Minerals Security Partnership (GS Paper 2, International Relation)

Why in news?

- India has been inducted into the Mineral Security Partnership (MSP), a US-led collaboration of 14 countries that aims to catalyse public and private investment in critical mineral supply chains globally.

What is MSP?

- The Minerals Security Partnership (MSP) is a global initiative by the US to bolster critical mineral supply chains. It is also known as the critical minerals alliance.

- It was announced by the US and other key partner countries in June 2022 with an aim to ensure that critical minerals are produced, processed and recycled in a way that helps countries secure a stable supply of critical minerals for their economies.

- It also aims to weaken China's grip on supplies of critical minerals worldwide.

- The focus is primarily on the supply chains of critical minerals such as cobalt, nickel, lithium and the 17 ‘rare earth’ minerals.

Critical minerals

- A critical mineral is a mineral resource that is essential to the economy and has high economic vulnerability and high global supply chain risk.

- Critical minerals have a supply chain at risk of disruption. They are used to manufacture advanced technologies, such as mobile phones, tablets, electric vehicles, solar panels, wind turbines, fibre optic cables, and defence and medical applications.

- Many critical minerals, including rare earth minerals and metals such as lithium, gallium, tellurium, and indium, are central to high-tech sectors. Rare earth (RE) comprises 17 elements which are classified as light RE elements (LREE) and heavy RE elements (HREE).

- Individual countries develop their own list of critical minerals depending on the importance of particular minerals in the industrial sector and the strategic assessment of supply risks.

- The major critical minerals are graphite, lithium and cobalt. They are critical for making semiconductors and high-end electronics manufacturing. They are also used in manufacturing fighter jets, drones, and radio sets.

Top producers of critical minerals

- The major producers of critical minerals are China, Congo, Chile, Indonesia, South Africa, and Australia. China has global dominance in terms of processing.

Rare earth minerals

- Rare earth minerals are a set of 17 metallic elements, which includes scandium, yttrium, and the 15 lanthanides (15 metallic chemical elements with atomic numbers 57–71, from lanthanum to lutetium).

- Rare earth minerals are necessary components of a wide range of applications such as cellular telephones, flat-screen monitors and televisions, and electric vehicles.

Countries part of the MSP

- Japan, Australia, Finland, the US, Germany, the UK, Canada, the Republic of Korea, France, Sweden, and the European Union are part of the Minerals Security Partnership,

India's concerns

- Some rare earth elements available in India are: neodymium, lanthanum, cerium, samarium, and praseodymium.

- Some elements classified as heavy RE elements, such as dysprosium, terbium, and europium, are not available in the country in extractable quantities. It relies heavily on China for HREE.

- India has recently witnessed a shift from public and private transport to electric vehicles. This underlines the need to secure the supply of critical minerals.

- India needs a multi-dimensional mineral policy to address the issues posed by the uneven distribution of rare earth elements, the Economic Survey 2022-23 had pointed out.

India-Australia Critical Minerals Investment Partnership:

- India and Australia decided to strengthen their partnership in the field of projects and supply chains for critical minerals under the Australia-India Critical Minerals Investment Partnership.

- In March 2022, Australia allocated $5.8 million to the three-year partnership.

- Under this partnership, India can take resources from Australia to meet the growing demand for critical minerals to help India's space and defence industries and the manufacture of electric vehicles.

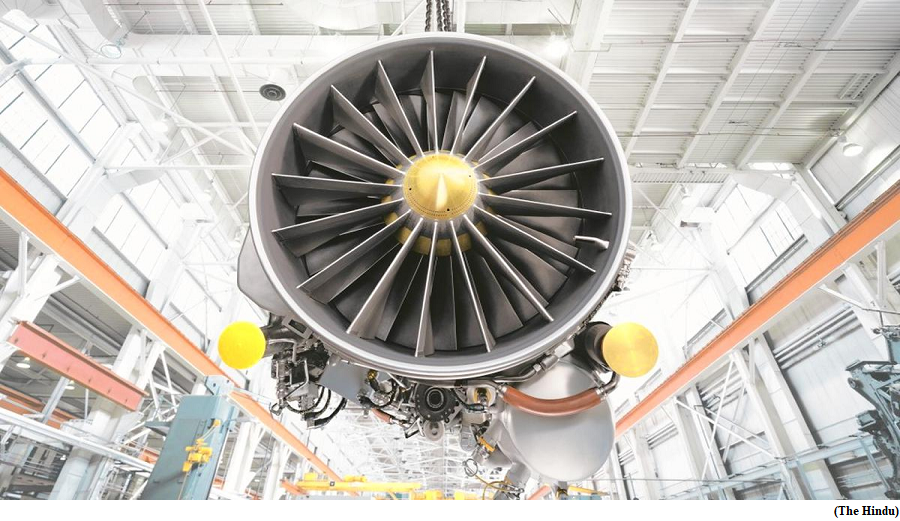

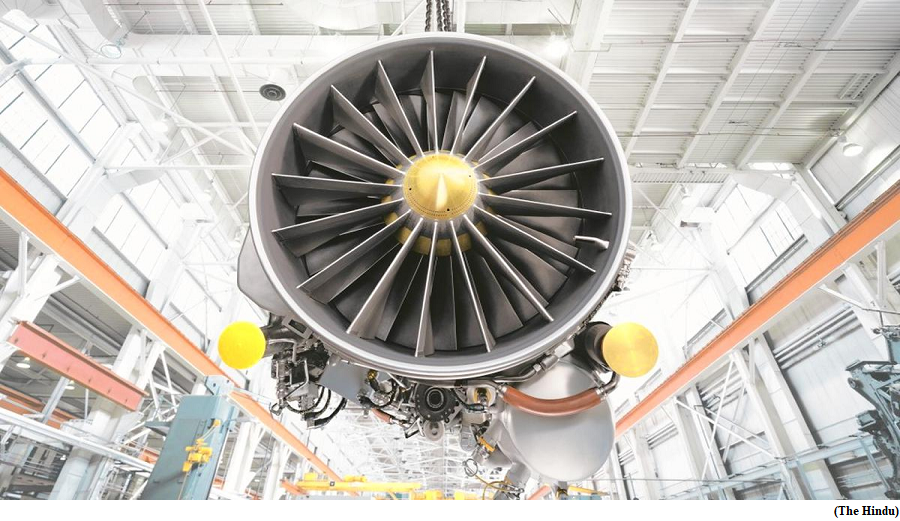

Jet engine deal ensures 80% technology transfer to HAL; first engine in three years

(GS Paper 3, Science and Technology)

Why in news?

- A factsheet issued by the US on the bilateral meetings, described the GE proposal to jointly produce the F414 jet engine in India as “groundbreaking”, adding that a manufacturing licence agreement has been submitted for Congressional notification.

Details:

- The Memorandum of Understanding (MoU) was signed between GE and HAL to manufacture F414 engines for the Light Combat Aircraft (LCA)-MK2 in India. Except for a small component, the F414-INS6 engine will entirely be manufactured in India.

- The jet engine deal with the U.S. will see 80% technology transfer by General Electric (GE) to Hindustan Aeronautics Limited (HAL).

- This will include critical technologies. The first engine will roll out three years after the contract is ready.

Background:

- A previous ‘Engine Development Agreement’ in 2012 between GE and HAL for the F414 engine had 58% technology transfer.

Some of the key technologies that would be transferred to India include

- special coatings for corrosion;

- casting, machining and coating for Single Crystal for turbine blades;

- casting, machining and coating of nozzle guide vanes and other hot parts;

- blisk machining;

- forging/power metallurgy discs for turbine;

- machining of thin walled titanium casing; friction inertia welding for fan and after burner;

- Polymer Matrix Composites (PMC) for bypass polymer duct;

- Ceramic Matrix Composites (CMC) for LPNGV,

- flaps;

- laser drilling technology for combustor;

- bottle boring of shafts.

LCA-MK2:

- The F414 will significantly enhance the capability of the LCA-MK2 and engines for prototype and testing are already available.

- The LCA-Mk2 will be 1350mm longer featuring canards and a payload of 6,500 kgs compared with 3,500 kgs for the Mk1 and MK1A.

- Around 120-130 LCA-MK2 jets are likely to be produced.

- The Cabinet Committee on Security (CCS) has already approved the development of the LCA-Mk2 at a total development cost of ₹9,000 crore.

Way Forward:

- The U.S. Congress would have to approve the deal which involves two separate legislations: Export Administration Regulations (EAR) and International Traffic in Arms Regulations (ITAR), and that some of the spadework had been completed during the Strategic Trade Dialogue in June 2023.

Resolution of six outstanding WTO disputes between US and India through mutually agreed solutions

(GS Paper 2, International Relation)

Why in news?

- Recently, the Union Minister of Commerce and Industry, highlighted the resolution of six outstanding World Trade Organisation (WTO) disputes between US and India through mutually agreed solutions as jointly communicated by the Prime Minister of India and President of the United States of America.

The six trade disputes that will be terminated are as follows:

Three of them have been filed by India against the USA namely,

- Countervailing Measures on Certain Hot-Rolled Carbon Steel Flat Products from India (DS436);

- Certain Measures Relating to the Renewable Energy Sector (DS510); and

- Certain Measures on Steel and Aluminum Products (DS547).

While the other three disputes, which have been filed by the USA against India are:

- Certain Measures Relating to Solar Cells and Solar Modules (DS456);

- Export Related Measures (DS541), and

- Additional Duties on Certain Products from the United States (DS585).

Highlights of Mutually Agreed Solution (MAS):

- As a part of the agreement, the US has agreed to grant market access to steel and aluminium products under the exclusion process of Section 232 of the Trade Expansion Act 1962.

- India has agreed to remove the additional duty, i.e., retaliatory tariffs on certain products. However, the prevailing basic import duty on these products applicable to all imports will continue.

- This market access will restore opportunities for Indian steel and aluminium exporters, which were restricted since 14th June 2018 because of the US 232 measure under which additional duties of 25% and 10% were levied on steel and aluminium products respectively.

- As part of the market access, going forward, the US Department of Commerce will clear 70% of steel and 80% of aluminium applications for products originating in India.

- These applications will be made under the exclusion process of Sec. 232 by the importers on behalf of the exporters. It would provide significant impetus to raise India's Steel and Aluminium exports by about 35%.

Background:

- India and the US have actively engaged in discussions during the last two years to terminate these six outstanding disputes at the WTO.

- These disputes have been filed by India and the US over a decade, representing certain key sectors of the economy such as steel, aluminium, renewable energy, solar products, and certain key export-related measures.