Scientists devise ‘glowscope’ to bring fluorescent microscopy to schools (GS Paper 3, Science and Tech)

Why in news?

- In 2014, a group of scientists at the Stanford University released Foldscope, a handheld microscope made almost entirely out of paper, which takes 30 minutes to put together, and which could capture images of cells.

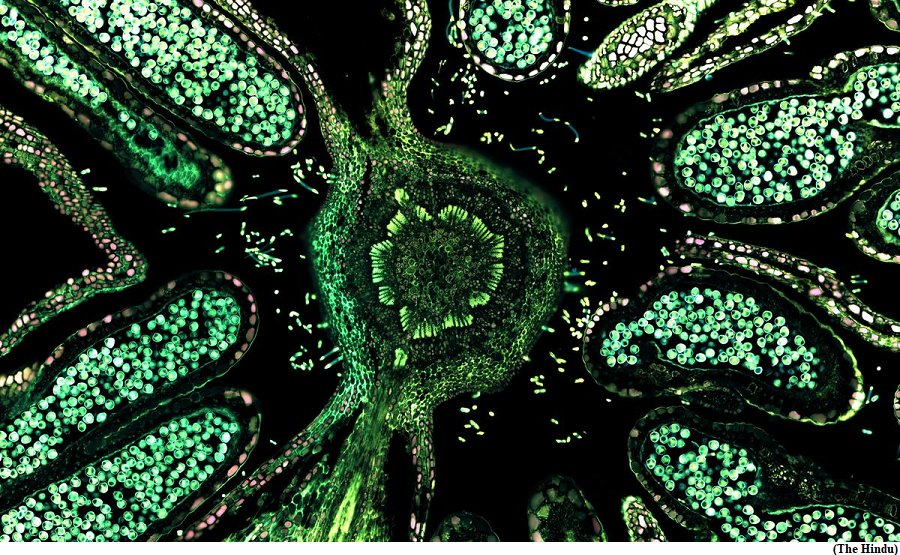

- Now, researchers at the Winona State University, Minnesota, have created a design for a ‘glowscope’, a device that could democratise access to fluorescence microscopy, at least partly so.

What is fluorescence microscopy?

- An optical microscope views an object by studying how it absorbs, reflects or scatters visible light. A fluorescence microscope views an object by studying how it re-emits light that it has absorbed, i.e. how it fluoresces. This is its basic principle.

- The object is illuminated with light of a specific wavelength. Particles in the object absorb this light and re-emit it at a higher wavelength (i.e. different colour). These particles are called fluorophores; the object is infused with them before being placed under the microscope.

- There are versions of fluorescent microscopes with more sophisticated abilities, such as epifluorescence and confocal laser-scanning microscopes.

Fluorophores:

- When the fluorophores fluoresce, a fluorescent microscope can track them as they move inside the object, revealing the object’s internal shape and other characteristics.

- For example, a fluorophore called the Hoechst stain binds to the DNA and is excited by ultraviolet light. So, a tissue sample collected from a person could be injected with the Hoechst stain and placed under a fluorescent microscope.

- When the sample is illuminated by ultraviolet light, the stain absorbs the light and re-emits it at a higher wavelength. The microscope will point out where this is happening: in the nuclei of cells, where DNA is located. This way, the nuclei in the tissue can be labelled for further study.

- Scientists have developed different fluorophores to identify and study different entities, from specific parts of the DNA to protein complexes.

How does the new device improve access?

- In the new study, their set-up consists of two plexiglass surfaces, an LED flashlight, three theatre stage-lighting filters, a clip-on macro lens, and a smartphone. The smartphone (with the lens attached) is placed on one surface that is suspended at a height (say, a foot above). The second sheet is placed below and holds the object.

- In their study, the objects were zebrafish embryos in a petri dish, prepared according to well-established guidelines to ensure they aren’t harmed. They were injected with different fluorophores depending on which part of the embryos were of interest. The sources of illumination were also LED flashlights emitting light of correspondingly different wavelengths.

- One of the stage-lighting filters was held between the flashlight and the object and the other two were held between the object and the smartphone.

- The role of these filters was to ensure that light of the right frequency reached the object and that fluoresced light of a suitable frequency reached the camera.

Outcome:

- With this setup, the researchers were able to image the creatures’ brain, spinal cord (using a fluorophore called DsRed), heart (mCherry), and head and jaw bones (mRFP).

- They were able to zoom in and out using the smartphone camera and the clip-on lens, and by adjusting the distance between the sample and the smartphone platforms.

Way Forward:

- Using a ‘glowscope’ still requires access to fluorophores, suitable biological samples, the know-how to combine the two, and some knowledge of physics to work out which LED flashlight to buy.

- Students as well as researchers in resource-poor labs can also use foldscopes and ‘glowscopes’ together to learn more about the microscopic world.

India’s silence on China’s role in Saudi Arabia-Iran deal is disquieting

(GS Paper 2, International Relation)

Context:

- The Saudi Arabia-Iran agreement signed in China, if successful, will have a far-reaching impact worldwide.

Details:

- The result of negotiations that were kept secret till they reached agreement could signal an easing of tensions between Saudi Arabia and Iran after many years; peace in Yemen, where the two countries have carried out proxy battles; and a boost for China’s efforts to project itself as a peacemaker.

- While the agreement has been welcomed by the United Nations, France, Jordan and West Asian countries, it is also seen as a counter to the U.S.-brokered Abraham Accords, and will be greeted with some concern in the U.S., Israel and the UAE.

What it translates for India?

- Though India has not formally reacted to the announcement so far, the fact that two close partners such as Saudi Arabia and Iran have reached a deal with China’s influence is disquieting, given India’s current tensions with China.

- Previous attempts brokered by Iraq and Oman had not succeeded in any breakthrough.

- Other analysts have pointed to India’s focus on the I2U2 quadrilateral along with Israel, the U.S. and UAE, which may have taken the spotlight away from its ties with Iran and Saudi Arabia.

- In November, Saudi Crown Prince and Prime Minister Mohammad Bin Salman cancelled a visit to India, which is expected to be rescheduled 2023.

- Iranian Foreign Minister Hossein Amir-Abdollahian cancelled his participation in Raisina Dialogue 2023, run by the Ministry of External Affairs (MEA) and the Observer Research Foundation, reportedly after protesting a promotional video for the event that appeared critical of Iranian President Ebrahim Raisi.

Strained U.S-Saudi ties:

- While the U.S.-Iran tensions are high given the recent breakdown in talks over the Joint Comprehensive Plan of Action, more commonly known as the Iran nuclear deal, the Beijing agreement also shows up the strain in Washington’s ties with Saudi Arabia.

- Despite U.S. President Joe Biden’s visit to Riyadh in 2022, Saudi Arabia refused to heed his request to cap oil prices by the Organization of Petroleum Exporting Countries to reduce demand for Russian oil in the wake of the Ukraine conflict.

China-Iran ties:

- Chinese President Xi Jinping’s visit to Riyadh in December was a stark contrast, in terms of more than a dozen agreements on energy and infrastructure that were signed.

- Iranian President Mr. Raisi visited Beijing in February, and Mr. Xi is expected to travel to Iran later to take forward talks on the Belt and Road Initiative and an MoU worth an estimated $400 billion for oil and infrastructure projects.

US influence:

- Diplomats, however, point out that Saudi Arabia’s agreement with Iran does not signify a rejection of the U.S., so much as it shows that new global players are exerting their influence.

- While the balance of power remains with the U.S., its influence and commitment in the region have definitely reduced, given an absence of strategic vision in conflicts in Iraq, Syria, Yemen and so on.

- The past decade has shown many Middle Eastern countries losing faith in the U.S., and broadening their options to players like Russia for energy matters, and China for economic and political matters.

Silicon Valley Bank ‘contagion’ may leave India unscathed

(GS Paper 3, Economy)

Why in news?

- The collapse of Silicon Valley Bank is causing global contagion, with some impact on the sentiment of the market in the short term and long term. However, the Indian banking system is more insulated and regulated, and the Indian equity markets are unlikely to be impacted.

- There will be some impact on the sentiment of the market in the short to medium term but will not affect Indian equity markets in the long term.

Why did Silicon Valley Bank fail?

- The Silicon Valley Bank became the largest bank to fail since the 2008 financial crisis. The move put nearly $175 billion in customer deposits under the control of the Federal Deposit Insurance Corp.

- Silicon Valley Bank was hit hard by the downturn in technology stocks over the past year as well as the Federal Reserve’s aggressive plan to increase interest rates to combat inflation.

- The bank bought billions of dollars worth of bonds over the past couple of years, using customers’ deposits as a typical bank would normally operate. These investments are typically safe, but the value of those investments fell because they paid lower interest rates than what a comparable bond would pay if issued in today’s higher interest rate environment.

- Typically that’s not an issue, because banks hold onto those for a long time, unless they have to sell them in an emergency.

- But Silicon Valley’s customers were largely startups and other tech-centric companies that started becoming more needy for cash over the past year.

Withdrawal of funds:

- Venture capital funding was drying up, companies were not able to get additional rounds of funding for unprofitable businesses, and therefore had to tap their existing funds, often deposited with Silicon Valley Bank, which sat in the center of the tech startup universe. So Silicon Valley customers started withdrawing their deposits.

- Initially that wasn’t a huge issue, but the withdrawals started requiring the bank to start selling its own assets to meet customer withdrawal requests.

- Because Silicon Valley customers were largely businesses and the wealthy, they likely were more fearful of a bank failure since their deposits were over $250,000, which is the government-imposed limit on deposit insurance.

- That required selling typically safe bonds at a loss, and those losses added up to the point that Silicon Valley Bank became effectively insolvent. The bank tried to raise additional capital through outside investors, but was unable to find them.

- Bank regulators had no other choice but to seize Silicon Valley Bank’s assets to protect the assets and deposits still remaining at the bank.

Is this a sign of repeat what happened in 2008?

- At the moment, no, and experts don’t expect there to be any issues spreading to the broader banking sector.

- Silicon Valley Bank was large but had a unique existence by servicing nearly exclusively the technology world and VC-backed companies. It did a lot of work with the particular part of the economy that was hit hard in the past year.

- Other banks are far more diversified across multiple industries, customer bases and geographies. The most recent round of “stress tests” by the Federal Reserve of the largest banks and financial institutions showed that all of them would survive a deep recession and a significant rise in unemployment.

- However, there might be economic ripple effects in the Bay Area and in the technology start-up world if the remaining money can’t be released quickly.

![]()