Supreme Court verdict on ECI appointments (GS Paper 2, Judiciary)

Why in news?

- Recently, a five-judge bench of the Supreme Court unanimously ruled that a high-power committee consisting of the Prime Minister, Leader of Opposition in Lok Sabha, and the Chief Justice of India must pick the Chief Election Commissioner (CEC) and Election Commissioners (ECs).

Why did the SC debate the issue?

- In 2015, a public interest litigation was filed by Anoop Baranwal challenging the constitutional validity of the practice of the Centre appointing members of the Election Commission.

- In October 2018, a two-judge bench of the SC referred the case to a larger bench since it would require a close examination of Article 324 of the Constitution, which deals with the mandate of the Chief Election Commissioner.

- The SC had not debated this issue earlier. In September 2022, a five-judge Constitution bench headed by Justice KM Joseph began hearing the case and almost a month later, the verdict was reserved.

What is the challenge?

- Article 324(2) reads: “The Election Commission shall consist of the Chief Election Commissioner and such number of other Election Commissioners, if any, as the President may from time-to-time fix and the appointment of the Chief Election Commissioner and other Election Commissioners shall, subject to the provisions of any law made in that behalf by Parliament, be made by the President.”

- The crux of the challenge is that since there is no law made by Parliament on this issue, the Court must step in to fill the “constitutional vacuum.” This examination also leads to the larger question of separation of powers and if the judiciary is overstepping its role in filling this gap in the law.

- Two corollary issues that were also examined by the Court are whether the process of removal of the two Election Commissioners must be the same as the CEC; and regarding the funding of the EC.

- As per the current process, the Law Minister suggests a pool of suitable candidates to the Prime Minister for consideration. The President makes the appointment on the advice of the PM.

What did the court decide?

- Justice Joseph authored the majority opinion while Justice Rastogi authored a separate opinion agreeing with the majority view.

- The appointment of the Chief Election Commissioner and the Election Commissioners shall be made by the President on the advice of a Committee consisting of the Prime Minister, the Leader of the Opposition of the Lok Sabha, and in case no leader of Opposition is available, the leader of the largest opposition Party in the Lok Sabha in terms of numerical strength, and the Chief Justice of India.

- This means that Parliament can undo the effect of the SC verdict by bringing in a new law on the issue.

How did the court arrive at the verdict?

- The Court’s verdict is based on a reading of the debates of the Constituent Assembly to ascertain what the founding members of the Constitution envisaged the process to be and an interpretation of similar provisions in the Constitution.

- The verdict states that a “golden thread runs through” the proceedings of the Constituent Assembly debates on the provision. All the Members were of the clear view that elections must be conducted by an independent Commission. It was a radical departure from the regime prevailing under the Government of India Act, 1935.

- The deliberate addition of the words “subject to the provisions of any law made in that behalf by Parliament” after prolonged discussions, according to the court, indicate that “what the Founding Fathers clearly contemplated and intended was, that Parliament would step in and provide norms, which would govern the appointment to such a uniquely important post as the post of Chief Election Commissioner and the Election Commissioners.”

What was the government’s stand?

- The government argued that “in the absence of such a law, the President has the constitutional power.” The government has essentially asked the court to exhibit judicial restraint.

- The court in its ruling discusses at length its intention to “maintain a delicate balance” on separation of powers.

- The ruling cites past instances of the Court stepping into to fill a gap in the law, including the Vishaka guidelines to curb sexual harassment at workplace, and the interpretation on the process of appointment of judges.

What are the other findings of the court?

- On the issue of whether the process of removal of Election Commissioners must be the same as it is for the CEC, the Court ruled that it cannot be the same. The Constitution states that the CEC can be removed in a process similar to a judge, through a majority in both houses of Parliament on grounds of proven incapacity or misbehaviour.

- On the issue of funding the EC, the Court left it to the government.

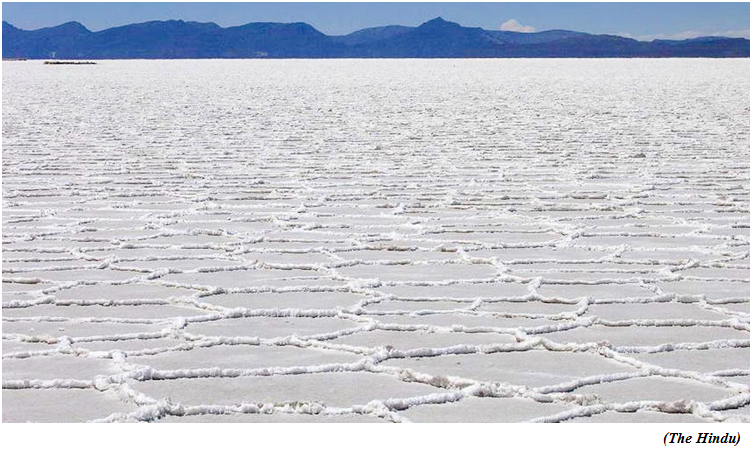

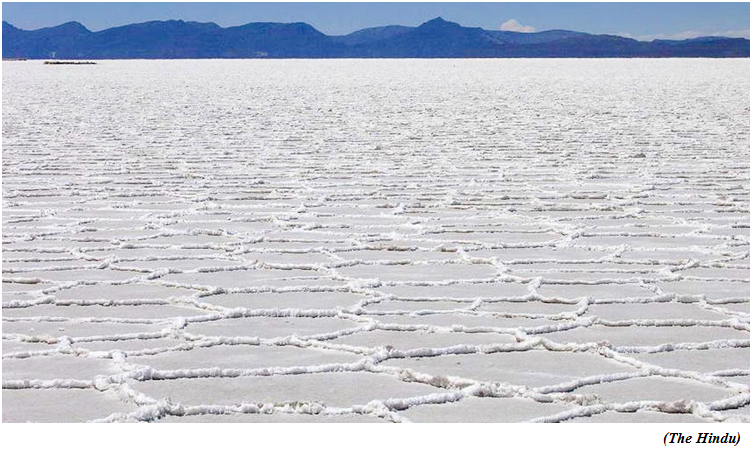

Salt flats around the world are covered in a similar pattern of ridges

(GS Paper 3, Environment)

Context:

- In salt flats across the world, the salt on the surface forms ridges that join together in a patchwork of pentagons and hexagons. These captivating patterns have been photographed as far apart as Bolivia, Chile, China, India (in the Rann of Kutch), Iran, Tunisia, and the U.S. These shapes are also invariably a metre or two across.

- That the salt always crenellates in these shapes and at these sizes, irrespective of the local environmental conditions, the mineral chemistry, the soil type, and other factors has puzzled researchers.

New study:

- In a new study, researchers from Austria, Germany, and the U.K. using a combination of ground sampling and computer models, they have found the way salt flows up and down in the soil below this formation.

- It is important to know the underlying mechanism because salt flats have significant effects on both humans and the climate.

What are salt flats?

- A salt flat is a natural landscape in which a large area of flat land is covered by salt. Perhaps the world’s most well-known salt flat is the Salar de Uyuni in Bolivia. It is the largest in the world of its kind, and also contains more than half of the planet’s lithium reserves.

- A salt flat forms from a natural water body whose recharge rate is lower than the evaporation rate. Over time, all the water evaporates, leaving behind the dissolved minerals, usually salts.

- They reflect sunlight strongly and thus appear bright. The underlying soil is highly saline: even if the water table is shallow, the groundwater is too salty for humans to drink.

How do the shapes form?

- The researchers found that the salt penetrated deeper into the soil exactly below the ridges, and remained shallow under the flat areas.

- That is, if you removed the topmost layer and looked directly down at the soil, you would see that the salty groundwater is flowing deeper into the soil along vertical sheets, not throughout.

What explains this finding?

- The surface of a salt flat has a layer of salt that has been deposited over time. So just under the surface, the groundwater is highly saline and denser than the groundwater further below.

- If any water reaches and rises above the surface, it evaporates to leave more salt behind. The researchers found that if the rate of evaporation is sufficiently high, i.e. if the rate of salt deposition on the surface is sufficiently high, the denser groundwater will sink down and the less-saline, less-dense groundwater will rise to the top. This body of descending and ascending water is called a convection cell.

- Over time, there will be more saline groundwater rising up towards the surface through the convection cells than through other parts of the soil – simply because the less-dense water within the column is being displaced upwards. As a result, the salt this water carries will accumulate on the surface, forming the narrow ridges that make up the polygons.

Why do the results matter?

- Since at least the early 1960s, scientists have offered different explanations for why the surface of dried salt lakes becomes covered with this pattern of polygonal shapes. Most of them have either considered above-the-surface dynamics or below-the-surface dynamics, whereas the new study shows that the polygons are formed when these two realms interact.

- The theory and the results matter because when winds blow over salt flats, they carry some of the salt with them as particulate matter. When this air mass reaches the ocean, it deposits the salts there. Such sea salt can enter the atmosphere and go on to swirl at the centre of cyclones.

- When a salt-bearing air mass reaches an inhabited area, the particles cause significant respiratory problems. A 1996 study characterised the salt flat of what was once Owens Lake in California the “single greatest source of particulate matter in North America”.

Way Forward:

- To mitigate the deleterious effects of salt flats, experts have recommended covering them in a shallow layer of water, so that the salt is deposited on the surface more uniformly and less salt is carried away by winds.

- Salt suspensions are also an important group of aerosols (suspensions of fine solids in air) that reflect sunlight.

- The saline lakes around the world are shrinking, including due to agriculture. So more accurate climate models will need to better understand the sources of salt, and the new findings describe one such source.

Combining social welfare and capital markets through SSE

(GS Paper 3, Economy)

Why in news?

- Recently, the National Stock Exchange of India received the final approval from the markets regulator Securities and Exchange Board of India (SEBI) to set up a Social Stock Exchange (SSE).

- Finance Minister, presenting the Union Budget back in 2019, had proposed to initiate steps for creating a stock exchange under the market regulator’s ambit. The proposal was cleared in September 2021.

What is a Social Stock Exchange?

- The SSE would function as a separate segment within the existing stock exchange and help social enterprises raise funds from the public through its mechanism.

- It would serve as a medium for enterprises to seek finance for their social initiatives, acquire visibility and provide increased transparency about fund mobilisation and utilisation.

- Retail investors can only invest in securities offered by for-profit social enterprises (SEs) under the Main Board. In all other cases, only institutional investors and non-institutional investors can invest in securities issued by SEs.

What about eligibility?

- Any non-profit organisation (NPO) or for-profit social enterprise (FPSEs) that establishes the primacy of social intent would be recognised as a social enterprise (SE), which will make it eligible to be registered or listed on the SSE.

- The seventeen plausible criteria as listed under Regulations 292E of SEBI’s ICDR (Issue of Capital and Disclosure Requirements) Regulations, 2018 entail that enterprises must be serving to

- eradicate either hunger, poverty, malnutrition and inequality;

- promoting education, employability, equality, empowerment of women and LGBTQIA+ communities;

- working towards environmental sustainability;

- protection of national heritage and art or bridging the digital divide, among other things.

- At least 67% of their activities must be directed towards attaining the stated objective. This is to be established by enumerating that, in the immediately preceding three-year period, either 67% of its average revenue came from the eligible activities, expenditure (in the same proportion) was incurred towards attaining the objective or the target population constitute 67% of the overall beneficiary base.

- Corporate foundations, political or religious organisations or activities, professional or trade associations, infrastructure and housing companies (except affordable housing) would not be identified as an SE.

- Additionally, NPOs would be deemed ineligible should it be dependent on corporates for more than 50% of its funding.

How do NPOs raise money?

- NPOs can raise money either through issuance of Zero Coupon Zero Principal (ZCZP) Instruments from private placement or public issue, or donations from mutual funds.

- SEBI had earlier recognised that NPOs by their very nature have primacy of social impact and are non-revenue generating. Thus, there was a need to provide NPOs a direct access to securities market for raising funds.

- ZCZP bonds differ from conventional bonds in the sense that it entails zero coupon and no principal payment at maturity. The latter provisions a fixed interest (or repayment) on the funds raised through varied contractual agreement, whereas ZCZP would not provision any such return instead promising a social return.

- It is mandatory that the NPO is registered with the SSE for facilitating the issuance. The instrument must have a specific tenure and can only be issued for a specific project or activity that is to be completed within a specified duration as mentioned in the fund-raising document (to be submitted to the SSE).

- It must also demonstrate the requisite expertise through their performance in similar projects in the past, thus, acquiring investor confidence and tackle concerns about potential default.

- The minimum issue size is presently prescribed as Rs 1 crore and minimum application size for subscription at Rs 2 lakhs for ZCZP issuance.

- The NPO may choose to register on the SSE and not raise funds through it but via other means. However, they would have to make necessary disclosures about the same.

What about on completion of projects?

- Another structured finance product available for NPOs is the Development Impact Bonds.

- Upon the completion of a project and having delivered on pre-agreed social metrices at pre-agreed costs/rates, a grant is made to the NPO. The donor who makes the grant upon achieving the social metrics would be referred to as ‘Outcome Funders’.

- Since the payment above is on post facto basis, the NPOs would have to also raise money to finance their operations. This is done by a ‘Risk Funder’ who alongside enabling the financing of operations on a pre-payment basis, also bears the associated risk with non-delivery of social metrics. S/he typically earns a small return if the metrics are delivered.

How do FPOs raise money?

- For-Profit Enterprises (FPEs)need not register with social stock exchanges before it raises funds through SSE. However, it must comply with all provisions of the ICDR Regulations when raising through the SSE.

- It can raise money through issue of equity shares (on main board, SME platform or innovators growth platform of the stock exchange) or issuing equity shares to an Alternative Investment Fund including Social Impact Fund or issue of debt instruments.

What disclosures need to be made?

- SEBI’s regulations state that a social enterprise should submit an annual impact report in a prescribed format. The report must be audited by a social audit firm and has to be submitted within 90 days from the end of the financial year.

- Listed NPOs, on a quarterly basis, are specifically required to furnish details about the money they have raised category-wise, how they have been utilised and the unutilised balance amount. The latter needs to be furbished until the proceeds are fully utilised or the purpose has been achieved.