What is the legal row between farmers and PepsiCo? (GS Paper 2, Judiciary)

Why in news?

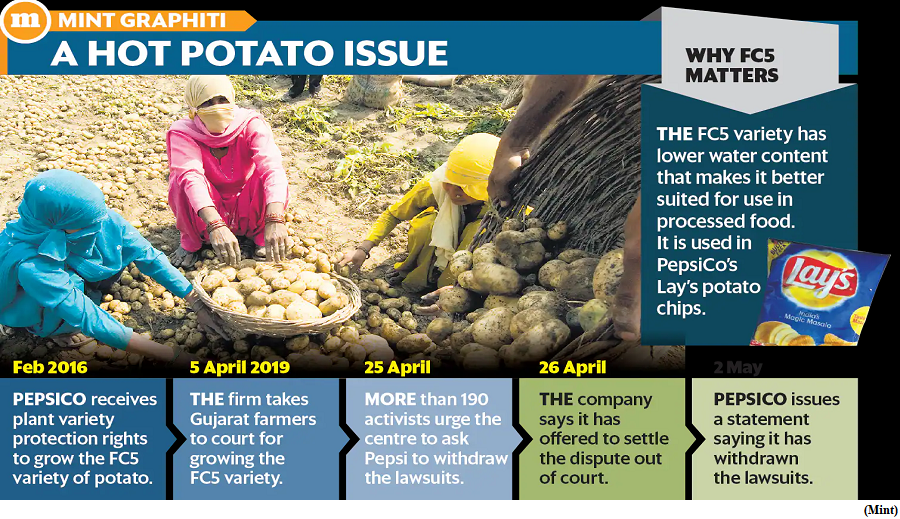

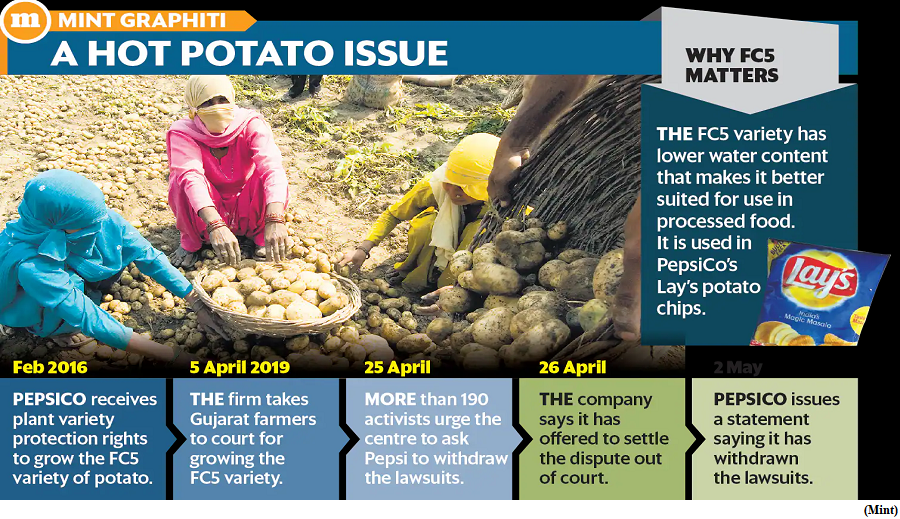

- Recently, the Delhi High Court held that there was “no merit” in the appeal filed by PepsiCo over the patent rights for its ‘unique potato’ variety.

- The appeal was against an order passed by the Protection of Plant Varieties and Farmers Rights’ Authority (PPVFRA), revoking PepsiCo’s registration vis-a-vis the unique potato variety developed by it.

What was the case about?

- The PPVFRA revoked PepsiCo’s registration with respect to its potato plant variety, ‘FL 2027’ (used in Lay’s chips), on the grounds provided under Section 34 (grounds for revocation of registration) of the Protection of Plant Varieties and Farmers Rights Act, 2001 (PPV&FR).

- FL 2027 is a ‘chipping potato’ variety with low external defects, high dry matter/high solids content and stable sugars, all of which make it highly suitable for the manufacture of chips.

- It was developed in the U.S. by Robert W. Hoopes, a plant breeder and a former employee of Frito-Lay Agricultural Research, a division of PepsiCo Inc.

- A certificate of registration for FL 2027 was granted to PepsiCo India on February 1, 2016, conferring it an exclusionary right to market, sell, import, export or distribute FL 2027 for a period of six years.

- However, in an application filed by Kavitha Kurungati, a farmers’ rights activist, the PPVFRA revoked the company’s registered potato variety on December 3, 2021.

What is the PPV&FR Act?

- The Act provides an effective framework to conserve and encourage the development of various plant varieties.

- It established an effective system to safeguard and recognise the rights of breeders, researchers and farmers to promote agricultural development in the country.

- Additionally, it also facilitates the mushrooming of the Indian seed industry to ensure the availability of high-quality seeds and planting materials to farmers.

What are grounds for revocation?

According to Section 34 of the PPV&FR Act, the protection granted to a breeder may be revoked by the authority on the following grounds —

- that the grant of a registration certificate is based on incorrect information furnished by the applicant;

- that the registration certificate was granted to an ineligible person;

- when the breeder does not provide the registrar with the required documents;

- a failure to provide an alternative denomination for variety registration in case the earlier variety provided is not permissible for registration;

- a failure of the breeder to provide the required seeds for compulsory licence;

- failure to comply with the acts, rules, regulations and directions issued by the Authority;

- and if the grant of the registration certificate is against public interest.

Why did the court reject the appeal?

- In relation to Section 34(a) (incorrect information furnished), it was discovered that PepsiCo had sought the registration of FL 2027 variety as a “new variant” instead of an “extant variant” in its application dated February 16, 2012, despite furnishing the date of its commercialisation in India to be December 17, 2009.

- However, to be registered as a “new variant” an additional requirement of ‘novelty’ in addition to ‘distinctiveness’, ‘uniformity’ and ‘stability’ must be satisfied one year before the date of filing of the application for registration.

- The court held that FL 2027 could not fulfil the criteria of novelty and was only eligible for registration under “extant variety”.

What next?

- India is an agri-based economy with the agriculture sector having the highest workforce, nearly 152 million as of FY2021 as per Statista.

- Multinational food processing companies and investors must prioritise the well-being of farmers and their rights by developing a comprehensive understanding of India’s local laws, particularly the PPV&FR Act 2001, and recognise the safeguards and protections it provides to farmers.

India registers poverty reduction with 415 mn coming out in 15 years, UN

(GS Paper 1, Indian Society)

Why in news?

- Recently, the latest update of the global Multidimensional Poverty Index (MPI) was released by the United Nations Development Programme (UNDP) and the Oxford Poverty and Human Development Initiative (OPHI) at the University of Oxford.

Key Highlights:

- It said that 25 countries, including India, successfully halved their global MPI values within 15 years, showing that rapid progress is attainable.

- These countries include Cambodia, China, Congo, Honduras, India, Indonesia, Morocco, Serbia, and Vietnam.

- In April, India surpassed China to become the world's most populous nation with 142.86 crore people. Notably, India saw a remarkable reduction in poverty, with 415 million people exiting poverty within a span of just 15 years from 2005/2006 to 2019/2021.

Findings about India:

- In India, 415 million poor people moved out of poverty from 2005/2006 to 2019/2021, with incidence falling from 55.1 per cent in 2005/2006 to 16.4 per cent in 2019/2021.

- In 2005/2006, about 645 million people were in multidimensional poverty in India, with this number declining to about 370 million in 2015/2016 and 230 million in 2019/2021.

- The deprivation in all indicators declined in India, and the poorest states and groups, including children and people in disadvantaged caste groups, had the fastest absolute progress.

- The people who are multidimensionally poor and deprived under the nutrition indicator in India declined from 44.3 per cent in 2005/2006 to 11.8 per cent in 2019/2021, and child mortality fell from 4.5 per cent to 1.5 per cent.

- Those who are poor and deprived of cooking fuel fell from 52.9 per cent to 13.9 per cent, and those deprived of sanitation fell from 50.4 per cent in 2005/2006 to 11.3 per cent in 2019/2021, according to the report.

- In the drinking water indicator, the percentage of people who are multidimensionally poor and deprived fell from 16.4 to 2.7 during the period, electricity (from 29 per cent to 2.1 per cent) and housing from 44.9 per cent to 13.6 per cent.

Global scenario:

- The countries with different incidences of poverty also halved their global MPI value. While 17 countries that did so had an incidence under 25 per cent in the first period, India and Congo had a starting incidence above 50 per cent.

- India was among the 19 countries that halved their global Multidimensional Poverty Index (MPI) value during one period - for India it was 2005/20062015/2016.

- According to the 2023 release, 1.1 billion out of 6.1 billion people (just over 18 per cent) live in acute multidimensional poverty across 110 countries.

- Sub-Saharan Africa (534 million) and South Asia (389 million) are home to approximately five out of every six poor people.

- Nearly two-thirds of all poor people (730 million people) live in middle-income countries, making action in these countries vital for reducing global poverty. Although low-income countries constitute only 10 per cent of the population included in the MPI, these are where 35 per cent of all poor people reside.

- Children under the age of 18 account for half of MPI-poor people (566 million). The poverty rate among children is 27.7 per cent, while among adults, it is 13.4 per cent.

- Poverty predominantly affects rural areas, with 84 per cent of all poor people living in rural areas. Rural areas are poorer than urban areas across all regions of the world.

About global MPI Index:

- The index is a key international resource that measures acute multidimensional poverty across more than 100 developing countries.

- It was first launched in 2010 by the OPHI and the Human Development Report Office of the UNDP.

- The MPI monitors deprivations in 10 indicators spanning health, education and standard of living and includes both incidence as well as intensity of poverty.

Recommendations of 50th meeting of GST Council

(GS Paper 3, Economy)

Why in news?

- The 50th meeting of the Goods and Services Tax (GST) Council was recently under the chairpersonship of the Union Finance & Corporate Affairs Minister.

- In the 50th Meeting of the GST Council, recommendations relating to changes in GST tax rates, measures for facilitation of trade and measures for streamlining compliances in GST were made.

Changes in GST Tax Rates:

Recommendations relating to GST rates on Goods

A. Changes in GST rates of goods

- It has been decided to reduce the rate on uncooked/unfried snack pellets, by whatever name called, to 5% and to regularise payment of GST on uncooked /unfried snack pellets during the past period on “as is basis”.

B. Other changes relating to goods

- It has been decided to exempt IGST on Dinutuximab (Quarziba) medicine when imported for personal use.

- It has been decided to exempt IGST on medicines and Food for Special Medical Purposes (FSMP) used in the treatment of rare diseases enlisted under the National Policy for Rare Diseases, 2021 when imported for personal use subject to existing conditions.

- It has been decided to clarify that supply of raw cotton, including kala cotton, by agriculturists to cooperatives is taxable under reverse charge mechanism and to regularise issues relating for the past period on “as is basis”.

- It has been decided to reduce GST on imitation zari thread or yarn known by any name in trade parlance from 12% to 5% and to regularize payment of GST related to this matter during the past period on “as is basis”.

- It has been decided to amend the entry 52B in compensation cess notification to include all utility vehicles by whatever name called provided they meet the parameters of Length exceeding 4000 mm, Engine capacity exceeding 1500 cc and having Ground Clearance of 170 mm & above and to clarify by way of explanation that ‘Ground clearance’ means Ground Clearance in un-laden condition.

- It has been decided to reduce GST rate on LD slag from 18% to 5% to encourage better utilisation of this product and for protection of environment.

- It has been decided to regularise the matters relating to trauma, spine and arthroplasty implants for the period prior to 18.07.2022 on “as is basis” in view of genuine interpretational issues.

- It has been decided to reduce the GST rate on fish soluble paste from 18% to 5% and to regularise payment of GST on fish soluble paste during the past period on “as is basis”.

- It has been decided to regularise the matters relating to dessicated coconut for the period 1.7.2017 to 27.7.2017 on “as is basis” in view of genuine interpretational issues.

- It has been decided that on pan masala, tobacco products etc, where it is not legally required to declare the retail sale price, the earlier ad valorem rate as was applicable on 31st March 2023 may be notified in order for levy of Compensation Cess.

- It has been decided to include RBL Bank and ICBC bank in the list of specified banks for which IGST exemption is available on imports of gold, silver or platinum and update the list of banks /entities eligible for such IGST exemption as per Annexure 4B (HBP) of Foreign Trade Policy 2023.

- Consequential changes in notifications may be carried out in view of new Foreign Trade Policy 2023.

- It has been decided to regularise the issues relating to GST on plates and cups made of areca leaves prior to 01.10.2019.

- It has been decided to regularise the issues relating to GST on biomass briquettes for the period 01.7.2017 to 12.10.2017.

Recommendations relating to GST rates on Services

A. Changes in GST rates of services

- It has been decided that GST exemption on satellite launch services supplied by ISRO, Antrix Corporation Limited and New Space India Limited (NSIL) may be extended to such services supplied by organisations in private sector also to encourage start ups.

B. Other changes relating to Services

Services

- As a trade friendly measure, it has been decided that GTAs will not be required to file declaration for paying GST under forward charge every year. If they have exercised this option for a particular financial year, they shall be deemed to have exercised it for the next and future financial years unless they file a declaration that they want to revert to reverse charge mechanism (RCM).

- It has also been decided that the last date of exercising the option by GTAs to pay GST under forward charge shall be 31st March of preceding Financial Year instead of 15th March. 1st January of preceding Financial Year shall be the start date for exercise of option.

- It has been decided to clarify that services supplied by a director of a company to the company in his private or personal capacity such as supplying services by way of renting of immovable property to the company or body corporate are not taxable under RCM.

- It has been decided to clarify that supply of food and beverages in cinema halls is taxable as restaurant service as long as (a) they are supplied by way of or as part of a service and (b) supplied independently of the cinema exhibition service.

Second Report of Group of Ministers (GoM) on Casinos, Race Courses and Online Gaming

- A Group of Ministers (GoM) was constituted to look into the issues related to taxation on casinos, horse racing and online gaming. The GoM submitted its report and it was placed before the 50th GST Council meeting.

- The GoM has recommended that since no consensus could be reached on whether the activities of online gaming, horse racing and casinos should be taxed at 28% on the full-face value of bets placed or on the GGR, the GST Council may decide. The GST Council has deliberated on the issues and has recommended the following:

- Suitable amendments to be made to law to include online gaming and horse racing in schedule III as taxable actionable claims.

- All three namely Casino, Horse Racing and Online gaming to be taxed at the uniform rate of 28%.

- Tax will be applicable on the face value of the chips purchased in the case of casinos, on the full value of the bets placed with bookmaker/totalisator in the case of Horse Racing and on the full value of the bets placed in case of the Online Gaming.