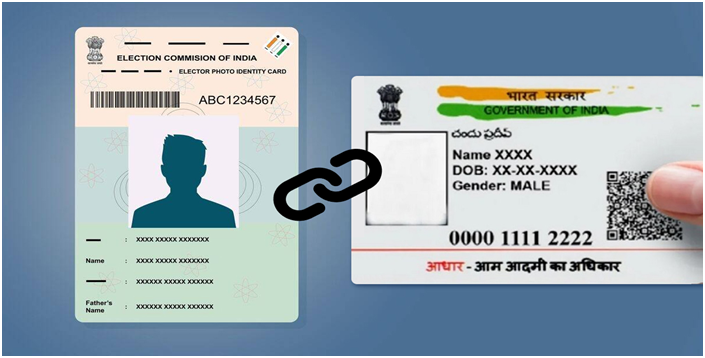

- Reports have surfaced online of instances where block level officers have asked individuals to link their Aadhaar with their Voter IDs, failing which their Voter IDs could be cancelled.

- This comes in the aftermath of the Election Commission’s (EC) campaign to promote the linkage of Voter ID and Aadhaar that began on August 1.

- In the first ten days since its launch, the campaign saw almost 2.5 crore Aadhaar holders voluntarily submitting their details to the EC.

Why does the government want this?

- The EC conducts regular exercises to maintain an updated and accurate record of the voter base.

- A part of this exercise is to weed out duplication of voters, such as migrant workers who may have been registered more than once on the electoral rolls in different constituencies or for persons registered multiple times within the same constituency.

- As per the government, linkage of Aadhaar with voter IDs will assist in ensuring that only one Voter ID is issued per citizen of India.

Is the linking of Aadhaar with one’s Voter ID mandatory?

- In December 2021, Parliament passed the Election Laws (Amendment) Act, 2021 to amend the Representation of the People Act, 1950, inter alia.

- Section 23(4) was inserted in the Representation of the People Act, 1950.

- It states that the electoral registration officer may “for the purpose of establishing the identity of any person” or “for the purposes of authentication of entries in electoral roll of more than one constituency or more than once in the same constituency” for citizens already enrolled, require them to furnish their Aadhaar numbers.

Rule 26B:

- To reflect this amendment, in June 2022, the government notified changes to the Registration of Electors Rules, 1960.

- Rule 26B was added to provide that “every person whose name is listed in the roll may intimate his Aadhar number to the registration officer”.

- Although, the use of discretionary language throughout the amendments have been accompanied by assurances by both the government and the EC that linkage of the Aadhaar with Voter ID is optional, this does not seem to be reflected in Form 6B issued under the new Rule 26B.

- Form 6B provides the format in which Aadhaar information may be submitted to the electoral registration officer. Form 6B provides the voter to either submit their Aadhaar number or any other listed document.

- However, the option to submit other listed documents is exercisable only if the voter is “not able to furnish their Aadhaar number because they do not have an Aadhaar number”.

- To that extent, the element of choice that has been incorporated in the amendments seem to be negated or at the very least thrown into confusion.

Why is the mandatory linking of Aadhaar to the Voter ID an issue?

- The preference to use Aadhaar for verification and authentication, both by the state and private sector, stems from two reasons.

- First, at the end of 2021, 99.7% of the adult Indian population had an Aadhaar card. This coverage exceeds that of any other officially valid document such as driver’s licence, ration cards, PAN cards etc that are mostly applied for specific purposes.

- Second, since Aadhaar allows for biometric authentication, Aadhaar based authentication and verification is considered more reliable, quicker and cost efficient when compared to other IDs.

Puttaswamy judgment:

- But these reasons do not suffice the mandating of Aadhaar except in limited circumstances as per the Puttaswamy judgment. It needs to be considered whether such mandatory linkage of Aadhaar with Voter ID would pass the test of being “necessary and proportionate” to the purpose of de-duplication which is sought to be achieved.

- In Puttaswamy, one of the questions that the Supreme Court explored was whether the mandatory linking of Aadhaar with bank accounts was constitutional or not. The Court observed that the mandatory linking of Aadhaar with bank accounts was not only for new bank accounts but also existing ones, failing which the individual will not be able to operate their bank account.

- The Court held that depriving a person of their right to property for non-linkage fell foul of the test of proportionality. Even though the situation at hand is slightly different in that other means of verification and authentication are allowed if the person does not hold an Aadhaar, given the wide coverage of Aadhaar, the current design would in effect mandate Aadhaar linkage.

- In this context, it needs to be considered whether requiring an Aadhaar holder to mandatorily provide Aadhaar for authentication or verification would not be considered violative of their informational autonomy (right to privacy) which would allow them to decide which official document they want to use for verification and authentication.

- Moreover, in Lal Babu Hussein (1995), the Supreme Court had held that the Right to vote cannot be disallowed by insisting only on four proofs of identity, voters can rely on any other proof of identity and obtain the right to vote.

What are the operational difficulties?

- First, the preference to Aadhaar for the purposes of determining voters is puzzling as Aadhaar is only a proof of residence and not a proof of citizenship. Therefore, verifying voter identity against this will only help in tackling duplication but will not remove voters who are not citizens of India from the electoral rolls.

- Second, the estimate of error rates in biometric based authentication differ widely. As per the Unique Identification Authority of India in 2018, Aadhaar based biometric authentication had a 12% error rate.

- This led the Supreme Court to hold in Puttaswamy that a person would not be denied of benefits in case Aadhaar based authentication could not take place. This concern is also reflected in the previous experiences of using Aadhaar to clean electoral rolls.

- A similar exercise undertaken in 2015 in Andhra and Telangana led to the disenfranchisement of around 30 lakh voters before the Supreme Court stalled the process of linkage.

Right to privacy and surveillance:

- Lastly, civil society has highlighted that linking of the two databases of electoral rolls and Aadhaar could lead to the linkage of Aadhaar’s “demographic” information with voter ID information, and lead to violation of the right to privacy and surveillance measures by the state.

- This, however, would seem to be the case with the use of any other officially valid document to verify or authenticate the identity of the voter. This would leave the EC with the option of verifying its information only through door-to-door checks.

- It also needs to be noted that the Puttaswamy judgment, after reviewing the Aadhaar architecture, held that the use of biometric based authentication and verification, did not lead to the creation of a “surveillance state”. To address these concerns, one needs to have enforceable data protection principles that regulate how authentication data will be used.

What is the way forward?

- Even as the amendments have been made and the EC has launched a campaign for linkage, a writ petition has filed with the Supreme Court challenging the same.

- It challenges the amendments as being violative of the right to privacy. The Supreme Court has transferred the writ to the Delhi High Court.

- In the meantime, it is important that the government clarifies through correction in Form 6B that the linking is not mandatory and expedites the enactment of a data protection legislation that allays concerns of unauthorised processing of personal data held by the government.

The cyber threat to mobile banking

(GS Paper 3, Science and Tech)

Context:

- Global cybersecurity firm Kaspersky warns of an increase in cyberattacks on Android and iOS devices in the Asia Pacific (APAC) as more people switch to mobile banking in the region.

- The mobile banking Trojans are dangerous malware that can steal money from mobile users’ bank accounts by disguising the malicious application as a legitimate app to lure unsuspecting people into installing the malware.

- A Trojan is a malicious code or software that looks legitimate but can take control of your device, including smartphones.

Vulnerability in India:

- According to a 2020 Statista survey of five thousand odd households across 25 States in India, two-third respondents said they had a smartphone.

- Of these, half said they sent and received money digitally, and about 31% said they had a mobile app for banking. Nearly 14% said they used their mobile phones for banking-related purposes. This number further jumped as the COVID-19 pandemic made a lot more people switch to digital modes of payment instead of transacting with cash.

This acceleration brings along with it a vulnerability: an increased threat of cyberattacks on mobile devices.

Malware campaigns:

Anubis:

- One mobile banking trojan, called Anubis, has been targeting Android users since 2017, and its worldwide campaigns have hit users in Russia, Turkey, India, China, Colombia, France, Germany, the U.S., Denmark, and Vietnam.

- The malware has continued to be one of the most common mobile banking trojans with one in 10 unique Kaspersky users encountering a banking threat from the malware.

- The perpetrators infect the device through legitimate-looking and high-ranking malicious apps on Google Play, smishing (phishing messages sent through SMS), and BianLian malware, another mobile banking Trojan.

Roaming Mantis:

- Roaming Mantis is another prolific malware targeting mobile banking users. The group attacks Android devices and spreads the malicious code by hijacking domain name systems (DNS) through smishing exploits.

- Kaspersky’s research team has been tracking the malware since 2018; and between the start of 2021 to the first half of 2022 alone, they detected nearly half a million attacks in the APAC region.

- While this threat group is known for targeting Android devices, their recent campaign has shown interest in iOS users.

- The group targets users by sending smishing texts with a short description and a URL landing page. If a user clicks on the link and opens the landing page, they are redirected to a phishing page.

- For iOS users, the landing page mimics Apple’s official website; while Android devices download another malware. And once the individual inputs their login credentials and proceed to the two-factor authentication, the attacker gets to know the user’s device and login details.

Interoperability compounds problems:

- Mobile payment platforms like Google Pay, PaytM, PhonePe, Square, PayPal, and Alipay have benefited from the shift in consumers’ adoption of mobile banking.

- As a result, they have also permanently changed the payments game to their advantage. But these platforms are operating in a closed-loop payment world where a Google Pay user can send money to another bank account via only the search giant’s payment platform.

- This is similar to how Visa and Mastercard operate as they let payment transactions happen only within their own networks, not between each other.

- This business model could change driven partly by regulators that prefer open, standardised platforms that lower barriers to entry.

Changing business model:

- Some countries are already making payment platform providers change their business model. China, for instance, has ordered its internet companies to offer their rival firm’s link and payment services on their platforms.

- In India, a new law demands all licensed mobile payment platforms to be capable of providing interoperability between wallets. The push from regulators to make payment platforms interoperable comes at a time when the demand for technical experts is a serious concern in the banking industry.

- The shortage of technology, engineering, data and security experts needed by banks to realise their digital aspirations tends to hide a much wider problem: banks’ appeal as first-choice employers of all kinds of talent has faded.

- The lack of adequate cybersecurity and the dearth of talent in banking could potentially lead to a further rise in cyberattacks on user devices. And until this mismatch is fixed, it helps to be careful and extremely cautious when using a mobile device to make payments.

Way Forward:

- Apart from the usual digital hygiene practices like keeping the phone up-to-date and rebooting regularly, consumers can ensure they use their phones for banking only when the device is connected to a secure VPN.

‘One Nation One Fertilizer’ policy

(GS Paper 3, Economy)

Why in news?

- Recently, the Union Ministry of Chemicals and Fertilisers issued a memo announcing the implementation of the “One Nation One Fertiliser” scheme under which a single brand and logo for fertilisers will have to be used by all manufacturers under the Centre’s fertiliser subsidy scheme newly renamed as a Prime Minister’s scheme- “Pradhanmantri Bhartiya Janurvarak Pariyojna” (PMBJP).

- The announcement drew criticism from Congress which called it a way for the Prime Minister to promote himself, terming it the “One Nation, One Man, One Fertiliser” scheme.

- Party leaders also asked how the scheme would benefit farmers and if it would stop fertiliser companies from engaging in extension activities as they would be selling under a single official brand name.

What is the ‘One Nation One Fertiliser’ scheme?

- Under the scheme, all fertiliser companies, State Trading Entities (STEs) and Fertiliser Marketing Entities (FMEs) will be required to use a single “Bharat” brand for fertilisers and logo under the PMBJP.

- The single brand name for UREA, DAP, MOP and NPKS etc. would be BHARAT UREA, BHARAT DAP, BHARAT MOP and BHARAT NPK etc. respectively for all Fertiliser Companies, State Trading Entities (STEs) and Fertiliser Marketing Entities (FMEs).

The memo outlines the specifications of the new packaging for companies-

- The new “Bharat” brand name and PMBJP logo will cover two-thirds of the front of the fertiliser packet

- The manufacturing brands can only display their name, logo, and other information on the remaining one-third space.

- The government has also asked fertiliser companies not to procure old design bags from September 15, adding that the rollout of the new bags under One Nation One Fertiliser would begin from October 2.

What is the Centre’s rationale behind it?

High cost of subsidy:

- The price of the most used fertiliser, urea, is controlled by the government, meaning all manufacturing companies sell at a fixed MRP, which is just 10-20 per cent of production costs. The government provides 80-90 per cent of the cost of productionto the manufacturers in the form of a subsidy.

- The fertiliser subsidy bill of the government is huge each year (expected to be over Rs. 2 lakh crore in 2022-23) and only second to the food subsidy in terms of expenditure.

- For other fertilisers like Diammonium phosphate (DAP) and Muriate of Potash (MOP), while prices are not officially controlled by the government, they do fall under a subsidy system, meaning the manufacturers sell around a tacitly fixed MRP. But companies were until now selling the product under their own brand identity and not that of the government.

Industry experts say that the government possibly felt that farmers should know the financial burden it incurs in providing fertilisers at a cheaper rate.

Freight subsidies:

- Besides paying subsidies to companies for the cost of production, the government also pays manufacturers freight subsidies- or the cost of ferrying their products to the end-user.

- So, another argument for the launch of single-brand fertilisers is to reduce transport subsidies, estimated to be over ₹6,000 crore per year. While the government decides where manufacturers can sell their products under the Fertiliser (Movement) Control Order, 1973, due to the freight subsidy provided, manufacturers don’t hesitate to sell across longer distances.

Branding:

- Brand-wise demand for fertilisers in specific areas is one of the reasons for this movement.

- One rationale is that if manufacturers stop selling urea distinctively under individual brands, there would be no need for Indian Farmers Fertiliser Cooperative (IFFCO) to move fertilisers across states, thus reining in the fertiliser subsidy expenditure.

What are the criticisms?

- Critics argue that completely commoditising fertilisers could impact their quality, discourage manufacturers from bringingnewer and more efficient products into the market if there is less scope for building a unique brand identity, and leave them as mere importers or contractors of fertilisers.

- Besides, the government has expressed targets to become “Atmanirbhar” or self-sufficient in fertilisers, which are currently imported in large proportions. Meeting these targets would also mean encouraging Indian firms to stay in the business. Many private players such as the Tatas and Indo Gulf Fertilisers, have exited the urea business in recent years.

- Many manufacturers have also expressed reluctance to spend on a brand they do not own.

- Another argument is that a government brand will add another layer of regulation to the fertiliser manufacturing sector where almost every aspect- from product pricing to cost structure to geographical distribution and sale- is controlled by the government.

Pricing in fertiliser sector:

- Contextualising this, industry experts and economists have been calling for more reforms in the fertiliser sector for a while in order to reduce the huge subsidy bill and maintain a nutrient balance in fertilisers containing nitrogen, phosphorus and potassium (N, P, and K), which is currently skewed in the direction of urea.

- The prices of fertilisers remained fairly stagnant in the 1980s and 1990s and when the prices were increased, the government faced stiff opposition. In the face of this, the price increase on urea was reversed.

- This change, and the fixing of the MRP for urea on multiple occasions, disturbed the relative prices of various fertilisers and resulted in a big shift in favour of urea, which till date costs a fraction of the price of others like DAP and MOP. The subsidy on urea also led to its diversion for non-agricultural purposes.

- The government in 2010 introduced the Nutrient Based Subsidy (NBS) system to address the growing imbalance in fertiliser use in many States but only non-nitrogenous fertilisers (P and K) moved to NBS and urea was left out. This meant that the price of urea once again could not be decontrolled. The fertiliser subsidy bill, meanwhile, kept going up.

Direct Benefit Transfer (DBT):

- The Chief Economic Advisor noted in the Economic Survey of 2016 that the fertiliser sector is highly regulated, which causes a major distortion in the sector.

- The subsidy which is intended to help small farmers, the Survey said, is actually benefiting a small proportion of them- “24 per cent is spent on inefficient urea producers of the remaining, 41 per cent is diverted to non-agricultural uses and abroad; of the remaining, 24 per cent is consumed by larger farmers.”

- Experts thus call for Direct Benefit Transfer (DBT) to farmers and decontrolling the price of fertilisers, so that the system empowers farmers by giving them a range of choices and motivates manufacturers to make better products. All of this in turn would help reduce the subsidy bill.

While the government has tried DBT in fertilisers on a pilot basis, the massive subsidy targets announced by the government till 2026 don’t seem to indicate a full-fledged rollout of the DBT system soon.